A farm business that has collected and organized their farm records will be able to complete management reports or financial statements. The Farm Financial Standards Council (FFSC – https://ffsc.org/) recommends farmers create four financial statements from which the financial position and performance may be analyzed. These statements include the balance sheet, income statement, statement of cash flows and statement of owner equity.

The five criteria recommended by FFSC for farm financial analysis can be divided between measures of financial position or financial performance. The financial position describes the financial strength of the farm business at a point in time. The financial performance is how well the farm has performed over time. Both sets of measures are important for a farmer to understand the farm’s overall financial health and assist with business decision-making, such as financing, investment and future planning decisions.

Financial position refers to the total resources controlled by a farm business and total claims against those resources, at a single point in time. Information from the balance sheet is utilized to determine the farm’s financial position.

Measures of financial position indicate a farm’s financial strength and capacity to withstand risk, and provide a benchmark against which to measure the results of future farm business decisions.

Financial performance is a measure across time, such as months, quarters, or years. It refers to the results of the production across this time and the financial decisions contributing to the financial strength over one or more periods of time. Information from the balance sheet, income statement, and statement of cash flow are utilized to determine the farm’s financial performance.

Measures of financial performance include external effects that may be out of the farm’s control, such as drought, grain embargoes, pandemic, etc. Financial performance describes the results of a farm’s operating and financing decisions. It describes how money flows through a farm business and how well the business can pay its bills, meet payroll costs, and how much money is reserved for unanticipated expenses. This information is useful for improving the farm’s financial performance when the farmer knows the results of operating and financing decisions that are made during the course of running their farm business.

Financial measurement is the quantification or measurement of the financial position and financial performance of a farm business. Financial measures or ratios can be most informative when analyzed and compared to the same measures or ratios in the farm’s previous time period or benchmarked to comparable farm businesses.

Each of the five criteria recommended have a set of financial measures to help the farmer understand how well their farm business is doing. Each category tells us something different about the farm business.

Measures of financial performance

The Farm Finance Scorecard provides a set of benchmark ratios for each of these measures. This scorecard will help the farmer summarize a farm’s position based on a “stoplight” analysis.

Red – potentially vulnerable/weak position or performance with high risk.

Yellow – caution/review position or performance with moderate risk.

Green – strong position or performance with low risk.

Green ratios or measures highlight areas that are strong, while red measures indicate areas that are vulnerable and can use improvement in the farm business. A weakness in one measure may be offset by strength in other measures.

Conclusion

Financial measures interpret a large amount of farm records into suitable financial statements for analysis. No one financial measure is sufficient for decision-making in a farm business. Evaluation of several measures would be more useful to provide insight into past performance versus present performance, present performance versus budgeted performance, and a multi-year performance trend. In addition, financial measures allow a farm business to measure and benchmark financial performance and position to other similar size and type farm businesses.

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

Benchmarking: Three part process for financial analysis

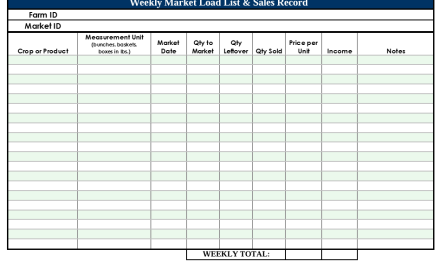

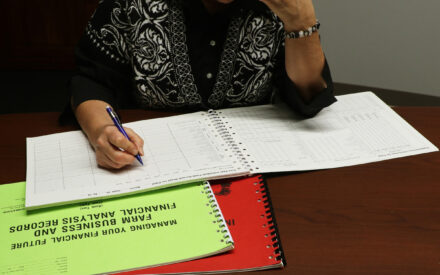

Benchmarking: Three part process for financial analysis Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers

Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers Review recordkeeping methods and retention standards in the new year

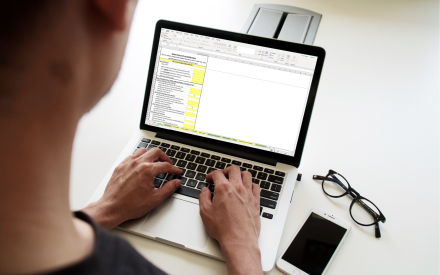

Review recordkeeping methods and retention standards in the new year  ▶ Watch: Financial Statement and Analysis Spreadsheet Walkthrough

▶ Watch: Financial Statement and Analysis Spreadsheet Walkthrough