The second measure of financial position is solvency. Solvency is the ability of a farm business to pay all its farm debts if the business was sold tomorrow. Solvency is important in evaluating the financial risk and borrowing capacity of the farm business.

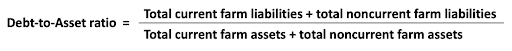

Debt-to-Asset Ratio

The Debt-to-Asset ratio compares a farm’s total assets with total liabilities by dividing the sum of the current and non-current farm liabilities by the sum of the current and non-current farm assets.

This ratio shows what percentage of total farm assets are owed to creditors or creditors’ claims against the assets of the farm business. The larger the sum of the farm’s liabilities compared with the farm’s assets, the higher the debt-to-asset ratio will be. A higher debt-to-asset ratio indicates greater risk exposure for the farm business and less flexibility for responding to adverse situations and borrowing capacity.

The Farm Finance Scorecard shows a strong debt-to-asset ratio is less than 30% while a ratio greater than 60% is a concern and makes the farm business vulnerable. Another way of saying this is that for every $1 of assets that you have, you have xx cents worth of debt.

The farm can also compare equity to assets by dividing total farm equity by total farm assets. The equity-to-asset ratio is the farmer’s share of the farm business. A strong ratio is greater than 70% while a weak ratio is less than 40%.

When you add the debt-to-asset ratio percentage to the equity-to-asset ratio percentage, the sum will always equal 100 percent. By looking at these ratios together, a farm business can report that of all the assets of the farm business, creditors are providing xx percent of the debt and the farmer is supplying xx percent of the equity.

Alternatively, the farm may want to calculate the debt-to-equity ratio to review how much the farmer has leveraged the equity in their business. This ratio can be determined by dividing the farm’s total liabilities by total farm equity.

Next Steps

Remember the farm’s balance sheet is a snapshot of the farm’s financial position on a specific date. The balance sheet changes depending on the timing of the year, such as spring planting versus crop harvesting. Many farm business activities may affect the business’s debt to asset ratio.

What if I am not comfortable with the farm’s solvency ratios or measures? Here are a few suggestions:

- Consider selling non or low profit capital assets and/or enterprises

- Create a strong risk management plan

- Develop a strong marketing program and/or production contracting

- Does not guarantee a higher price, but assures a price/margin in advance

- Add off-farm contributions

- Improve profitability in the long-run

Conclusion

Solvency relates primarily to the farm’s ability to meet long-term commitments as they come due. If the value of total farm assets exceeds total farm liabilities, the farm business is solvent; if the sale of all assets would not generate sufficient cash to pay off all liabilities, the farm business is insolvent.

If the farm business has a strong solvency position, it is better able to continue even when asset values, asset returns, and interest rates are less favorable. The farm may also be better able to take advantage of opportunities when they come along.

If the farm business has a weak solvency position, it may have few reserves to fall back on if asset values or asset returns decline or interest rates increase. Low solvency means the farm business might have a hard time taking advantage of opportunities, such as if farmland nearby comes up for sale.

Solvency is important in evaluating the financial risk and borrowing capacity of the farm business. Some farmers may be comfortable with a higher risk, while others may not. As the solvency position decreases, the greater the risk to the farm business. In this situation, lenders or investors in the farm business may demand more accountability for future decisions

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

Liquidity: Relationship between current farm assets to current farm liabilities

Liquidity: Relationship between current farm assets to current farm liabilities Profitability: Seed for a farm's future

Profitability: Seed for a farm's future Repayment and Replacement Capacity: A farm's ability to repay debts

Repayment and Replacement Capacity: A farm's ability to repay debts Financial Efficiency: A farm’s use of assets to generate income

Financial Efficiency: A farm’s use of assets to generate income