Farm Pulse – Financial Management Program

Farm Pulse: Financial Management and Analysis

A self-paced online course for conventional and organic farmers interested in learning how to use farm financials to explore

their farm business decisions

Farm Pulse: Financial Management and Analysis is a self-paced online course for conventional and organic farmers interested in learning how to use farm financials to explore their farm business decisions. This course will help farmers evaluate their finances, take the pulse of their farm business, and set goals for the future of their operation.

What will I learn in this course?

You will learn how to:

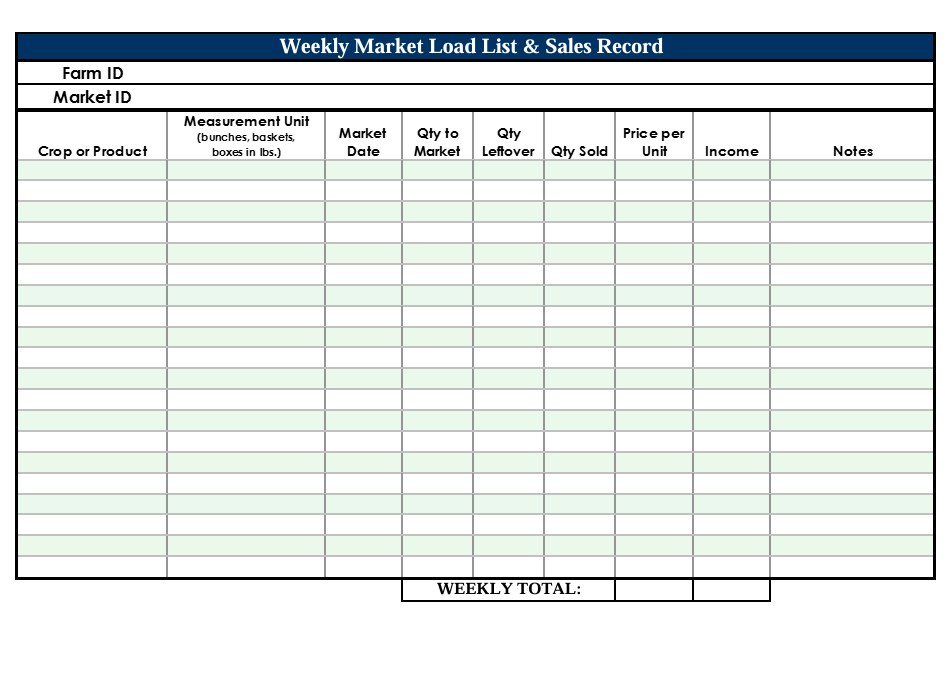

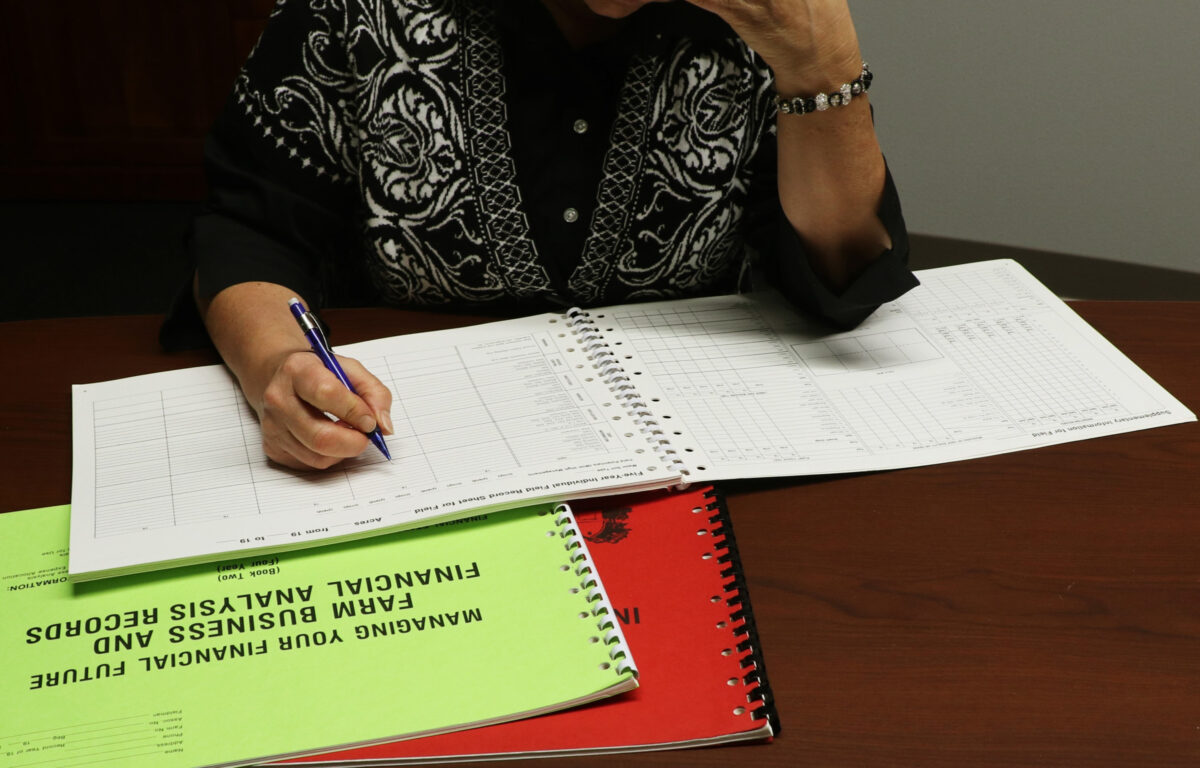

- Identify which records to collect for your farm business

- Compare and contrast financial strengths and weaknesses

- Organize financial information into financial statements

- Define the structure of balance sheets, income statements, statements of cash flow, and statements of owner equity.

- Interpret financial statements for the analysis of a farm’s financial position and financial performance

- Illustrate your farm’s plan to communicate with your lender

Course overview

Participants are able to choose between a conventional or organic course

with case farms to follow throughout the series of 8 modules; completing hands-on, interactive financial activities related to these case farms. After completing the course, participants will be able to transfer these skills from the case farm to their own farm businesses. Instructors will be available throughout the course to provide technical support and a one-on-one financial review.

Conventional Case Farms

Bella Acres, a dairy farm

Johnson Ranch, a livestock and grain farm

Organic Case Farms

Davis Organic Dairy, an organic dairy and grain farm

Golden Apple Orchard, a small organic apple orchard

Pride Garden, a small organic vegetable farm (coming soon!)

This course fulfills education requirements for USDA Farm Service Agency loan borrowers in Wisconsin (all U.S. states will be available soon).

The 8 modules

- Module One: Overview and introduction to the case farms

- Module Two: Farm financial model and records

- Module Three: Financial statements – balance sheet, income statement, statement of cash flows, statement of owner equity

- Module Four: Financial position – liquidity and solvency ratios

- Module Five: Financial performance – profitability, repayment and replacement capacity, and financial efficiency ratios

- Module Six: Decision-making – DuPont Analysis, planning, and budgeting

- Module Seven: Working with your lender

- Module Eight: Next steps

Registration

Frequently asked questions

How much does this course cost?

The course fee is $299, which includes access to the course materials for one year. Participants are also able to meet with the instructor for a financial review at any time during the course. You may want to check with your lender to see if they provide reimbursement for borrower education and training programs.

Who should register for this course?

The course is open to anyone involved in agriculture. In particular, farmers or farm managers who are interested in developing farm financial statements to explore and make informed financial and production decisions on a farm business. Farm Pulse – Financial does fulfill education requirements for USDA Farm Service Agency loan borrowers in Wisconsin (all U.S. states will be available soon).

Can I register at any time?

Yes. The course is available on demand, allowing you to work through the course at your own pace and on your own time. After registration and payment, you will receive credentials to log in to Canvas, UW’s online learning management system. Canvas’ browser-based interface works on multiple devices, allowing you to progress through the course wherever and whenever you have internet access.

Approximately how long does the course take to complete?

This course will take approximately 6 hours to complete. The course is comprised of 8 modules of asynchronous online learning, which allows you to view instructional materials at any time and does not include a live video lecture component. The course lessons feature short readings and/or videos teaching key concepts. Knowledge checks will feature interactive learning experiences. And each lesson concludes with a short quiz to reiterate the learning objectives for the lesson and provides you with immediate feedback, as opposed to waiting for instructors to grade them. A course outline will be provided to assist you in tracking your progress. Additional time may be spent applying the information to your own farm business.

What materials will I need to complete this online course?

You must have internet access.

Other software that will be used in this course:

- Adobe Reader: Download the latest version of Adobe Reader to view PDF (portable document format) files. Note: Do not select the optional offer for McAfee Security Scan Plus.

- Word Processor, Presentation, and Spreadsheet Software: Choose from the following options:

- Microsoft Office (free for UW-Madison students through Office 365 portal; for PC or Mac)

- Google Docs (free cloud service; web browser-based)

- OpenOffice (free download; for PC or Mac)

Is this online course accessible for people who require special needs or services?

Yes. UW-Madison has specific accessibility requirements regarding online content, both to benefit learners and to comply with the law. We have designed the Farm Pulse-Financial online course content to meet those requirements.

What happens once I complete the course?

A certificate of completion will be provided to participants once all modules have been reviewed, the quizzes have been completed with a score of 70% of higher, and the post-course surveys have been completed. Certificates are generated at the end of each month and sent electronically.

You will have the option to schedule a meeting with the course instructor with a link provided at the end of the course.

Will additional Farm Pulse courses be offered?

Yes! Farm Pulse: Crop Insurance and Grain Marketing is available now!

Who should I contact if I have more questions?

For more information on the Farm Pulse course, feel free to contact farms@extension.wisc.edu.

Related articles

The Farm Pulse: Financial Management and Analysis work is supported by USDA/NIFA grant under Award Number 2018-70027-28586.

Funding for Project or Publication was made possible by a grant/cooperative agreement from the U.S. Department of Agriculture (USDA) Agricultural Marketing Service. Its contents are solely the responsibility of the authors and do not necessarily represent the official views of the USDA.