The final measure of financial performance is financial efficiency. Financial efficiency shows how efficiently a farm business uses assets to generate income. It also indicates where each dollar of income generated in the farm business has been spent.

The four measures used to assess financial efficiency are operating expense ratio, interest expense ratio, depreciation and amortization expense ratio, and income from operations ratio.

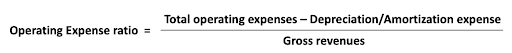

Operating Expense Ratio

The operating expense ratio looks at what percentage of farm income is used to pay operating expenses, not including depreciation/amortization and interest expenses. If the farm’s operating expenses are over 80%, it will not have enough revenue to pay for depreciation/amortization, interest, and owner withdrawals/family living expenses.

The Farm Finance Scorecard shows that a business is strong when operating expenses make up less than 60% of your total costs. When these expenses are greater than 80%, there is reason for concern.

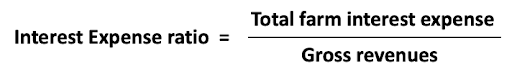

Interest Expense Ratio

Interest expense ratio measures the percentage of the farm income that was used to pay interest owed on debt. In general, the lower this ratio, the better. Inflation and rising interest rates could impact the interest expense ratio.

The Farm Finance Scorecard shows that a business is strong when farm interest expense makes up less than 5% of your total costs. When these expenses are greater than 10% there is reason for concern.

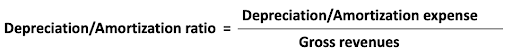

Depreciation and Amortization Expense Ratio

The Depreciation/Amortization expense ratio shows the percentage of the farm income that was used on new or existing capital used in the farm business. When the equipment is older and outdated, the farm may have a higher operating expense ratio for repair expenses and a lower depreciation ratio if it has depreciated the value of these assets.

If the farm has purchased newer farm equipment, the ratios are often reversed with a lower operating expense ratio and a higher depreciation ratio. These two ratios are usually connected.

The Farm Finance Scorecard shows that a business is strong when depreciation/amortization expenses make up less than 5% of your total costs. When these expenses are greater than 10%, there is reason for concern.

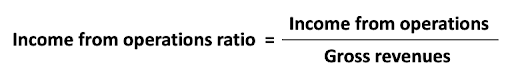

Interest From Operation Ratio

After paying operating expenses, depreciation/amortization, and interest expenses, the farm business can calculate its income from operations ratio and determine how much is remaining for owner withdrawals. The higher this ratio, the more return for unpaid labor and management will be received after expenses are paid.

The Farm Finance Scorecard shows that a business is strong when income from operations makes up more than 20% of total costs. When these expenses are less than 10% there is reason for concern.

Next Steps

Past performance of the farm business could well indicate potential future accomplishments and investments. It also answers the question – What are the effects of production, purchasing, pricing, financing, and marketing decisions on gross income?

Conclusion

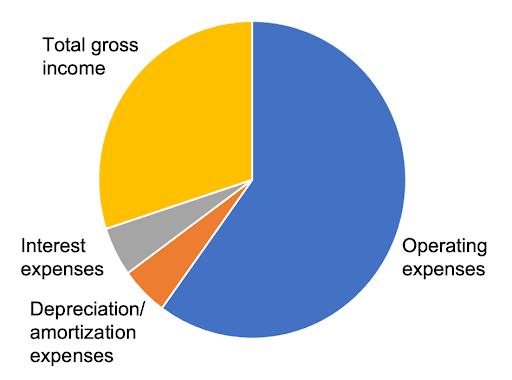

Financial efficiency is an indication of a farm business’s success in using productive resources (land, labor, capital) and managing those resources (purchasing, pricing, financing and marketing). The four efficiency measures can be thought of as slices of a pie. Together, they should add up to the farm’s total gross income.

The first three measures indicate what the farm’s income was spent on – operating, depreciation/amortization, and interest. The final measure shows what percentage of the farm’s income was left over for family living expenses. Financial efficiency indicates that the farm is balancing its expenses appropriately to generate income. Look at these four ratios together to get a better picture of the farm’s financial health.

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.