Wisconsin farms will often have many different enterprises that contribute to their whole farm business. For example, a dairy farm may have enterprises for milk sales, calf or finished cattle sales, grain sales, and hay sales. It is important for farmers to understand the income and expenses associated with each enterprise, how equipment or other capital is used in an enterprise, and ultimately the profitability of each enterprise. Farmers can use an enterprise budget to help review historical information for each enterprise as well as new enterprises under consideration.

What is an enterprise budget?

An enterprise budget is used for planning and estimating income (revenues), expenses (costs), and profits for a single enterprise of a farm business. Enterprise budgets are constructed on a per unit basis, such as per acre or per head, to facilitate comparisons among other enterprises. An enterprise is any activity which results in a product used on the farm, such as feed for livestock, or sold in the market, such as direct-marketed meat or corn sold to a local ethanol plant.

An enterprise budget is used to:

- Evaluate the efficiency of a single enterprise.

- Estimate benefits and costs for major changes in production practices.

- Identify profitable versus breakeven or losing enterprises.

- Support applications for credit.

Components of an enterprise budget

Every enterprise budget has three main parts: income, variable costs, and fixed costs.

Income

Income or revenue is the total sales of products or services from the single enterprise. Revenue can be calculated with the following formula:

Price or expected price x Units Sold = Total Income

Variable Costs

Variable costs, or out-of-pocket expenses, are those that vary with the product being produced and result from the use of purchased inputs and owned assets. Examples in crop budgets include fertilizer, seed, chemicals, crop insurance. In livestock budgets, variable costs may be feed, semen, marketing costs. Rental of farmland and buildings are also variable costs.

Fixed Costs

Fixed costs or ownership costs are incurred regardless of whether a product is produced and result from the ownership of assets. These costs include depreciation, interest, repairs on fixed assets (buildings, fences), taxes, and insurance. Often a piece of equipment or building will be used for more than one enterprise so it is important to estimate the percentage of use for each enterprise and allocate the cost accordingly.

Net Income

Net Income is the remaining amount after subtracting variable and fixed costs.

Net Income = Total Income – (Variable + Fixed Costs)

The enterprise budget can provide a farmer with more information than just net income. The budget can help determine product or commodity sales needed to cover variable costs and fixed costs, or total costs per unit. This information can also be utilized to determine pricing points, to identify efficiencies within the enterprise, and for the continuation of an enterprise.

Sensitivity analysis

Enterprise budgets can assist with forecasting and thus rely on assumptions. Farmers are encouraged to know the sensitivity of an enterprise to changes in price, production and other variables. To learn more about sensitivity analysis, please refer to the video below.

Sensitivity Analysis Video

Available enterprise budgets

Enterprise budgets may be detailed and take time to acquire the necessary information to complete. In addition, the data needed for enterprise budgets may be difficult to locate or not available in your area. To assist farmers, Extension has published enterprise budgets for various livestock and crop commodities.

- Crop Enterprise Budget Tool and Crop Budget Analyzer, UW Extension Crops and Soils Economics, Budgets & Financial webpage

- Beef and Small Ruminants Enterprise Tool, UW Extension Livestock Decision Tools and Software webpage

- Dairy Cow and Dairy Sheep Enterprise Tool, UW Extension Farm Management Enterprise Budgets & Benchmarking Tools webpage

- Organic, Vegetable and Specialty Crops and Livestock Budgeting Tools, Agricultural Marketing Resource Center

- Agricultural Budget Calculator, University of Nebraska-Lincoln Center for Agricultural Profitability

Conclusion

Enterprise budgets are important in assisting farmers with the mix of enterprises they may have in their farm business. These budgets can be used to develop whole-farm budgets that provide an estimate of the overall profitability and resource requirements (land, machinery, and labor) for a farm business. Knowledge of enterprise budgeting and the ability to use them will assist farmers in making sound business decisions.

Partial Budgeting

Partial Budgeting Cash flow budgeting

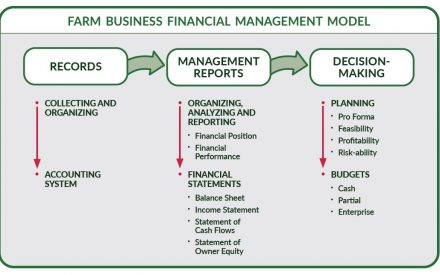

Cash flow budgeting Developing a Farm Financial Model

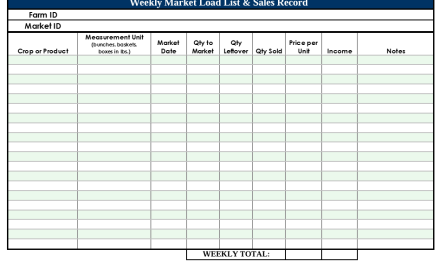

Developing a Farm Financial Model Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers

Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers