Host Katie Wantoch and Jenny Vanderlin, Associate Director of the UW Center for Dairy Profitability, discuss a farmer whose wife lost her off-farm job due and if she should do more work on the farm.

Host Katie Wantoch and Mark Hagedorn, retired Extension Dairy Program Manager, discuss a farmer who wants to know if they should sell pregnant dairy cattle heifers now or wait to sell these animals until after the cow has had her calf.

As we all know, the month of January often brings thoughts of taxes and tax preparation. Gary will focus on issues specific to farm tax returns so those listening may gain a better understanding of what to think about regarding farm tax preparation and be able to ask better questions with their tax advisor.

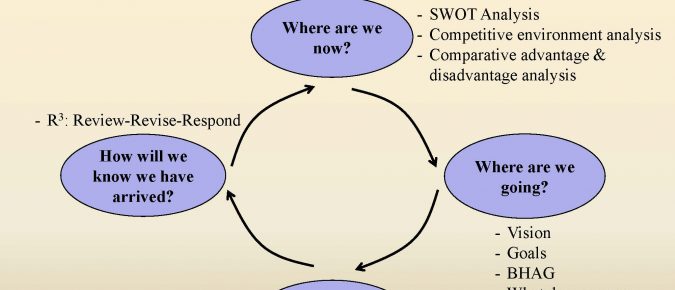

A new year always elicits new resolutions, goals and plans for how to better our business, family and self. However, a quick google search shows that only 8% of Americans keep their resolutions throughout the year and 80% have failed by February. How can we become an 8-percenter in the new year?

Negotiating is important for the success of any business, but it is especially critical during lean times. It may seem like common sense, but many times people let their emotions get the best of them and ignore their basic instincts. It takes homework, discipline, and street smarts to successfully make a deal.

A lender’s primary interest is in whether you’re likely to fulfill the requirements of a credit agreement. When a creditor lends you money, he or she does it with the expectation of earning a profit, which is unlikely to happen if there’s a good possibility that you’ll default on the loan. The lender will be […]

Debt can feel overwhelming. It can be difficult to think clearly when the bills pile up, late fees accrue and interest adds up. Taking a moment to organize your obligations is important to maintain your assets, avoid paying more in fees and interest, and protect your credit. Use the provided tool to develop a comprehensive list of all outstanding creditors so you are able to differentiate and organize secured and unsecured debt.

Equity is the wealth you have earned in your business and what is used to cover negative profits. Continuing negative profits drains your equity. If the prospect for future profits is not high or not high for a while, then the question becomes how much equity are you willing to spend.

The cash flow budget is a valuable planning tool for the farm manager. It enables the manager to know and plan borrowing needs and investment opportunities throughout the year. With a cash flow budget, the manager has an initial cash position for each time period. It can also serve as a communication tool to share with a lender to set up a line of credit, make capital investments, or perhaps discuss the reduction of debt.

Knowing where to start with financial analysis can be overwhelming. It may be helpful to remember this just one step in the Farm Financial Model: Records → Management Reports → Decision Making Cash vs. Accrual Accounting Records It’s important to know if your records are on a cash or accrual basis. Most farm records are […]

Investing in capital replacement or new investments is appealing, but building working capital and paying off dead-weight debt may be the more prudent financial decision.

Farmers are notorious for preferring to farm while leaving business dealings to trust, fate or chance. Afterall, there are only so many hours in a day, and when farm families work near each other all day, it is tempting to believe that assumptions or verbal communication may replace written text. Farmers must remember, however, that every business entity carries legal and tax implications, and the written operating agreement may save a lot of headaches and heartaches when legal and tax issues arise.

Regular family money meetings can help divide the stress of the financial burden into more manageable challenges.

Regardless of the time of year, it is important for farm operators to spend some time in their office completing their least favorite activity – paperwork. Most farmers enjoy getting their hands dirty, from digging in the soil, repairing machinery, or working with livestock. They will reluctantly compile the necessary information for income tax preparation, credit borrowing, and crop reporting.

With economists at the U.S. Department of Agriculture predicting farm debt will reach a record high this year, Wisconsin agricultural leaders are warning farmers against the dangers of unregulated lenders.