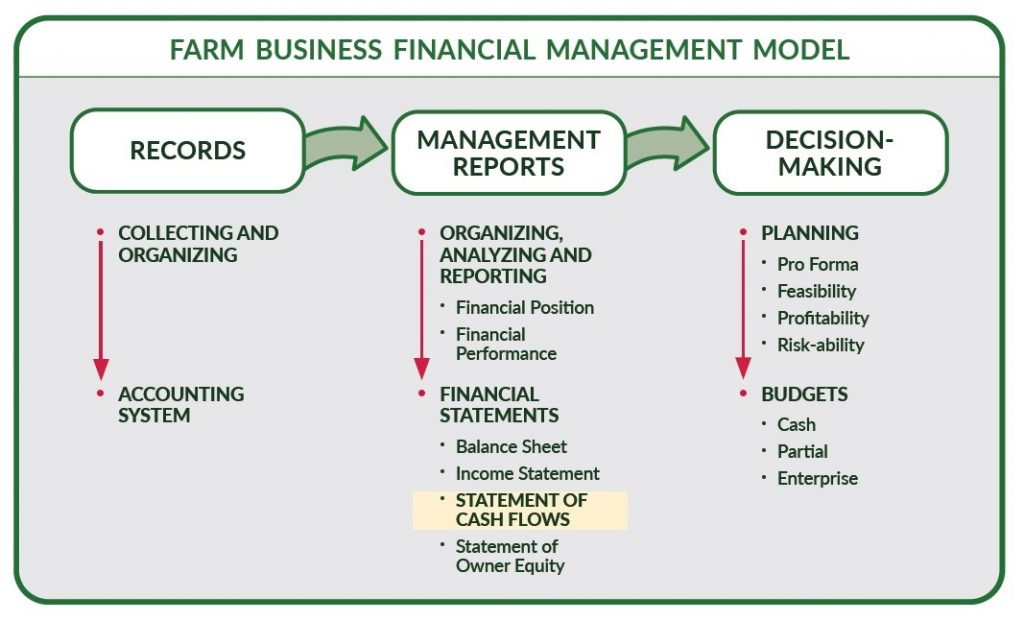

The statement of cash flows tracks the sources and uses of cash in the farm business in the past year. It also adds insight to the understanding of financial position and performance of the farm business.

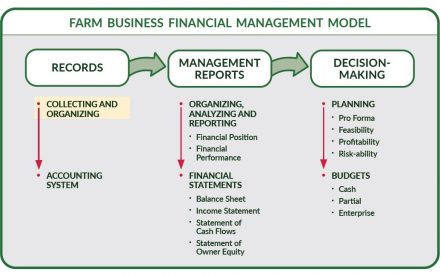

Introduction

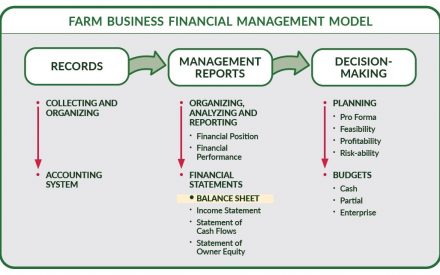

The statement of cash flows focuses on the “cash” activity of the farm business. The balance sheet is often associated with financial position, and the income statement with profitability of the farm business. The statement of cash flows is a value-added statement, giving additional insight to financial position and performance with respect to the cash activity coming into or exiting the farm business.

The statement of cash flows is a historical document summarizing cash activity over a certain time period (month, quarter, year). This statement is sometimes confused with the cash flow budget, which is a projection of future cash flows. The more general term, “cash flow statement,” is commonly used, and may refer to either the cash flow budget (planning future cash flows) or statement of cash flows (summarizing historical cash flows). The statement of cash flows and cash flow budget are different financial tools with different purposes and structures.

The statement of cash flows summarizes the cash activities into three areas of – operating, investing, and financing activities. These three activities might be thought of as three businesses, independent of each other, within the overall farm business. Ideally, the sum of their individual net cash balances should equal the change in the cash position between the beginning and ending balance sheet. If this doesn’t occur, it triggers an investigation into “why?”

The Farm Financial Standards Council (FFSC) provides the specific (and more rigorous) standards and structure for the statement of cash flows. This paper provides a concise and practical presentation of the statement of cash flows, while in compliance with the FFSC guidance.

Statement of Cash Flow Structure

The structure of the statement of cash flows is guided by the formula:

Cash (Jan. 1) + Cash Inflows – Cash Outflows = Cash (Dec. 31)

- Cash (Jan. 1 & Dec. 31) = checkbook balance, savings, etc.

- Cash Inflows = production sales, capital sales, borrowed funds, contributed capital, etc.

- Cash Outflows = operating expense, capital purchases, debt service, non-farm draws, etc.

Cash from Operating Activities

Operating activities include cash inflows and outflows associated with operating the farm business . Much of a farm business’ activities during the year are considered operating activities. Family living expenses, income and social security tax payments are part of this category.

Cash from Investing Activities

Investing activities include cash inflows from the sale of assets and cash outflows for the purchase of assets. How much cash did the farm business generate from the sale of breeding livestock, machinery, or land; and in turn, how much cash was used to purchase these assets? Often, the cash outflow exceeds the cash inflow, and as such, this imbalance is reconciled within the financing activities as additional debt (discussed below).

Cash from Financing Activities

Financing activities is the cash to and from external sources such as lenders, investors and shareholders. How is the business being funded? Incurring additional debt obligations or the repayment of an existing loan’s principal balance, are some of the activities that would be included in this section of the statement of cash flows.

The statement of cash flows may or may not be limited to the farm business. Cash may flow into the farm business as contributed capital, or flow out as withdrawals from the farm business. To the extent this occurs, it is noted within the financing activities.

Change in cash balances

The statement of cash flows shows the ending cash and cash related balances from the year-ending balance sheet (Dec 31). The ‘change in cash’ between the beginning (Jan 1) and ending balance sheets (Dec 31) should reconcile with the change in cash balances from operating, investing, and financing activities in the statement of cash flows.

Preparing Your Statement of Cash Flows

Statement of Cash Flow Tool

The Extension Statement of Cash Flow Tool consists of an excel worksheet that provides a means and help in developing the statement of cash flows. This tool consists of a main “tab” or worksheet “Statement of Cash Flows” with yellow shaded cells to be updated with user data.

Share your feedback on this tool by contacting our Extension team at farms@extension.wisc.edu

Summary

The statement of cash flows is a ‘cash’ concept, not ‘accrual’. It shows the cash inflows and outflows during a time period, regardless of when the earnings or expenses occurred. Therefore, the net cash position will not reflect profitability for the time period. A more thorough and rigorous statement of cash flows does afford the reconciliation of net income to net cash from operating activities. This is presented in the FFSC guidelines.

The statement of cash flows is also useful in comparisons with peers or past performance (i.e., previous years v. past year; debt payments planned v. actual payments).

The statement of cash flows does help the farm business understand the ‘use’ of cash.

- Where has cash left the farm business?

- How much cash was spent on an expense?

- Are there potential surplus or deficient periods during the year?

- Can the farm business estimate the minimum credit needs based on cash flow?

- When should loan payments be scheduled to match cash inflows?

- Is there sufficient cash for capital asset purchases?

Test your knowledge of statement of cash flows

True or False: The Statement of Cash Flows and the Cash Flow Budget are just two ways of referring to the same thing. That is, these two terms can be used interchangeably.

Answer: FALSE. The Statement of Cash Flows is sometimes confused with the Cash Flow Budget. However, they are very different. The Statement of Cash Flows looks backwards and tracks the sources and uses of cash that already occurred. The Cash Flow Budget is a planning document that is looking forwards and planning the sources and uses of cash in the month, quarter or year ahead.

True or False: The Statement of Cash Flows tracks incoming and outgoing cash in three different areas of business activity.

Answer: TRUE. The Statement of Cash Flows is structured into three business activities that each summarize sources and uses of cash within that area of activity – operating, investing, and financing.

This is one in a series to introduce you to the farm business financial management model. This presentation provides information on understanding your farm’s statement of cash flows. The statement of cash flows tracks the sources and uses of cash in your farm business and adds insight to the understanding of your financial position and performance. The statement of cash flows summarizes cash activity over a certain time period, such as a calendar year.

More Extension Farm Pulse Articles and Programs

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.