Host Katie Wantoch and Simon Jette-Nantel, former Professor at UW-River Falls and Extension Farm Management Specialist, discuss when is the right time for a farmer and his son to purchase the neighbor’s land and how the purchase will affect the farm’s cash flow.

Host Katie Wantoch and Kevin Jarek, Extension Crops, Soils, and Horticulture Agent in Outagamie County, discuss options to help boost a farmer’s forage inventory for this year.

Host Katie Wantoch and Stephanie Plaster, Agriculture Educator in Ozaukee and Washington counties, discuss a farmer and his son who are finally making money on their dairy farm and share steps to assist them in catching up on outstanding bills.

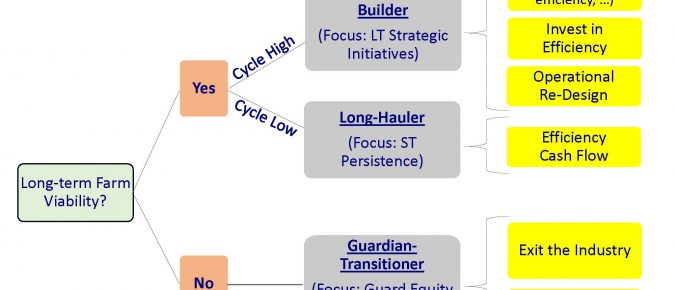

Long-term farm economic viability is the product of three parts – performance, capacity, and resilience. Performance is an efficiency measure, the ability of the farm business to create profit margins per unit of production. Capacity is whether there are enough production units (acres, cows, etc.) that when multiplied over the profit margin will cover debt service, asset maintenance and replacement, retained earnings and family living. Resilience is the ability of the business to take a punch and bounce back to normal operations.

Host Katie Wantoch and Lyssa Seefeldt, Dairy and Livestock Agent in Eau Claire County, discuss a farmer and his son who are breeding the bottom half of their dairy herd to AI beef bulls and things to consider on this new enterprise.

Host Katie Wantoch and Jenny Vanderlin, Associate Director of the UW Center for Dairy Profitability, discuss whether a farmer should refinance his loans and tips for communicating with his ag lender.

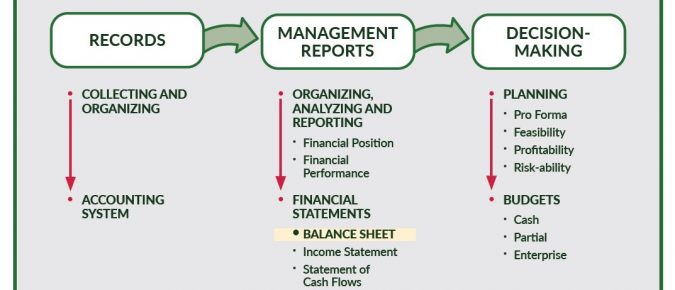

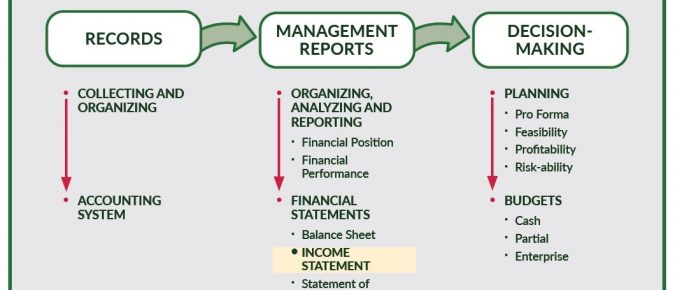

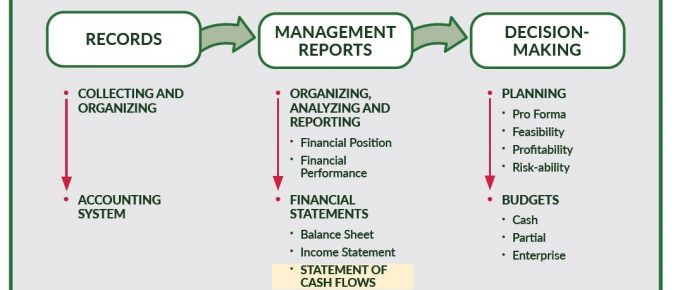

The farm financial model offers a linear and circular process for informed decision-making. Records feed into reports, and reports help farmers integrate financial sense into farm production decisions.

Farming is a complex business which demands accurate records and careful financial management.

An accounting system is a set of actions and methods designed to collect, store, and process financial transactions into management reports for decision-making.

The balance sheet is a report of the farm business’ financial position at a moment in time. It lists assets, liabilities, and net worth (owner’s equity), and represents a snapshot of the farm business as of a certain date.

The income statement is a report of the farm business’ financial performance during a given time frame. It measures profit or loss in a given time period.

The statement of cash flows tracks the sources and uses of cash in the farm business in the past year. It also adds insight to the understanding of financial position and performance of the farm business.

The statement of owner equity reconciles the change in equity from the beginning balance sheet to the ending balance sheet for the farm business. Also known as the statement of net worth, shows the source of change.

Host Katie Wantoch and Heather Schlesser, agriculture educator from Marathon County, discuss whether a dairy farmer and his son should purchase bred heifers or cows to expand their dairy herd.

Host Katie Wantoch and Stephanie Plaster, Agriculture Educator in Ozaukee and Washington counties, discuss a dairy farmer who has received a CFAP payment for their milk production and are wondering who should pay first with this program payment and how much they should pay to vendors.

Host Katie Wantoch and Simon Jette Nantel, Professor at UW-River Falls and Extension Farm Management Specialist, discuss if a farmer should offer a lower rental rate per acre to the neighbor who is retiring from farming.

Host Katie Wantoch and John Shutske, Professor and Director of UW Center for Agricultural Safety and Health and an Extension Specialist, discuss a farmer’s wife who is worried about her husband and the ongoing struggles with their farm business.

Host Katie Wantoch and Jerry Clark, Extension Agriculture Agent in Chippewa County, discuss a farmer who wants to know if they should sell surplus crops or keep the feed for next year.