Farming is a complex business The income statement is a report of the farm business’ financial performance during a given time frame. It measures profit or loss in a given time period.which demands accurate records and careful financial management.

Introduction

Every farm business produces a product. Product sales generate a return to the expenses incurred when making the product. The income statement is used to measure the cash income (revenues), cash expenses, and the financial value of non-cash income and expenses used during one production cycle, usually a calendar year for farmers. Accrual adjustments to both cash income (revenues) and expenses are made; depreciation and changes in capital assets (gain or loss) are also accounted for. The result is a statement of the financial value of the farm’s production for the year, and the cost of that production. The income statement is also known as the profit and loss statement or statement of earnings.

Most of the information needed to prepare an income statement can be found in the farm business’ records. Internal Revenue Service (IRS) form 1040F (Profit or Loss from Farming), also known as Schedule F, and IRS form 4797 (Sale of Business Property) may be used when creating the cash income statement. The tax return, although useful for verification purposes, is not a substitute for the income statement. The current beginning and ending year balance sheets (net worth statements) are also needed for determining accrual adjustments. The accrual adjustments are made from the asset and liability items listed on the balance sheet, and the change in capital assets listed on Form 4797.

The Farm Financial Standards Council (FFSC) provides the specific standards and structure for the income statement. This paper provides a concise presentation of the income statement that follows the FFSC guidance.

Income Statement Structure

The income statement is structured into two parts: revenues (income) and expenses (costs); and includes three presentations of profits – Income from Operations, Net Farm Income and Net Income. Each of these parts include cash transactions and non-cash (accrual) adjustments.

Revenues (income):

- sum of all cash farm income (Schedule F and Form 4797)

- +/- accrual adjustments for realized income from inventories raised/ harvested for sale or to be used in the production process

= Gross Farm Revenues (Total Farm Income)

Operating expenses (costs):

- sum all cash farm expense (Schedule F), excluding interest expenses

- +/- accrual adjustments from inventories purchased for resale or used in the production process

- + accrual adjustments from accounts payable

- + economic or real depreciation (not tax depreciation as reported on Schedule F)

= Total Farm Operating Expenses

Income from Operations = Gross farm revenues – Total farm operating expenses

- – Interest adjustments = interest expense +/- accrual adjustments from accrued interest

- +/- capital gains (losses)

- +/- Other farm income/expenses

= Net Farm Income

- – Taxes = cash taxes paid and +/- accrual adjustments for taxes payable or refunds

= Net Income

Preparing Your Income Statement

Income Statement Tool

The Extension Income Statement Tool consists of excel worksheets that provide a means and help in developing the income statement. The Income Statement Tool consists of a main “tab” or worksheet “Input Sheet” and additional tabs to support the development of the income statement.

Utilize the Explanation of Income Statement spreadsheet tool instructional document for a short description for using the tool.

Share your feedback on this tool by contacting our Extension team at farms@extension.wisc.edu

Summary

Net farm income (NFI) is a standard measure of profitability for the farm business. Generating a profit provides an opportunity for the farm business to expand, replace capital, reduce debt obligations, build working capital, and cover unpaid family living expenses. NFI should be increasing and providing an economic return for the owner’s equity, labor, and management in the farm business. Comparing and benchmarking NFI to previous years and to other similar farms gives insight to the farm business’ performance.

Test your knowledge of the income statement

The income statement is a measure of what?

Answer: Financial performance. Financial Performance refers to the analysis of revenues, expenses and ultimately profits that are part of the Income Statement.

An income statement includes three presentations of profits and each of these parts include cash transactions and non-cash (accrual) adjustments. These calculated profits include?

Answer: Income from Operations, Net Farm Income, and Net Income.

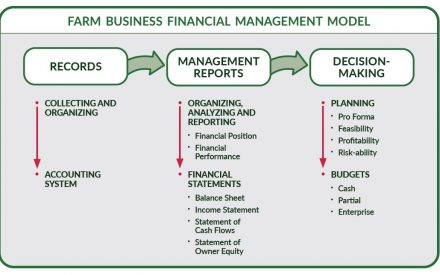

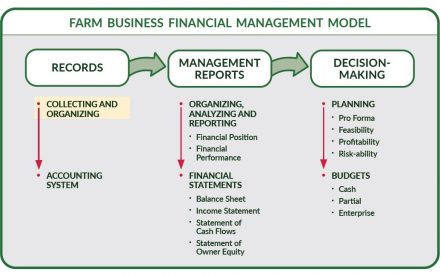

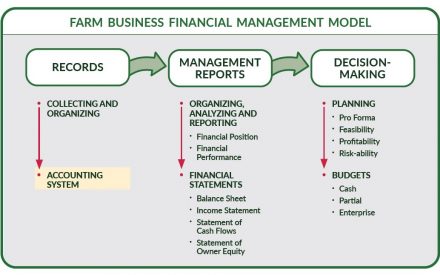

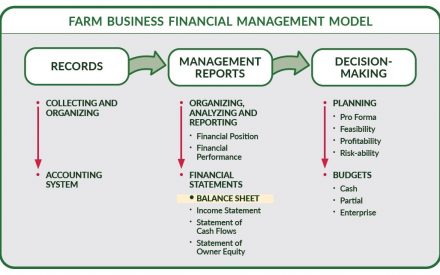

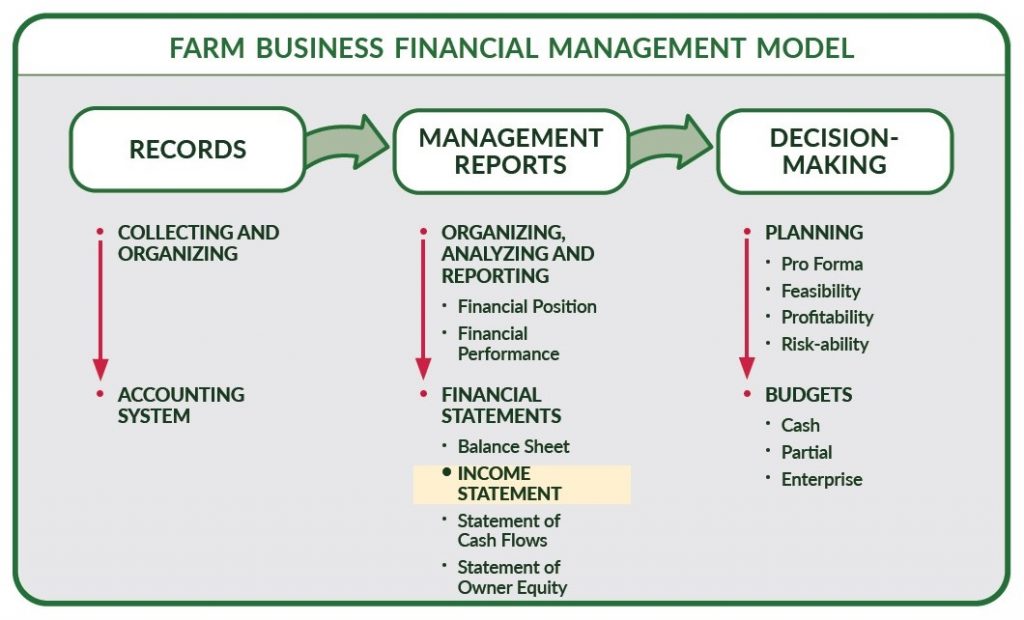

This is one in a series to introduce you to the farm business financial management model. This presentation provides information on preparing your farm’s income statement. The income statement is a report of the farm business’ financial performance during a given time frame. It measures profit or loss in a given time period.

More Farm Pulse Financial Management Resources

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586. Preparing the Income Statement (2021), drafted by Katie Wantoch, UW-Madison Division of Extension; reviewed by Kevin Bernhardt, UW Center for Dairy Profitability/UW-Platteville, and Jenny Vanderlin, UW Center for Dairy Profitability; based on material from Understanding the Farm Income Statement, Part I factsheet (2018), by Sandy Stuttgen, UW-Madison Division of Extension.