Risk and farming are two sides of the same coin. Like many industries, the farm business lives with and deals with risk daily. Further, the number of risks and their costs are increasing. These increases make the management of risk a vital component for successful long-term profitability.

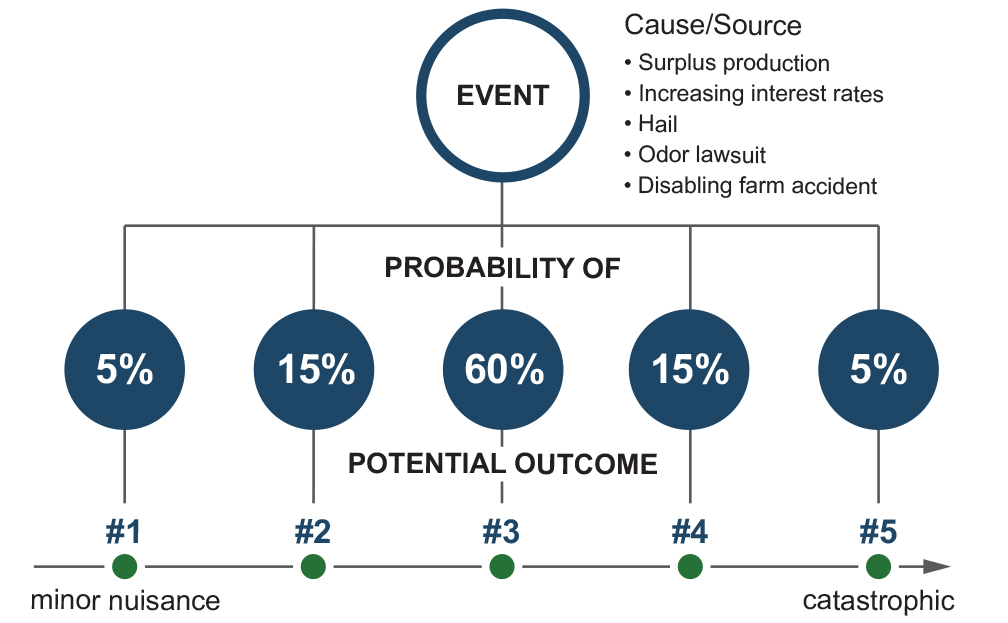

Risk is the probability that some event will cause exposure to a variety of potential outcomes that matter. There are three parts to this definition.

- Some event must happen. It could be an event that is a result of a management decision, such as hiring labor, or it could be something outside the manager’s control, such as weather.

- There are a range of potential outcomes that could occur. Those outcomes range from something that can hurt the business to a potential opportunity. A weather event can be harmful or very helpful.

- In between the event and the outcome is probability, that is, what’s the percent chance of a slow, soaking rain versus hail?

Risk management is making prior decisions that build a business’s resiliency. Optimal decisions are a tradeoff between opportunity that comes with taking a risk and the risk itself. Resiliency is the sum of risk management strategies and is the capacity of a business to take a hit and keep on going with minimal disruption.

Risk management is not a profit center. In fact, risk management decisions often come with a cost. The value to the business is that, if a risk occurs, the business can preserve its asset base and continue. Car insurance is a good example that is common to everyone. Car insurance protects the owner’s asset base (value of the car) in the event of a wreck. However, car insurance is clearly not a revenue source.

Building Resiliency

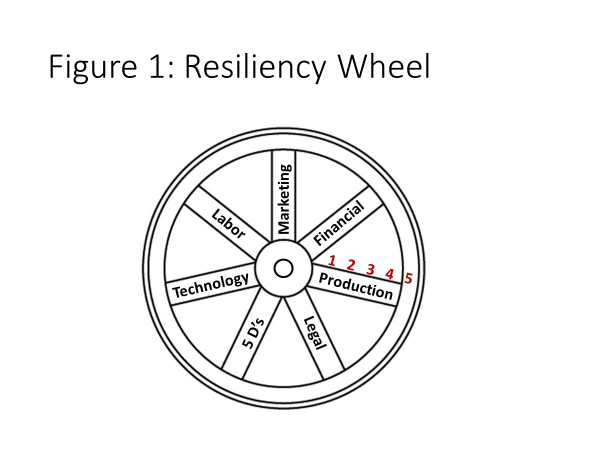

Risk encompasses all parts of a business, including production, marketing, legal, human resources, financial, the 5 D’s (death, disaster, disagreement, divorce, and disability), etc. Therefore, building resiliency is a multi-faceted chore that must address all parts of the business.

The “Resiliency Wheel” (Figure 1) is a planning concept for building business resiliency. Each spoke of the wheel is an area of potential risk (six are shown). The goal of the farm manager is to have a wheel that can get through the mud (risk) of agriculture; thus, they want a big and round wheel. A round wheel means all the spokes of risk have been addressed and a big wheel means they have been addressed in optimal ways. In Figure 1, a 1–5 score is shown with the risk of production. Assume that a score of 5 on the spoke means the risk has been fully assessed, addressed, and a risk management strategy implemented. A score of 1 means the risk has not been thought about and certainly no risk management strategy is in place.

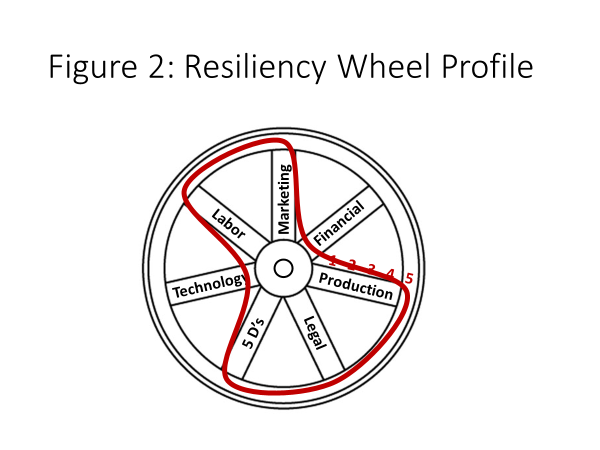

Once each area of risk is scored, a line connecting the scores shows a visual of the farm’s risk profile (Figure 2). The example farm in Figure 2 is doing well in most areas of risk but is lacking in financial and technology resiliency. Building better resiliency for this farm means spending management time with financial and technology risk management.

Analysis Tool for Building Better Resiliency

Risk and risk management are unique to every farm. Every farm has different enterprises, size, ownership, land quality, market access, family situation, etc. Each farm is also unique because each owner/manager has a different personality with respect to risk. Finally, each farm is unique because of differing financial capacities to withstand risk. Therefore, there is no tool or visual that works for everyone. Each farm business must adapt to their situation. However, common to all is the need to proactively build overall business resiliency and the first step in that process is awareness.

Complete the Risk-Resiliency Tool

The Risk-Resiliency Tool can be used as a starting point to determine your farm’s resiliency profile.

- Read the explanation on the ‘Title Page’ tab.

- Note, there are two questionnaires and accompanying visual wheel maps, 1) Resiliency Evaluation and 2) General Risk Evaluation. Read the instructions for each at the top of the questionnaire page and when completed, observe the accompanying wheel map on the ‘Resiliency Wheel’ tab and the ‘General Risk Wheel’ tab.

- In addition, just the “Financial” section is also mapped on its own visual wheel on the ‘Financial Wheel’ tab.

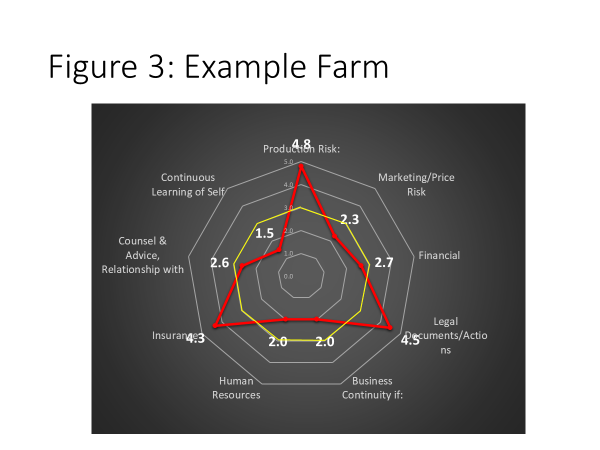

The Example Resiliency Wheel (Figure 3) shows that the example farm appears to be doing well in the areas of insurance, legal, and production risk, but may need to spend some time considering the other areas of risk. Note: The yellow circle in Figure 3 is at a score of 3. Any scores inside this yellow line are areas potentially needing management time.

Comprehensive Risk Assessment and Mitigation Tool

The Risk-Resiliency Tool looks at some major risk areas, but is certainly not comprehensive. It is a start, and it is the first step in a process for building awareness and better business resiliency. However, a more comprehensive management process is needed to build business resiliency.

The Risk Assessment and Mitigation Worksheet provides a more comprehensive process for identifying, assessing, and mitigating risks. The worksheet provides a process, but not the answers. Answers are more complex and are unique to each operation. Here are the steps in the process:

- Identify potential sources of risk the farm faces.

- Assess the potential impact of each risk.

- Determine potential mitigation strategies.

- Implement strategies.

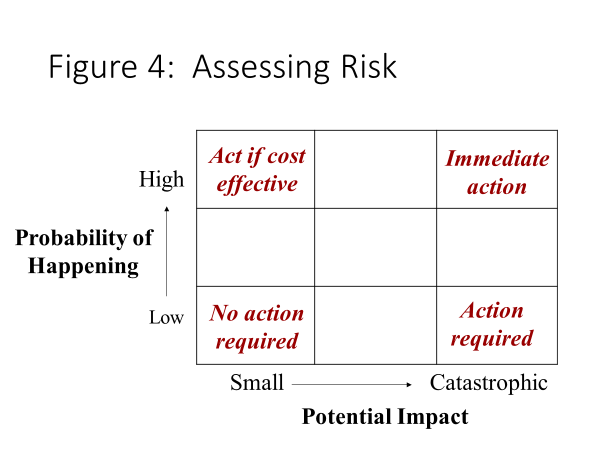

Assessing the potential impact of a risk requires analyzing the probability that the risk will occur and the level of hurt if it does occur. Figure 4 illustrates such a risk assessment. The probability of the risk and the severity of the potential impact determine whether action needs to be taken and, if so, at what level.

The Risk Assessment and Mitigation Worksheet includes questions that assist the user in quantifying a risk score and interpreting the score results. The higher the score the more urgent the need to act.

Risk Mitigation Strategies

Any risk may have several mitigation strategies.

Answers to the following five questions can help uncover a variety of mitigation strategies for one risk, such as an injury.

- Can I reduce the probability that the event will occur?

- Better diet, exercise, annual health exams.

- Can I reduce the impact (hurt) if the risk does occur?

- Co-manager/worker trained and ready to take over.

- Can I transfer all or part of the cost to someone else?

- Health and disability insurance.

- Can I completely avoid the source of risk?

- Not in this case, but for the example of hired labor making a mistake, this mitigation strategy would be to right-size your operation so you don’t need to hire any labor.

- Can I just do nothing?

- Know the risk might occur, know the likely hurt if it does occur, and plan/budget accordingly.

Summary

Managing risk is a continuous process. New risks, new twists on old risks, and new mitigation strategies are always appearing. Success in that process will continuously build better business resiliency, a major component of long-term business viability.

Many sources are available to assist in identifying potential risks and mitigation strategies.

- United States Department of Agriculture, Risk Management Agency

- University of Minnesota, Ag Risk and Farm Management Library