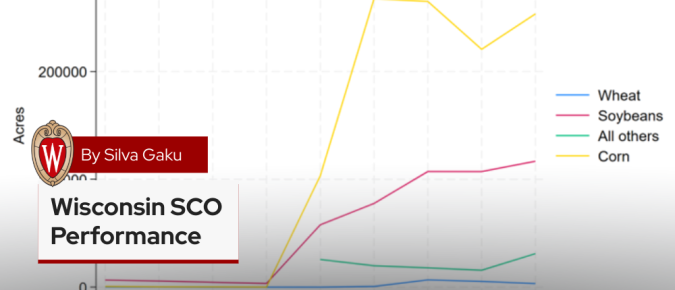

Supplemental Coverage Option (SCO) is a crop insurance product that provides additional coverage for an underlying crop insurance policy. This article provides a brief overview of Wisconsin SCO and discusses its performance from 2015 to 2023.

To help producers manage the risks associated with forage production, several insurance and support programs are available to Wisconsin producers. This article provides a historical examination of forage risk management programs available in Wisconsin from 2015 to 2024.

Producers can use Whole Farm Revenue Protection to mitigate the risks associated with forage production, offering revenue protection for an entire farm operation rather than individual crops or livestock.

Variability in crop markets can make it challenging for farmers to choose the right ARC/PLC program for their specific area and crop. This ‘What-If’ Tool helps Wisconsin producers analyze potential payments at various price levels and county yields.

The Extension Farm Management Program has developed interactive tools to assist Wisconsin producers in comparing ARC-County (ARC-CO) and PLC payments by county, commodity, and irrigation type.

In this presentation, Sylvanus Gaku, Extension Farm Financial Management Outreach Specialist, covers what producers need to know for the 2025 ARC/PLC sign-up.

This article provides estimates of economic assistance for Wisconsin producers following the passage of the American Relief Act, 2025, on December 20, 2024.

The USDA’s 2025 projections for corn and soybean prices are below the estimated break-even prices for Wisconsin farmers. If these projections hold true, Wisconsin grain farmers are likely to face negative margins in 2025.

“Is my operation big enough?” It’s a loaded question that includes values, policy, lots of opinions, more than a few arguments, and even a little economics, the latter of which is the subject here. Economically “big enough” is the capacity needed to achieve profit goals given prices and costs of production. There are two sources of […]

There are four strategies that can be pursued to help manage farm business risks.

Understanding how a farmer’s own risk preferences and that of others affect the risk management decisions made for the farm business is important.

Let’s look at the concept of price risk with an example of the average monthly corn prices in the United States.

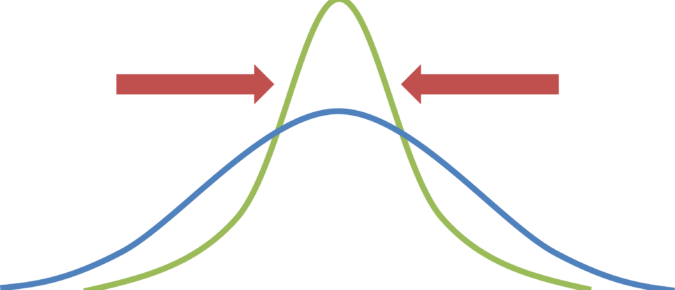

The greater the uncertainty, the greater the risk.

The more likely a negative factor will occur, the greater the risk potential.

Dairy producers need to stay informed about the latest developments of the Dairy Margin Coverage (DMC) program so that they can make timely and informed decisions for their operations.

This article was originally published in Progressive Dairy. For many farmers, farming is widely viewed as a “way of life” rather than as a business. The Internal Revenue Service (IRS) considers an activity a trade or business if it is conducted with a profit motive. Profit is defined as income or receipts greater than expenses, […]

Financial Planning Month is observed during October. For farmers, this time of year may be focused on harvesting the crops that were planted earlier this spring or summer. But in this day and age of farming, crops can be harvested all year long with many different types of crops, season extensions like high tunnels, and indoor spaces such as greenhouses.

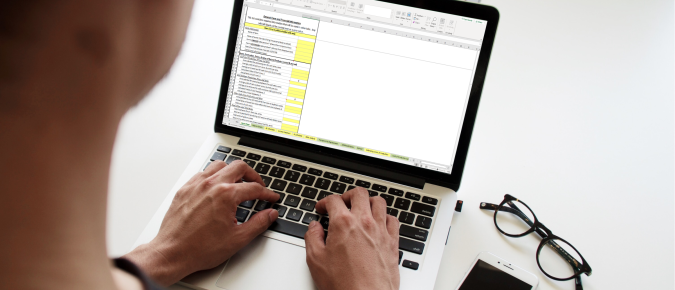

This video series will introduce you to the Financial Statement and Analysis Spreadsheet. In these videos, Kevin Bernhardt, Extension Farm Management Specialist with UW-Madison Division of Extension and Professor at UW-Platteville, provides information on completing the spreadsheet. The Extension Farm Financial Statement and Analysis Tools consists of Excel worksheets that: The Spreadsheet Tools are more […]

Wisconsin farms will often have many different enterprises that contribute to their whole farm business. For example, a dairy farm may have enterprises for milk sales, calf or finished cattle sales, grain sales, and hay sales. It is important for farmers to understand the income and expenses associated with each enterprise, how equipment or other […]