Farming is a complex business which demands accurate records and careful financial management.

Introduction

Farming is widely viewed as a “way of life” rather than a business. Both financial and production records are required to provide information the farmer needs to make critical risk management decisions. Farmers need to keep records to pursue effective risk management strategies that will enhance the longer-term profitability of their business. Recordkeeping begins with collecting and organizing of the farm business’ production (physical) and financial (income/expense) information.

Recordkeeping Categories

Production (physical)

- Livestock: identification; weights, date of birth, pregnancy rate, calving rate, death loss rate, average weaning weight, average daily gain.

- Crop: yields, inputs (fertilizer, seed), pesticide application, irrigation, planting and harvest dates.

- Labor: paid and unpaid.

- Weather: precipitation, wind, storm events (hail, snow).

Financial

- Income and expense receipts,

- Invoices, checks, bank statements.

Methods of Recordkeeping

Records may need to be provided to government agencies, lenders, insurance companies, safe handling practices, organic production, etc. One of the most important decisions is deciding how to track your production and financial records.

- Paper – “shoebox” method, pen and paper or notebook, ledger book specific to production and/or financial records. This method requires more time with potential errors, but is favorable to farmers not familiar with computers. Minor costs associated with this method.

- Electronic – spreadsheet (Microsoft Excel®, Google Sheets, etc.), software package (CenterPoint, Farm Biz, QuickBooks®, Quicken®, PCMars, Ultra Farm Accounting, etc.). The program may complete the calculations, however, the farmer must have a basic knowledge of computers, time to learn the software, design the form, and enter the receipts correctly. There may be varying costs associated with an electronic method.

- Outsourcing – hiring a professional for record keeping. Expect higher costs associated with this method.

Summary

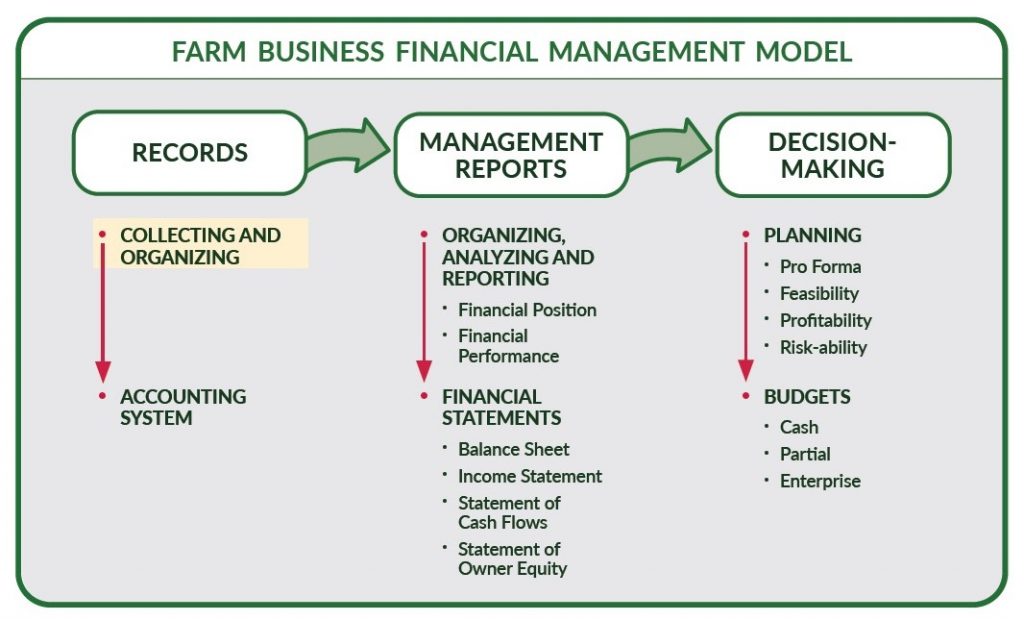

Record keeping is best kept simple! There is no “best” record keeping system for all situations. If the record keeping method is too complicated, the farmer may be more likely to make mistakes or avoid record keeping all together. Records should provide essential information on a timely basis. Both financial and production records need to be collected and organized to generate management reports for farm business decision-making.

Test your knowledge of collecting and organizing records

True or False: Farmers collect records only for income tax reporting.

Answer: FALSE! Collecting and organizing income and expense receipts is done for tax reporting. However, collecting and organizing further details will assist you in generating financial statements, and support your management decisions.

Organizing your records may involve what methods?

Answer:

- Paper: Simple, pen or paper only needed.

- Electronic: Tools such as spreadsheets or software programs.

- Outsourcing: Hiring a professional.

This video is one in a series to introduce you to the farm business financial management model. The presentation covers information on records, which details collecting and organizing of your farm business’ production and financial information. With the information from records, you will be able to generate financial statements and can begin creating management reports for decision-making.

More Farm Pulse Financial Management Resources

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.

Download Article

Selecting your Farm Accounting System

Selecting your Farm Accounting System Preparing a Balance Sheet

Preparing a Balance Sheet Cash flow budgeting

Cash flow budgeting Find a good farm accounting software system

Find a good farm accounting software system