The first measure of financial position is liquidity. Liquidity is the ability of a farm business to meet the financial obligations as they come due – to generate enough cash to pay family living expenses and taxes and make debt payments on time. The two measures used to assess liquidity are current ratio and working capital as percent of gross revenues ratio.

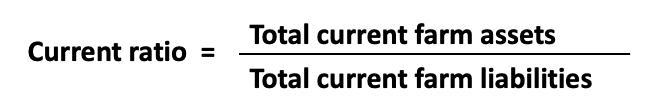

Current Ratio

The current ratio looks at the relationship between a farm’s current farm assets and current farm liabilities (debts). It measures the business’s ability to meet financial obligations when they come due on a particular date. The current ratio also measures whether the current farm assets listed on the farm balance sheet – if they were sold tomorrow – would pay off all of the current farm liabilities. The current ratio does not predict the timing of cash flow during the year or adequately determine future cash flows.

Examples of Current Assets

- Cash

- Accounts receivable

- Grain in storage

- Feed inventory

- Marketable livestock

- Farm supplies

- Prepaid expenses

Examples of Current Liabilities

- Accounts payable

- Line of credit balance

- Credit card balance

- Unpaid taxes

- Accrued interest

- Term debt principal payments due within the next 12 months

A strong current ratio means assets are a lot greater than liabilities. It allows the farmer to go to their lender and obtain an operating loan to cover unexpected cash needs, such as feed purchases during drought conditions. The current ratio can vary throughout the production cycle of the farm business (i.e. planting may have increased liabilities versus harvest time when may have increased assets on hand).

The Farm Finance Scorecard shows:

- Greater than 2.0 is strong. Look to improve the current ratio to above 2.0

- 2.0 to 1.3 falls in the caution range. Less than 1.3 would be vulnerable.

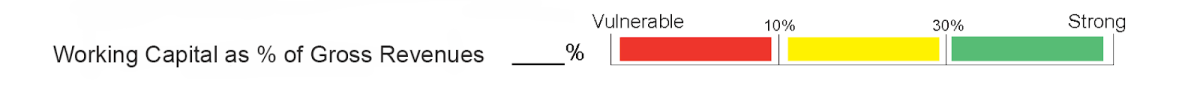

Working Capital as Percent of Gross Revenues Ratio

The working capital as percent of gross revenues ratio measures the farm business’s working capital compared to the overall size of the farm business. For this ratio, the farmer will divide their working capital by total (gross) farm revenues from the income statement at a particular point in time.

Let’s start by looking at what working capital is.

Working capital is the farm business’s short-term operating capital. It is the amount of money the farm would have available to buy inventory items and inputs after having turned current farm assets into cash and used that cash to pay off current farm liabilities.

This number may be positive or negative, and whether it is a “good number” or not depends on the size of the farm business.

While gross farm revenues may cover a period of time (e.g. month, quarter, annual, etc.), the farm’s working capital represents assets and liabilities at a single point in time.

The previous ratio is needed to compare the farm’s working capital with gross farm revenues.

A strong working capital as a percent of gross revenues ratio allows the farm to have greater liquidity. A weak ratio may result in the farm business relying more on borrowed operating funds sooner in the growing season since it will have run out of its own working capital earlier in the year. This ratio can vary throughout the production cycle of the farm business (i.e. planting versus harvest time).

The Farm Finance Scorecard shows that a strong working capital to gross revenues ratio is greater than 30% while a ratio less than 10% is a concern and a weakness.

The farm can also compare working capital with operating expenses, rather than with gross income. Since working capital is generally used to fund farm operating expenses, this approach may be helpful. For this ratio, the farm should use the same working capital measure (total current farm assets minus total current farm liabilities) and divide it by total operating expenses from the income statement, rather than gross revenue. A strong ratio is greater than 40% while a weak ratio is less than 20%.

Next Steps

Remember the farm’s balance sheet is a snapshot of the farm’s financial position on a specific date. The balance sheet changes depending on the timing of the year, such as spring planting versus crop harvesting. Many farm business activities may affect the business’s current ratio and working capital.

What if I am not comfortable with the farm’s liquidity ratios or measures? Here are a few suggestions:

- Increase cash reserves during good market years

- Add off-farm contributions

- Restructure outstanding liabilities (debt)

- Adjustment short-term liabilities to long-term

- Look to lower interest rates

- Seek interest only loan payments

- Potential for new or bridge funds

Conclusion

A farm with a strong liquidity position is better able to have cash available when it needs or wants it. A farm with a weak liquidity position is more likely to have trouble making purchases, paying bills, making debt payments, and paying living expenses. In extreme situations, a farm may need to sell assets that it wouldn’t otherwise sell to generate cash. Selling these assets is likely to then disrupt normal farm business operations even further.

A farmer needs to determine their risk tolerance and manage the farm’s finances to maintain the desired liquidity ratio or measure. A more thorough analysis of liquidity can also be made with Cash Flow Budgeting

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.