Farm financial statements, such as the balance sheet, income statement, statement of cash flows, and statement of owner equity provide a historical review of the farm business’s financial position and performance. This financial analysis provides a basis from which to plan for the future of the farm business and draft pro forma financial statements.

What is a pro forma financial statement?

A pro forma financial statement is defined as a financial statement that uses hypothetical data or assumptions to develop projections for a certain period of time that hasn’t occurred yet. Pro forma statements are common types of forecasts or financial projections to assist a farmer with their future plans and answer the critical “what if” questions when designing those plans.

Pro forma refers to the future view of the farm’s financial position and performance. Pro forma financial statements are a set of financial statements, usually a balance sheet, income statement, and statement of cash flows.

Creating pro forma statements

Farm financial analysis methods, like benchmarking, cost of production, and the DuPont Analysis are used to better understand a farm’s financial position and performance over a period of time. While these methods provide a historical review, creating pro forma financial statements helps a farmer to focus on their future.

The main difference between historical and pro forma statements is that assumptions and adjustments must be made when creating the forecasts or projections. These projections are a farmer’s best estimate of future income and expenses over a period of time. A farmer might review their revenue and costs from the last period, along with reviewing commodity market outlooks, and make necessary adjustments when determining future income and expenses.

For example, a dairy farm is considering expanding their dairy cow herd. The farm has historical financial statements that can be used to review their financial position and performance. Some income and expense items are fixed costs and will not change if the dairy farm undergoes an expansion. However, the farm will need to make assumptions of income and expense of individual line items that will change, such as future herd size, feed costs, etc.

Answering “what if” questions

A farm business that might be considering a new enterprise or transition should develop pro forma financial statements over the next several periods of time. Long-term projections are important for farmers to compare their forecasts to during changes in their business until a steady state is reached again.

In the previous example of a dairy farm considering a future expansion, the projected income statement should answer the “what if” question – will this expansion generate future profits? As a business changes, there is often a transition period where farm profits may vary over similar time periods. This will likely be the case in a dairy farm expansion, especially if the farm purchases springing heifers to increase their herd size. The farmer should create multiple projections showing the increase in herd size and milk production until the farm reaches a point when herd size and production remain constant.

Another “what if” question the farmer might ask – What will the balance sheet look like after this future expansion? Preparing a projected balance sheet with the increased herd size is much the same as preparing a historical balance sheet. However, the liability section may need to be updated depending on if financing is needed for the expansion. Completing all pro forma financial statements will provide the farmer with a true picture and make the best decisions for the future of their farm business.

Conclusion

Understanding the farm business’s history of financial position and financial performance provides a basis for a farmer to make decisions and plan into the future. The future financial position can be analyzed for feasibility, profitability, and risk-ability.

There are limitations to pro forma financial statements. These statements are based on assumptions so they should not be taken as fact. Rather, pro forma should be used to help make decisions based on historical data and research-based information.

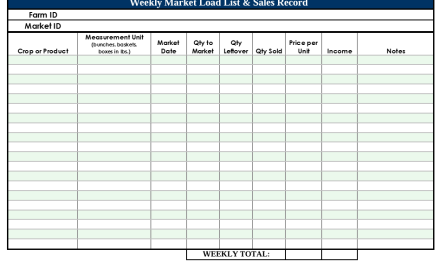

Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers

Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers Review recordkeeping methods and retention standards in the new year

Review recordkeeping methods and retention standards in the new year  ▶ Watch: Financial Statement and Analysis Spreadsheet Walkthrough

▶ Watch: Financial Statement and Analysis Spreadsheet Walkthrough Enterprise Budgeting: Review of a single enterprise in a farm business

Enterprise Budgeting: Review of a single enterprise in a farm business