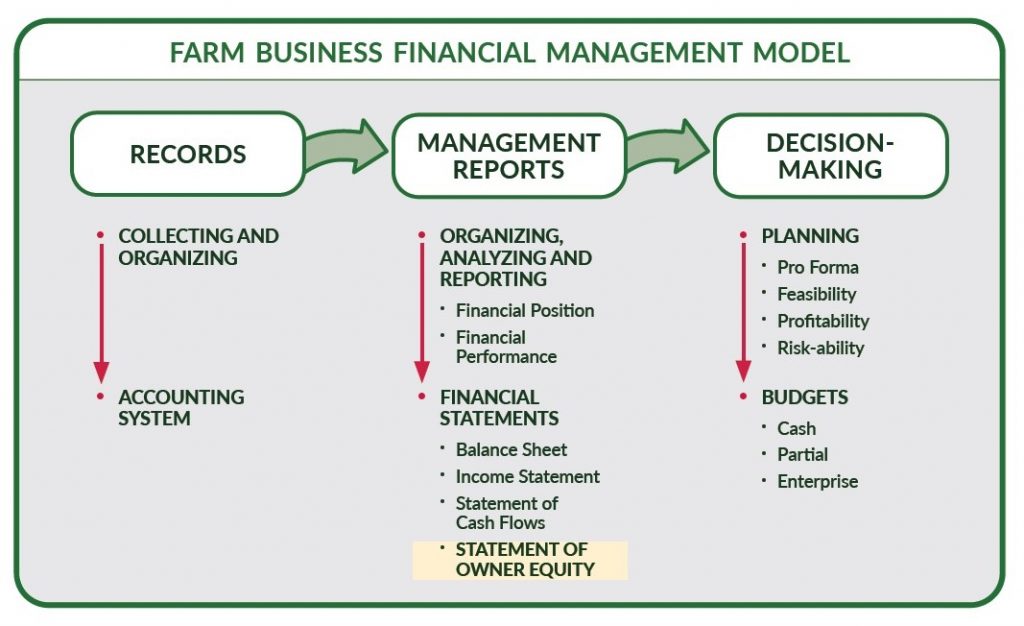

The statement of owner equity reconciles the change in equity from the beginning balance sheet to the ending balance sheet for the farm business. Also known as the statement of net worth, shows the source of change.

Introduction

Owner equity, or net worth, is the owner’s share of the assets of the business and is a basic measure of the financial strength. The terms “owner equity” and “net worth” mean the same thing and are interchangeable. The Farm Financial Standards Council (FFSC) guidance is to use “owner equity” when referring to the farm business only, and to use “net worth” when combining business and personal information in the statement.

Analysis of the statement of owner equity provides understanding of whether change in total equity was due to profitability (i.e., net profit or loss), capital gains or losses from the sale of assets, contributed capital, or a revaluation of assets. Reconciling also determines if any errors may have occurred in completing the balance sheet.

A common financial goal is the accumulation of equity. Changes in equity come from three overall areas – retained earnings, contributed capital and valuation equity. Positive equity changes from any source are good for the owners but increases in equity coming from retained earnings means the operation itself is creating profits and equity.

Retained Earnings

The primary motivation for the statement of owner equity is to identify the amount and source of changes in equity. Retained earnings shows the accumulation over time of profits (net income from the income statement). It is earnings that have not left the business and provides a measure of the farm business’ ability to generate profits.

Contributed Capital

Contributed capital is equity that has been provided to the business from sources other than the business itself. It may be contributed by owners from a source other than the farm, from parents or other investors. Contributed capital can be further assessed to determine the source of the contribution.

Valuation Equity

Valuation equity is the market value of capital assets compared to the assets cost or book value. For example, an increase in real estate values compared to the original cost is additional equity for the owners. However, it was not equity that came from operations (retained earnings) or contributed to the business (contributed capital), rather it is additional owner equity from the increasing value of owned assets. Valuation equity may also be attributed as management strength to have invested in appreciating assets, along with their profitability potential.

Preparing Your Statement of Owner Equity

The Extension Statement of Owner Equity Tool consists of an excel worksheet that provides a means and help in developing the statement of owner equity. This tool consists of a main “tab” or worksheet “Statement of Owner Equity” with yellow shaded cells to be updated with user data.

Summary

The statement of owner equity may or may not be limited to the farm business. Total equity for a combined balance sheet (farm business and personal) would have an additional category recognizing non-farm equity. Equity outside the farm business is different from contributed capital to the farm business. Non-farm equity sources may be specifically identified and provide more insight about personal contributions.

It is important to first identify and understand the changes in total equity, before making conclusions about financial position. The statement of owner equity is designed to provide insight into the financial position of the farm business.

Test your knowledge of statement of owner equity

True or False: The statement of owner equity is divided into three areas that each examine a different source equity impacting your farm business.

Answer: TRUE. These areas of the statement of owner equity include: retained earnings, contributed capital, and valuation equity.

True or False: Valuation equity is the best measure of how well I am doing at creating and building wealth due to the operational decisions I am making.

Answer: FALSE. Valuation equity is the market value of capital assets compared to the assets cost or book value. For example, an increase in real estate values compared to the original cost is additional equity for the owners. However, it is not equity that came from operational performance (retained earnings) or contributed to the business (contributed capital), rather it is additional owner equity from the increasing value of capital assets.

If this article was helpful, check out more Extension Farm Pulse Articles and Programs

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.