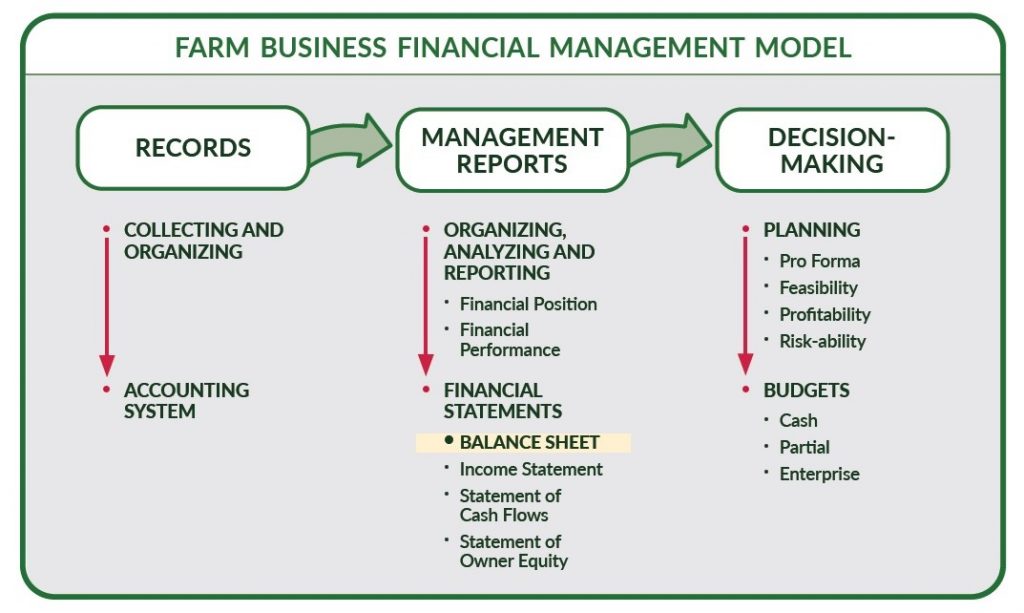

Definition and Purpose of a Balance Sheet

The balance sheet is a financial statement that measures the financial position of the farm business at a given point in time. The underlying principle of the balance sheet is the Universal Accounting Equation:

Assets = Liabilities + Net worth (Owner Equity)

The word “balance” in “balance sheet” is a statement that every penny of assets comes from one of two sources: liabilities or owner equity.

Figure 1: Balance Sheet Equation

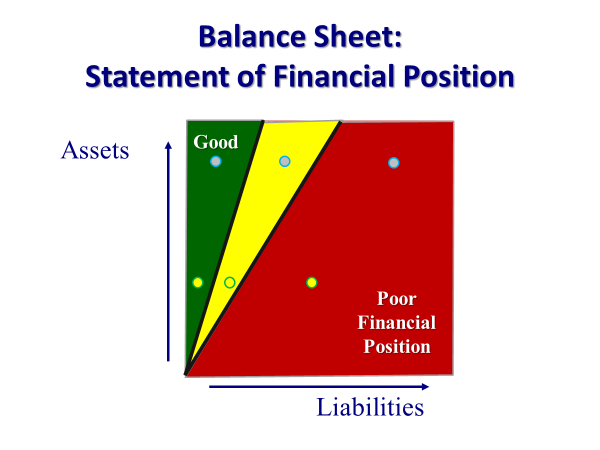

The balance sheet is a measure of financial “position.” Ultimately, “position” refers to the level of wealth of the owners, known as “owner equity” or “net worth.” “Position” is also a statement of the level of who “owns” the assets of the business, creditors (liabilities), or owners (owner equity). Good financial position means greater wealth for the owners.

Figure 2: Balance Sheet

The balance sheet is a very important document for lenders as it shows the value of collateral, financial wealth of the business and owners, and working capital position (a risk management strategy).

Balance Sheet Structure

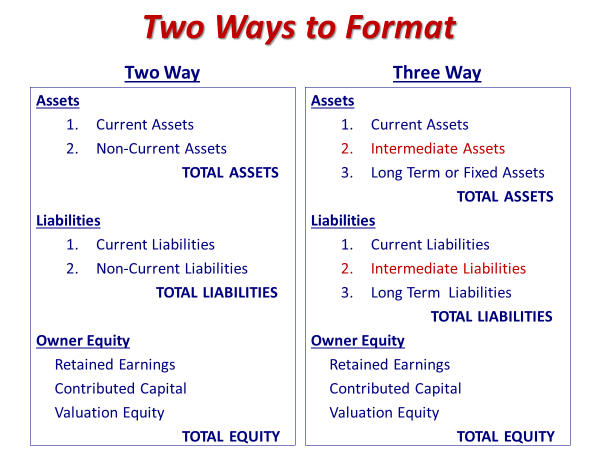

There are a variety of structural issues with the balance sheet and all seem to follow the Rule of Two.

- Two ways to format a balance sheet: two-way versus three-way

- Two types of balance sheets: market basis versus cost basis

- Two kinds of assets: market assets versus capital assets

- Two ways to value assets: market value versus cost value

A confusion is that the word “market” is often used yet its meaning changes depending on the context of its usage.

Two-Way versus Three-Way Balance Sheet

The two-way balance sheet refers to having two categories of assets and liabilities, current and non-current. This is the format that is recommended by the Farm Financial Standards Council (FFSC) and the type commonly used outside of production agriculture. An alternative and acceptable format is the three-way balance sheet, which adds a third, intermediate category to both assets and liabilities. Lenders tend to favor the three-way format as it more closely tracks the length of time farm assets are useful and thus how loans should be structured for those assets.

- Current Assets: Market assets expected to be used/converted to cash within 12 months

- Cash, accounts receivable, inventory, supplies, prepaid expenses, and others

- Intermediate Assets: Capital assets with a useful life from 1 to approximately 10 years

- Machinery, equipment, and breeding livestock

- Fixed, or Long-Term Assets: Capital assets with a useful life of more than 10 years

- Buildings, land, and land improvements

Figure 3: Two Ways to Format

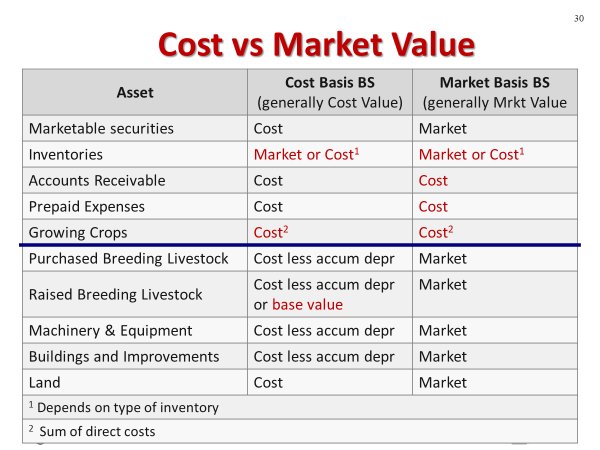

Market Basis versus Cost Basis Balance Sheet

There are two kinds of balance sheets, not to be confused with the two kinds of balance sheet formats. The two kinds of balance sheets are cost basis and market basis.

Cost-Basis Balance Sheet

A cost-basis balance sheet captures the position of the business before including any value gain on capital assets. Capital assets are valued at their original cost less any accumulated depreciation. The cost-basis balance sheet is a true picture of the financial position of the business based only on past operational performance. It is the gain or loss in wealth due largely to management decisions.

Market-Basis Balance Sheet

The market-basis balance sheet captures what the owners believe the assets could be sold for today—remember, the balance sheet is a snapshot in time reflecting the value today—regardless of what was paid for them or any depreciation that has occurred. The market-basis balance sheet is a true picture of actual market value today, which includes both past operational performance plus the good or bad luck of the agricultural economy beyond the farm gate.

Using unimproved land as an example, if a producer purchased 100 acres for $2,000 per acre, then the value on the cost-basis balance sheet is $200,000. However, if the market value of the land today is $6,000 per acre, then the market-basis balance sheet will show $600,000. The additional $400,000 is not due to operations, rather the good luck of the agricultural economy over time, particularly real estate values.

This additional value is called “valuation equity.” The statement is often heard in agriculture that a farmer is cash poor, but balance sheet rich. This is often a true statement and reflects the gain in value of capital assets, particularly land, and it won’t convert to cash until the capital asset is sold. Of course, that sale will trigger a tax and that looming tax is referred to as “deferred tax.”

Another statement that is sometimes heard is that a farmer is spending their equity. This is a reference to the situation where a farm business is losing money in terms of operational performance but is financing those losses with loans that are collateralized by their equity. Occasionally this will happen to any business, but it is not a long-term strategy.

Market Assets versus Capital Assets

There are two kinds of asset on the balance sheet: market assets and capital assets.

Market Assets

Market assets are products that are regularly produced and sold for the purpose of making profits. It is why the producer is in business—to grow and sell corn, cattle, or milk for example. Market assets are found in the “Current Assets” section of the balance sheet.

Capital Assets

Capital assets are those assets that are put to work to create the market assets. Capital assets include machinery, breeding herd, buildings, and land. While these assets are sold, sometimes at a profit, that is not the purpose of the business. While they are an asset, capital assets are a cost of doing business, a subject that will be taken up again later in the income statement discussion.

Market Value versus Cost Value

There are two ways to value assets: market value and cost value.

Market Value

Market value is whatever the asset is worth today if it were to be sold in today’s market. Cost value is the acquisition cost of the asset or, if it is a depreciable asset, then the acquisition cost less accumulated depreciation.

Cost Value

One might think that the cost value way of valuing assets would be used on the cost basis balance sheet and that market value would be used to value assets on the market basis balance sheet. If only life were that sensible! Unfortunately, that is not the case, it all depends on the kind of asset.

Figure 4: Cost versus Market Value

Summary

Which balance sheet should be used? There is a good economic answer to that question and that is: “It depends!” If your question is financial position due to operations only, then cost basis. If your question is overall financial position or collateral value, then market basis. If your question is determining valuation equity or deferred taxes, then both are needed.

Test your knowledge of balance sheet structure

True or false? A capital asset is one that is put to work to create a market asset.

Answer: TRUE. Capital assets include machinery, breeding herd, buildings, and land.

Which balance sheet shows the financial position of a farm business based only on the profitability of past operations?

- Cost basis

- Market basis

- Cost value

- Market value

Answer: 1. Cost basis. A cost-basis balance sheet captures the position of the business before including any value gain on capital assets. Capital assets are valued at their original cost less any accumulated depreciation.

True or false? Cost value is used for valuing assets on the cost-basis balance sheet and Market Value is used for valuing assets on the market-basis balance sheet.

Answer: FALSE. It all depends on the kind of asset (see Figure 4 above).

If this article was helpful, check out more Extension Farm Pulse Articles and Programs

References:

- Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

- Preparing the Balance Sheet (2021), drafted by Katie Wantoch, UW–Madison Division of Extension; reviewed by Kevin Bernhardt, UW Center for Dairy Profitability/UW-Platteville, and Jenny Vanderlin, UW Center for Dairy Profitability; based on material from Understanding the Farm Balance Sheet, Part I Factsheet (2018), by Sandy Stuttgen, UW–Madison Division of Extension.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.