2020 Report

Section One: State Level Overview

Section Two: Sales Location

Section Three: Land Values vs Rental Rates

Section Four: Implications for Agricultural Land Owners and Farmers

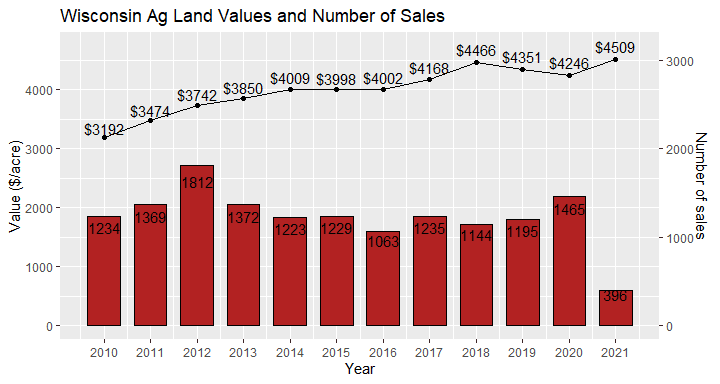

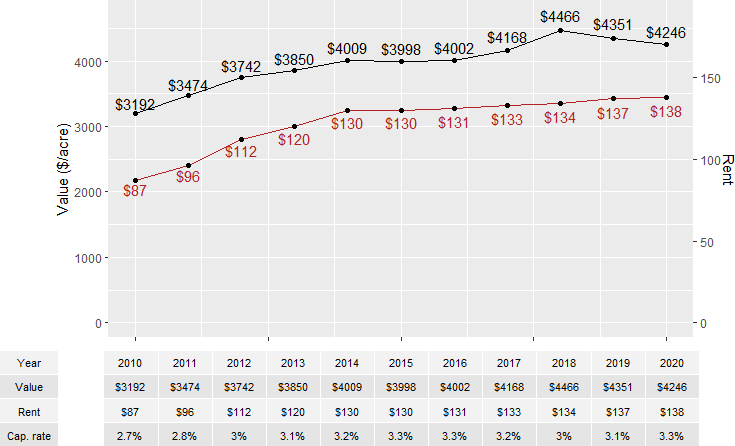

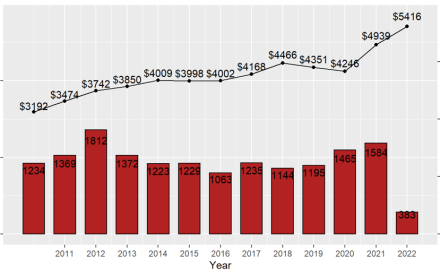

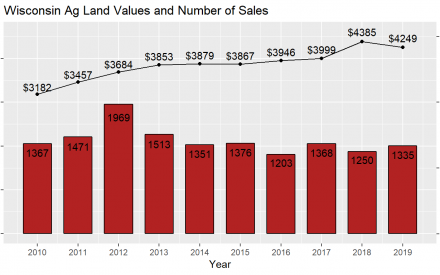

The average price of agricultural land sold in Wisconsin between January and December 2020 was $4,246 per acre (see figure 1). This is a 2.4% decrease from 2019. Land values had increased significantly in 2018, so 2019 and 2020 may have been a correction to that upswing. The uncertainty brought by COVID-19 and the surrounding economic context may also explain some of this decrease. In comparison, the 2020 USDA estimates for farmland values show the prices stayed the same from 2019 to 2020 at the national level. However, if we look at inflation adjusted numbers we see that the average price from 2019 to 2020 decreased by 0.8%. It is important to note that Wisconsin was the only state in the Seventh Federal Reserve District (Iowa, Illinois, Indiana, Michigan, and Wisconsin) that saw a decrease in their farmland value. All of the other states saw an increase in farmland value. This softening of land values occurred despite historically low interest rates, improving commodity prices and farm income1. There were 3% fewer acres sold in 2020. However, there were 18% more reported transactions, indicating there was a sale of smaller parcels of land.

There are marked differences in sale prices across the state with some regions faring better than others. Despite the difficult economic conditions and substantial losses in the number of dairy farms over the last few years, the land market has been supported by the ability of landowners to hold onto their property and limit the supply of land on the market. The vast majority of land owners, even those forced to exit the dairy industry, were not forced to sell their land. Most could continue cropping or renting the land. Thus, limiting the supply of land on the market which helped support market values. In some areas, other factors such as urban sprawl, have helped to maintain or even bring up land values.

Between 2015 and 2020 the average annual growth in Wisconsin agricultural land value was 1%. In comparison, between 2010 and 2014 the average annual growth in value was 4.0%. Adding in the capital gains of 1% to a rental income of about 3.25% 2 gave Wisconsin land owners an average annual return on investment of 4.25% for the 2015-2020 period. Therefore, returns to land in the last five years are comparable to other low risk investments such as low risk corporate bonds which averaged 3.5% over that period. 3

Nevertheless, we have seen signs of a weakening demand over the last 2 years. The lower interest rates and the projected increase in overall farm income provide some hope for land values to remain steady in 2021. The first quarter 2021 sales show an increase in land values. This increase may be due to the increase in corn and bean prices. Data for the second quarter of 2021 will indicate if this uptick will remain or even out.

Farmland is the most valuable asset on most farmer’s balance sheet. However, estimating land values is always difficult. Each individual parcel of land is unique. While many thousands of homes are sold each year, only a small fraction of the state’s agricultural land changes hands on the open market in any given year.

Surveys of farmers, bankers, real estate professionals and appraisers are sometimes used to estimate changes in land values. While easy to conduct, these opinion surveys are subjective and can be hard to interpret. News of high-priced sales travels quickly – but these sales are often the exception and not reflective of the market.

The Wisconsin Department of Revenue (DOR) collects an alternative source of agricultural land sales data. A transfer return tax is collected when a property is sold, and a transfer return form is collected with the tax payment. Data from these transfer return forms are used in this paper.

Wisconsin’s agricultural land values are low compared to some of our highly productive neighboring states. This is due to the fact that a large portion of our land is not suitable for continuous row crop farming and is used for forage production, woodlots and pasture. The shorter growing season in northern Wisconsin also limits the potential agricultural value of the land.

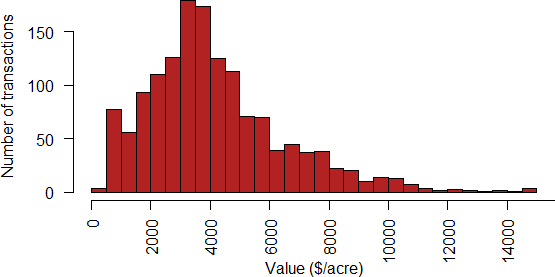

While the state average decreased in 2020 there was wide variation in the sales price per acre. In Wisconsin, 24% of the sales were less than $2600/acre and only 18% of sales had prices above $6,000/acre. High priced sales make good headlines; however, there were very few sales above $10,000/acre (3% of all transactions) (see figure 2).

Methodology

This statewide report is based upon sales of bare land between non-related parties in Wisconsin townships. All parcels were between 35 acres and 2,000 acres and their predominant use was agriculture at the time of the sale. Properties with water frontage or managed forest acreage were filtered out. Parcels sold with retained property rights or with miscellaneous use note referring to mining were also excluded.

The Department of Revenue’s transfer return data is an objective and relatively timely data source for measuring changes in agricultural land values over time. Towards the end of every year the Wisconsin Agricultural Statistics Service posts a summary of agricultural land sales – both bare land and improved properties. The NASS uses the same transfer return data as this study. The delay in the publication of the summary document allows county assessors to collect and verify each parcel’s intended future use. This means that some of the parcels included in our analysis may later be eliminated from the NASS summary because they are no longer being used in production agriculture.

There are a few other differences in our approaches. The NASS summary is not limited to parcels 35 acres and above and includes properties in cities and villages. Using only the transfer return data enables us to make an earlier assessment of the direction of land values. The NASS reports (which typically are updated in late summer) are another good alternative with more information about tillable land and land diverted from agriculture.

Sales Location

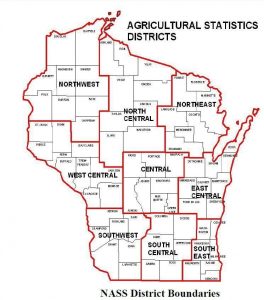

Location is an important determinant of value. In addition to the state-wide averages, land prices are reported using NASS districts. The map below displays the borders of the various districts.

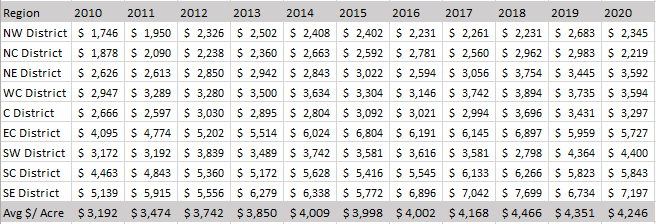

Table 1 contains the average sale price ($/acre) in each of the nine NASS reporting districts. There are often wide variations in the value of individual parcels even within the same township or county due to soil, quality, topography, drainage, and proximity to urban centers. From table 1 we can see that the average land values increased in four of the nine reported areas. The highest average prices paid for agriculture land were in South Eastern Wisconsin in recent years – which makes it difficult to gauge market value trends.

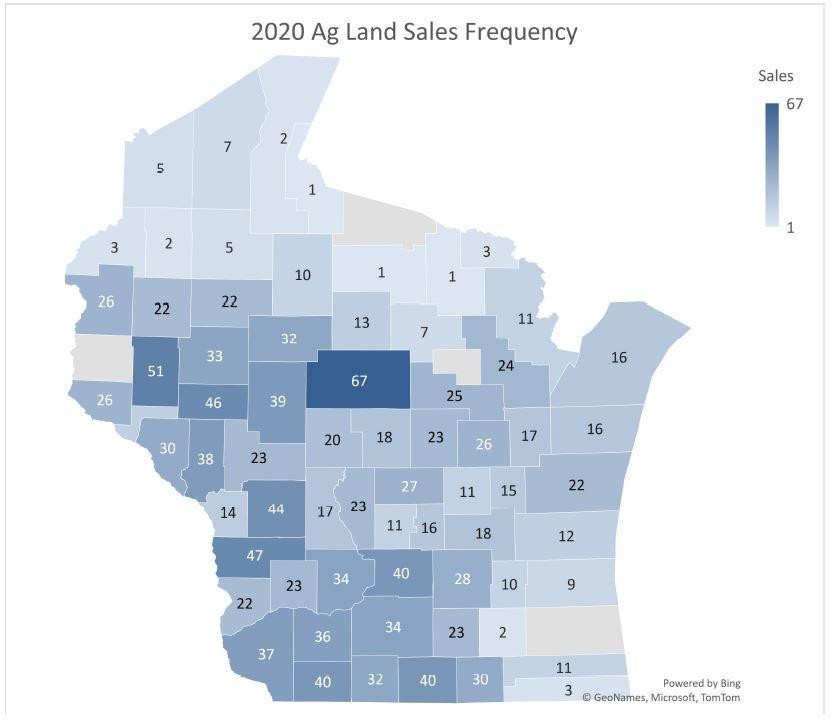

The map below illustrates the number of sales per county. From this map we can see that Marathon County led the state in agricultural land sales in 2020, with 67 sales. Marathon County has many relatively small dairy farms. The great uncertainty caused by COVID-19 after years of low commodity prices may have contributed to some of these sales. There were relatively few sales in South Eastern WI as urban development pressures have continued to convert land to non-agricultural purposes.

Land Values vs Rental Rates

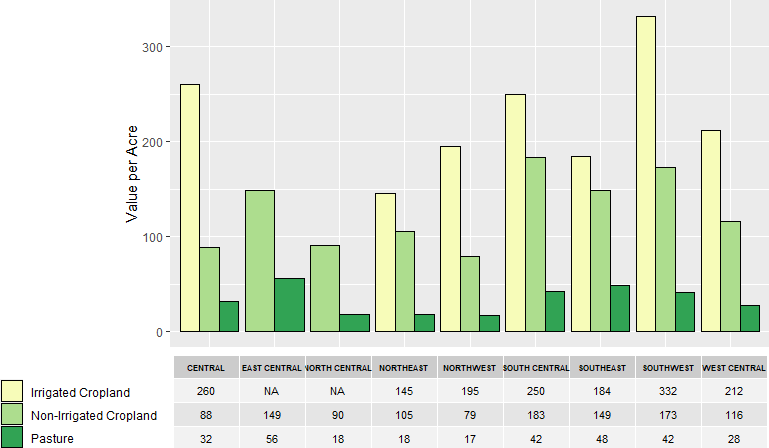

The 2020 NASS Wisconsin average rental rate for non-irrigated cropland was $138/acre compared to $137/acre for 2019. The average rent in 2020 is about 3.3% of the state-wide average sale price. Figure 3 below shows the rental rate per district for pasture as well as irrigated and non-irrigated cropland for 2020. The data is compiled by USDA National Agricultural Statistics Service. Even within a county, rental rates are highly variable. Some of the factors which affect rental rates are soil quality, field size, topography, drainage, existing relationships between parties, and demand for nutrient management purposes.

In recent years rent has been relatively high compared to land value. Rent increased an average of 10.25% per year between 2010 and 2014, while land values increased at a lower rate of 6%, reflecting growing competition for land rental. This makes for higher returns to land ownership and reflects some degree of stickiness in the rental market. In other words, when rent increases at a higher rate than land values for a prolonged period, instead of a correction/decline in rent we usually witness a leveling off of rent in subsequent periods until land values can catch up. This phenomenon is what we have seen since 2014, with rental prices increasing only slightly from $130 to $138 or on average 1% per year (see figure 4). On the other hand land values have increased at an average rate of 3% per year.

The capitalization rate (i.e. Rent/Value) can be a useful tool to determine the rental value of land. Typically, rent represents about 3% of the land value. If we look at the last five years [Figure 4] we see that the rental rate on average is 3.1% of the land value. With higher commodity prices anticipated again in 2021, competition for rental land – especially good quality land may strengthen rental rates 2021.

Implications for Agricultural Land Owners and Farmers

The appreciation in land value is only realized when the assets are sold. In most cases, the operating agricultural business will not directly benefit from changes in land value. High land values provide the retirement cushion for “last generation” farm businesses. However, high land prices make it more difficult for new entrants to get started without significant help from family members or other benefactors.

Dairy farming in South Eastern, East Central and South Central Wisconsin is in competition for land from those wishing to purchase it for other uses. If the trend continues, dairy production will continue to shift away from these parts of Wisconsin to parts where land prices are not as competitive.

Dairy farming is a capital-intensive business. A typical dairy cow and her replacement consumes approximately 7.5 tons of forage dry matter and 100 bushels of grain each year. Manure management and nutrient balancing are a growing challenge. The typical Wisconsin dairy farm requires 2-3 acres of cropland to grow the forages and grain consumed by each dairy cow.

Wisconsin’s farmland use value assessment has greatly reduced the costs of holding agricultural real estate. The real estate taxes for agricultural land are much lower than they once were. Record low interest rates and changing population demographics have also increased demands for open space. Expanding dairy businesses may need to rely on long-term leases or manure trading arrangements to assure compliance with environmental regulations and land use constraints.

Although dairy farming is well suited to the climate, topography and infrastructure of Wisconsin, the continued survival of a viable dairy industry depends upon access to affordable land resources.

References:

1 See USDA-ERS Farm Land Value for details

2 Farmland rental rates usually represent about 3% to 3.5% of the land market value. For example, land valued at $3,000/ac would usually rent for $90/ac. to $105/ac., and land valued at $7,500/ac. would usually rent for $225/ac. to $263/ac.

3 For example, see Moody’s Seasoned Aaa Corporate Bond Yield for details

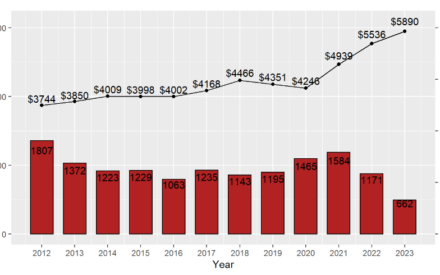

Wisconsin Agricultural Land Prices 2024

Wisconsin Agricultural Land Prices 2024 Wisconsin Agricultural Land Prices 2023

Wisconsin Agricultural Land Prices 2023 Wisconsin Agricultural Land Prices 2022

Wisconsin Agricultural Land Prices 2022 Wisconsin Agricultural Land Prices 2021

Wisconsin Agricultural Land Prices 2021