Having financial statements (balance sheets and income statements) is a first step towards financial management decision-making. However, it is the next step that makes a difference in future profitability and that is analyzing the financial story being told by the financial statements and making decisions on where to spend management time to improve future profitability.

There are many methods, tools, and processes for analyzing financial statements and one of those is the DuPont System for Financial Analysis. The DuPont system is a means to fairly quickly assess where the business strengths and weaknesses potentially lie and thus where management time may optimally be spent.

The DuPont system focusses on the profit metric, return on equity (ROE), and recognizes three primary levers of profitability that impact return on equity (Figure 1). The analysis of those three levers enables the farm manager to understand where profitability challenges may lie and where and how return on equity may be improved if those challenges are addressed. The three levers are:

- Turning assets into gross revenues (measured by the asset turnover (ATO) ratio)

- Efficiency of keeping revenues as profits after expenses are paid (measured by the operating profit margin (OPM) ratio)

- Leveraging outside financing of profitable activities (measured by the leverage ratio total assets to total equity)

Figure 2 shows a diagram of the linkages among the DuPont system ratios. The goal of the system is a higher return on equity shown on the right-hand side of Figure 2. If return on equity is too low, then the farm manager can trace back the cause of the lower return on equity to one or more of the three levers and thus indicate where to spend management time.

DuPont Analysis Math

The DuPont system is a set of commonly used ratios that when combined link to the profit metric – return on equity (ROE). It begins with the asset turnover ratio.

DuPont Analysis Diagnostics

Diagnostics begins on the right-hand side of Figure 2. If return on equity (ROE) is low, then it is due to a low leverage ratio, low return on assets (ROA), or both. If low ROA is the problem, then it must be due to low asset turnover (ATO) ratio, low operating profit margin (OPM) ratio, or both.

The DuPont Analysis can assist in getting to the root of farm financial performance problems. The DuPont Analysis along with benchmarks for farm enterprises can assist farmers in their quest for higher profitability.

Cash flow budgeting

Cash flow budgeting Benchmarking: Three part process for financial analysis

Benchmarking: Three part process for financial analysis Partial Budgeting

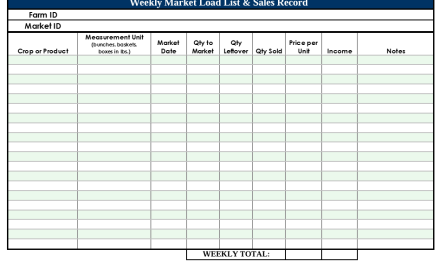

Partial Budgeting Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers

Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers