The first measure of financial performance is profitability. Profitability is the difference between the value of farm goods produced and the cost of the resources used in the production of those farm goods. In other words, profitability is what’s left after the farm business has paid all of its bills.

Profitability measures the financial performance of the farm business over a period of time, such as one month, quarter or year. The five measures used to assess profitability are rate of return on farm assets (ROA), rate of return on farm equity (ROE), operating profit margin ratio, and asset turnover ratio.

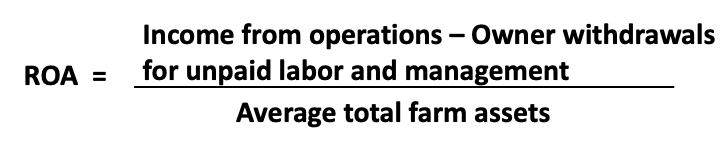

Rate of Return on Farm Assets

Rate of Return On Farm Assets, or ROA, is a measure of how profitable the farm business is relative to its assets. The greater the farm’s income in relation to its assets, the higher the ROA value and the more profitable the farm business is. A higher ROA shows that the farmer is using the farm’s resources well to increase profitability. The rate of return on farm assets will vary depending on the proportion of the assets, such as the proportion of owned land versus rented land, that is used in the farm business.

ROA includes:

- Net Income

- All farm assets

ROA does not include:

- Unpaid labor and management

- Realized or unrealized gains on farm real estate or other assets

The ROA uses the net income that has been generated from the farm’s operations to determine the results from the normal growing season or cycle. To compare the farm with other farms the farmer will need to deduct unpaid labor and management based on what could be earned in another job, if the farmer does not take a salary withdrawal. A substitute for unpaid labor and management estimates would be the amount of withdrawals listed as “family living expenses.”

ROA is often referred to as the “opportunity return on labor and management.” This amount is then divided by the average of the total farm assets, rather than the values of assets from the beginning and ending balance sheets. Any non-farm assets, such as a personal residence, should be excluded from the calculation of ROA for the farm business.

The Farm Finance Scorecard shows that a strong ROA is greater than 8% while a ROA less than 4% is a concern and a weakness.

ROA can be thought of as the average interest rate being earned on all (the farm’s and creditor’s) investments in the farm. When money is borrowed for the farm business, it is expected that it will increase the farm’s profitability over time. ROA measures the return to all capital of the farm, including debt and owner equity, and is known as the profitability per dollar of assets. The farmer can compare the farm’s ROA to different sized farms and businesses, along with a comparison to the borrowed debt in order to learn whether the farm is actually using that debt profitably.

If ROA is greater than the interest rates on the debt, then the farm is using their debt profitably. The farm is not paying more for the debt than what it is gaining from it.

Increasing the farm’s debt may contribute to additional business growth.

If the interest rates on the debt are greater than ROA, then the farm is not using debt profitably. The cost of the debt is greater than what the farm is gaining from it and increasing debt may reduce the growth of owner equity.

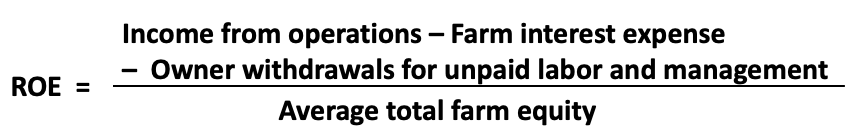

Rate of Return on Farm Equity

Rate of Return On Farm Equity, or ROE, is a measure of the return the farm is receiving on equity invested in the farm business. Unlike ROA, ROE looks at the farm’s equity, including farm assets and liabilities. ROE estimates how fast the equity is growing.

ROE includes:

- Net Income

- All farm assets

- All farm liabilities

ROE does not include:

- Farm interest expense

- Unpaid labor and management

- Realized or unrealized gains on farm real estate or other assets

ROE is the net income after the farm has deducted all farm labor and interest expenses. This is the residual return of farm investments divided by the average total farm equity between the beginning and ending balance sheets.

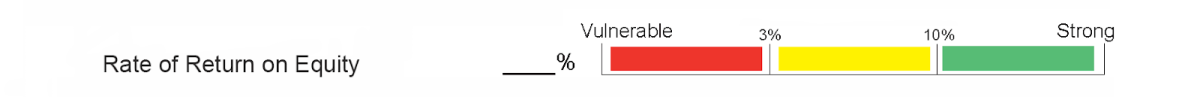

The Farm Finance Scorecard shows that a strong Return on Farm Equity is greater than 10% while a ratio less than 3% is a concern and a weakness.

The higher the value of ROE, the more profitable the farm business will be. The farmer may be able to compare the farm’s ROE to other rates of return that could be earned if the farm business decided to use the equity invested in the farm on alternative investments, such as stocks, bonds,certificate of deposit (CD), etc.

A high rate of ROE is often a good indicator, though caution should be used when associating this with a profitable farm business. A high ROE may also indicate an undercapitalized or highly leveraged farm business. And a low ROE could indicate a more conservative, high equity farm business.

A farm with a high rate of return on farm equity at 15% could also be highly leveraged if the assets and borrowed debt are listed under a different business entity. For example, if the farm is an LLC (Limited Liability Company) and farmland is owned by individuals of the farm, not the LLC business.

A farm may have a low rate of return on farm equity at 1.5% but may have a lot of equity, such as outdated equipment or land that is not utilized in the farm business like woods.

Like many of the other ratios, ROE should be used in conjunction with other measures when analyzing a farm business.

Operating Profit Margin Ratio

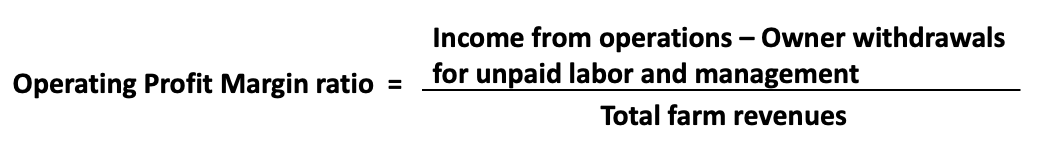

The operating profit margin ratio shows how well the farm business is controlling operating expenses compared to the value of the farm business’ output or the farm’s operating efficiency. It measures profitability in terms of the return per dollar of total farm revenue.

Definitions:

Like many of the other ratios, ROE should be used in conjunction with other measures when analyzing a farm business.

- Income from operations is the total farm revenues minus total farm operating expenses, plus or minus any accrual adjustments*.

- Owner withdrawals for unpaid labor and management. As with the Return on Assets (ROA) ratio, the farm business must deduct any withdrawals for unpaid labor and management or family living expenses.

- Total farm revenues includes income from operating the farm business, sale of livestock, and accrual adjustments* to revenue.

* The Farm Financial Standard Council (FFSC) recommends applying accrual adjustments to the farm’s cash-based income statement on an annual basis. To have a more precise account of the values produced during the year, the farm will need to adjust to an accrual-basis. More information on accrual adjustments is provided in the Preparing an Income Statement article.

A higher operating profit margin ratio means that the farm is efficiently converting the farm’s revenues into operating profits. It also indicates the farm’s operating margins and reflects the ability to generate revenues and control costs in order to generate a profit.

A low ratio could indicate that product prices and thus the farm’s income is low; operating expenses are high; or the farm is having production or efficiency problems. A farm business can improve efficiency by implementing management changes that increase revenues more than a corresponding increase in costs, decrease costs more than a corresponding decrease in revenues, or both will lead to efficiency improvements.

The Farm Finance Scorecard shows a strong operating profit margin ratio is greater than 25% while a ratio less than 15% is a concern and a weakness.

Asset Turnover Ratio

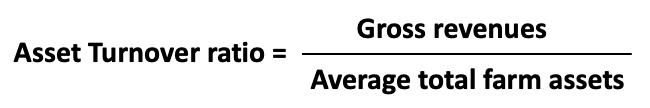

The final profitability measure is the asset turnover ratio. This ratio looks at how much revenue the farm business generated per dollar of assets. It measures how efficiently the farm is using its capital or “turning” farm assets into farm revenue.

The higher the farm’s asset turnover ratio, the more efficiently assets are being used to generate revenue. The Farm Finance Scorecard shows a strong asset turnover ratio greater than 45% while asset turnover less than 30% is a concern and a weakness.

Next Steps

The asset turnover ratio, operating profit margin, and rate of return on farm assets work together to explain the efficiency and profitability of the farm business. If the asset turnover ratio is multiplied by the operating profit margin ratio, the result is the rate of return on farm assets.

Conclusion

Farms may not be profitable every year. In some years, events that are beyond the control of the farmer can significantly reduce profits or result in farm losses. Events like major economic cycles (high interest rates, low commodity prices, etc.) or weather can be insured or hedged against to reduce the risk of losses.

Also, farm businesses continuously strive to be more competitive, to be more productive, to be more cost efficient, and to do a better job of marketing production. Generally, farms that are more successful doing these things are more profitable. Farms that are profitable can use their profits to improve their liquidity and solvency position. These businesses can build cash reserves or purchase or produce assets that can be readily converted to cash (liquidity). They can also build equity or net worth that the farmer can eventually retire on or can fall back on in poor years or periods of expansion or transition.

Profitability is the most important measure to consider for the future of the farm business and its investments. Farms that are not profitable will struggle and be unsuccessful in the long run. Generally, unprofitable farms will see their liquidity and solvency positions deteriorate and the only way unprofitable farms can stay in business is with the infusion of cash or assets from some other source, such as gifts or inheritance or through the depletion of previously paid for or infused assets.

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

Liquidity: Relationship between current farm assets to current farm liabilities

Liquidity: Relationship between current farm assets to current farm liabilities Solvency: Relationship between total farm assets and liabilities

Solvency: Relationship between total farm assets and liabilities Financial Efficiency: A farm’s use of assets to generate income

Financial Efficiency: A farm’s use of assets to generate income Repayment and Replacement Capacity: A farm's ability to repay debts

Repayment and Replacement Capacity: A farm's ability to repay debts