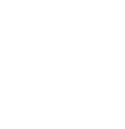

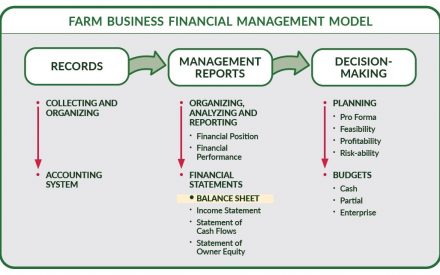

The farm financial model offers a linear and circular process for informed decision-making. Records feed into reports, and reports help farmers integrate financial sense into farm production decisions.

Introduction

The farm financial model is a concept for understanding the financial flow of the farm business. Collecting and organizing financial information (records) through an accounting system is the first step. This financial information is transformed into financial statements for analysis and interpretation of the farm’s historical and current financial position and performance. Budgeting, feasibility, profitability and risk-ability analyses allows the farmer to make the best decisions possible for the farm business’s future.

Records

The farmer must collect and organize income and expense receipts in an accounting system before generating financial statements. Receipt accounting is also referred to as record keeping.

Management Reports

Organizing the records provides the farmer with the financial information necessary to complete management reports, which are also known as financial statements. The Farm Financial Standards Council (FFSC) recommends farmers create four financial statements from which the financial position and performance may be analyzed. Financial statements should be prepared on a consistent basis. Statements include balance sheet, income statement, statement of cash flows, and statement of owner equity. The income statement, statement of cash flows, and statement of owner equity cover the same time period, and the balance sheet provides values for the beginning and end of that period. The strength of the business at a point in time (position) and how well the farm business has performed over time (performance) are two historical insights reported as financial statements.

- Financial position describes the farm’s assets. Assets include the tangibles needed by the farm business to function, such as cash, machinery and equipment, livestock, and other inventories.

- Financial performance describes how money flows through the farm business and how well the business can pay its bills, meet payroll costs, and how much money is reserved for unanticipated expenses.

- Financial analysis provides an opportunity for the farmer to determine the farm business’s profitability and financial efficiency. Using information generated from the management reports (financial statements), the farmer can benchmark the business against other farms in the industry, determine strengths and weaknesses, measure financial progress, and set financial goals. Financial analysis also allows for future management and decision-making.

Through the second step, the farmer has completed the historical review and understanding of the farm business’s financial position and performance. Financial measures, as absolute measures or financial ratios (Farm Financial Scorecard) can be most informative when analyzed to the same measures in the previous time periods or benchmarked to comparable farm businesses (Benchmarking). This financial analysis provides a basis from which to plan for the future and draft pro-forma financial statements.

Developing Your Farm Financial Statements and Analysis

The Extension Farm Financial Statement and Analysis Tools consists of excel worksheets that 1) provide a means and help in developing the financial statements: balance sheet, income statement, statement of cash flows, and statement of owner equity and 2) automatically calculate and organize relevant financial ratios for analysis. The Spreadsheet Tools are more involved than other calculators in that it offers an opportunity to input and connect all of your financial statements to conduct financial analysis of your farm business. As with many spreadsheet tools, there are tradeoffs between simplification, accuracy, and depth.

There are three spreadsheet tools. Each is the same with respect to calculating and organizing financial ratios for analysis. They are different in the inputs required.

Financial Statement and Analysis System spreadsheet tool

In addition to calculating and organizing financial ratios, the Financial Statement and Analysis System spreadsheet tool (ver 01-2023) includes supporting schedules and other input information for the original creation of the four financial statements recommended by the Farm Financial Standards Council (FFSC) – beginning and ending balance sheets, accrual income statement, statement of cash flow, and statement of owner equity. Also included is calculation of costs of production. The spreadsheet is for one year. Information on completing the spreadsheet is available in this video series.

Financial Trend Analysis spreadsheet tool

In addition to calculating and organizing financial ratios, the Financial Trend Analysis spreadsheet tool (ver 01-2023) enables users to transfer up to five years of already existing balance sheets and income statements into the spreadsheet. It is different than the previous tool in that it is for multiple years thus allowing trend analysis.

Financial Ratio Analysis spreadsheet tool

In addition to calculating and organizing financial ratios, the Financial Ratio Analysis spreadsheet tool (ver 01-2023) requires only some, but not all, information from already existing balance sheets and accrual income statements. This tool requires the least amount of entries but requires that already existing financial statements are available. It is also for multiple years, up to five.

Share your feedback on this tool by contacting our Extension team at farms@extension.wisc.edu

Decision-Making

Understanding the farm business’s history of financial position and financial performance provides a basis for the farmer to make decisions and plan into the future. Pro forma refers to the future view of the farm’s financial position and performance. For example, what would the balance sheet look like after a future expansion? The future financial position can be analyzed for feasibility, profitability, and risk-ability. Pro forma financial statements complement the farm’s budgets. Cash, partial, and enterprise budgets are commonly used to assist the farmer in decision-making.

Summary

The farm financial model helps the farmer make the best decisions for the farm business. From record keeping to financial analysis, this model illustrates how to make sound financial decisions and identifies tools to help in the process.

The full Farm Pulse – Financial Management and factsheet series (pdf) is available for download.

This is one in a series to introduce you to the farm business financial management model. This presentation provides an overview of the farm financial model.

More Farm Pulse Financial Management Resources

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586. Developing a Farm Financial Model (2021), drafted by Katie Wantoch, UW-Madison Division of Extension; reviewed by Kevin Bernhardt UW Center for Dairy Profitability/UW-Platteville, and Jenny Vanderlin, UW Center for Dairy Profitability; based on material from Understanding the Farm Financial Model factsheet (2018), by Sandy Stuttgen, UW-Madison Division of Extension.

Download Article

Collecting and Organizing your Farm Records

Collecting and Organizing your Farm Records Selecting your Farm Accounting System

Selecting your Farm Accounting System Preparing a Balance Sheet

Preparing a Balance Sheet Preparing an Income Statement

Preparing an Income Statement