The second measure of financial performance is repayment and replacement capacity. Repayment capacity shows the farm’s ability to repay term debts on time and as they come due. It includes non-farm income so it is not a measure of the farm business performance alone. The two measures used to assess repayment and replacement capacity are debt coverage ratio and replacement coverage ratio.

Debt Coverage Ratio

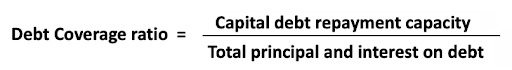

The debt coverage ratio measures the ability of the farm business to cover its debts and repay its loans. It looks at the total debt payments in terms of ability to make payments on that debt. A lender wants to be sure that a farm will have adequate cash flow to cover current interest expenses and intermediate and long-term debt payments.

This table shows the items that are included in the debt coverage ratio.

Capital Debt Repayment Capacity

Sum of:

- Income from operations

- (+/-) Miscellaneous revenues and expenses

- Non-farm income

- Depreciation and amortization expenses

Minus:

- Income taxes

- Owner withdrawals

- Interest expense on current debt

Total Principal and Interest on Debt

Sum of:

- Current portion of intermediate and long-term debt

- Current portion of finance leases

- Interest expense of intermediate and long-term debt

Capital debt repayment capacity is the net amount that the farm has to make its debt payments and includes net income generated from farm and non-farm sources. This amount is divided by the total amount of principal and interest payments on all of the farm’s debt.

A strong debt coverage ratio indicates that there is enough funds to cover all of the principal and the interest payments on the debt. A weak ratio indicates that the farm business is a high risk and may not be able to pay off the debt or request new loans from a lender. A ratio of 1.0 (100%) means that the farm is able to make its term-debt payments with nothing to spare.

The Farm Finance Scorecard shows that a strong debt coverage ratio is greater than 1.75 while a ratio less than 1.25 is a concern and a weakness.

Replacement Coverage Ratio

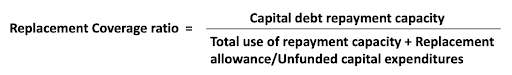

The Replacement Coverage ratio measures the ability of the farm business to make all its debt payments and replace capital assets when needed or make capital improvements.

This table shows the two parts of the value being compared to the capital debt repayment capacity – the total uses or commitments of repayment capacity and the replacement allowance or unfunded capital purchases, such as machinery.

Total Uses / Commitments or Repayment Capacity

Sum of:

- Total principal and interest on all debt

- Total annual payments on personal liabilities / debt

Replacement Allowance / Unfunded Capital Purchases

Net amount of cash used minus any new financing provided to purchase assets (such as personal debts).

When the replacement coverage ratio is calculated, consider the principal and interest payments on the farm debt, but also any cash, gifts, or other financing that may have been used to help pay for the replacement or improvement of capital assets.

Capital assets, such as machinery, can be purchased by borrowing the necessary funds or by generating enough cash in the farm business. A farm may borrow for most capital asset replacement needs. Other farmers may choose to finance all or part of their asset replacement with operating income. A farm business should include an asset replacement allowance in the future plans for use of operating income.

The Farm Finance Scorecard shows that a strong replacement coverage ratio is greater than 1.50 while a ratio less than 1.10 is a concern and a weakness.

Next Steps

What if I am not comfortable with the farm’s repayment and replacement capacity ratios or measures? Here are a few suggestions:

- Increase profitability

- Increase revenues

- Decrease expenses

- Increase off-farm income, reduce off-farm expenses

- Reduce family living expenses

- Restructure debt service

- Seek interest only

- Restructure debt, longer amortization on loans

Conclusion

Repayment capacity ratios are most often used by lenders when evaluating a request in a new loan application. A farm business with a large amount of debt will likely have to borrow the funds for capital replacement needs. A farm that has a weak repayment capacity may have trouble making debt payments and replacing capital.

While a farm business with a low amount of debt may be able to replace capital through cash flow from their farm. A farm that has a strong repayment capacity will have little trouble meeting scheduled term debt payments and replacing capital.

The best way to improve a farm’s repayment and replacement capacity is to improve the profitability of the farm.

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.