Planning for the future of a farm business is complex. There are many moving parts. Extension’s network of County Educators and State Specialists assist with workshops and one-on-one consulting with farm families working on their farm succession plans, including the communication, financial, and estate planning issues that surround farm succession.

Employment and training services are offered throughout the state of Wisconsin. These services, from resume development to skill training to on-the-job training, are provided through American Job Center system at any one of several Job Centers locate throughout the state. Basic services are provided to any individual searching for new employment. More intensive services require […]

Farmers are notorious for preferring to farm while leaving business dealings to trust, fate or chance. Afterall, there are only so many hours in a day, and when farm families work near each other all day, it is tempting to believe that assumptions or verbal communication may replace written text. Farmers must remember, however, that every business entity carries legal and tax implications, and the written operating agreement may save a lot of headaches and heartaches when legal and tax issues arise.

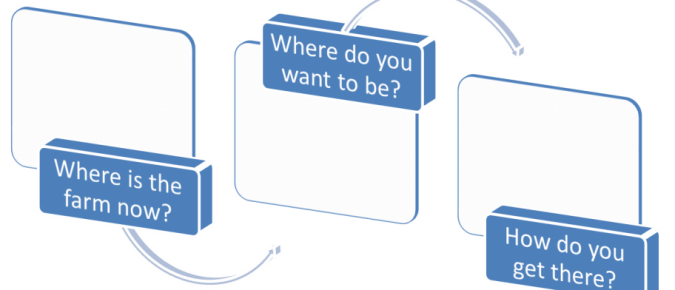

The development of a meaningful vision is not easy or instantaneous. It takes time, thought, effort, and teamwork. Once you have thought through the following steps, share your vision with the members involved in your farm business. The farm vision will need their input as well, if they are to be involved in the future of the business.

Business succession planning doesn’t happen on its own. Producers must intentionally focus on the planning and work with a team of professionals such as a tax specialist, attorney, financial planner, and lender. Family businesses in particular, should first recognize that family and business systems focus on different goals. A family farm inherently mixes family and […]

Strategic thinking helps farm businesses make decisions by thinking ahead, visualizing potential problems, and finding solutions. A comprehensive SWOT analysis helps a farm respond to opportunities and threats by taking advantage of their strengths and weaknesses. Developing realistic strategies and goals helps the farm adapt and make proactive decisions.