The new year often brings thoughts of income taxes and tax preparation. Some farmers might have received a loan servicing assistance payment if they were experiencing certain types of financial distress. These loan servicing assistance payments resulted from the Inflation Reduction Act (Public Law 117-169), signed into law on August 16, 2022. These farmers will want to review information about ways to mitigate the tax consequences of these payments.

Inflation Reduction Act

According to Rob Holcomb, an Enrolled Agent and Extension Educator in Agricultural Business Management from the University of Minnesota, the loan servicing assistance associated with the passage of the Inflation Reduction Act is taxable income and reportable on the farmer’s tax return. Loan Servicing Assistance is not treated as forgiveness but simply as a payment. If the payment exceeds $600, the farmer will receive a Form 1099-G , and this income must be reported on their Schedule F.

Additionally, if the interest paid by the farmer on the loan associated with the service assistance payment exceeds $600, the farmer will also receive a Form 1098. A Form 1098 reports interest paid on loans. This interest may be deductible on the farmer’s schedule F.

On October 18, 2022, USDA announced that distressed borrowers with qualifying farm loans would receive financial assistance. Loan servicing assistance payments were paid by electronic transfer for direct loans. For all other loans, a check was sent to the farmer that was jointly made out to both the farmer and the lender. In this case, the farmer needs to endorse the check and then the funds are applied to the loan.

Holcomb notes that it is vital to note that assistance payments will not show up in the farmers’ bank account, thus creating “phantom” cash/income. Receipt of a loan assistance payment will increase taxable income and result in additional tax. Mitigation efforts may require the farmer to borrow additional funds.

For more information about the tax impacts of the loan servicing assistance payments, farmers can visit the Agricultural Finance, Tax, and Asset Protection (AgFTAP) website at https://agftap.org. The website includes a fact sheet (https://agftap.org/home/resourcedetails?id=b4f40c55-d414-48f6-8985-2ab4d912bc4c), drafted by Holcomb, to address the impacts of the loan servicing assistance payments and also addresses strategies to help mitigate the tax consequences.

AgFTAP (Agricultural Finance, Tax, and Asset Protection) Portal

The AgFTAP portal is a resource to enhance farmers’ and ranchers’ ability to understand and navigate the farm business tax and asset protection strategies for their operations. It is part of the USDA Farm Services Agency (FSA)’s $10 million investment in its new Taxpayer Education and Asset Protection Initiative. To learn more about the program and its collaborators visit the AgFTAP portal at https://agftap.org.

AgFTAP Programs in Wisconsin

In Wisconsin, AgFTAP collaborators are Extension Farm Management Outreach Specialist Katie Wantoch and Specialist Kevin Bernhardt. A webinar discussing the Impacts of the Inflation Reduction Act Assistance for Distressed Borrowers will be held on February 20, 2013. Registration is available at https://go.wisc.edu/h3o89h. More information about future programs on income taxes, USDA program payments, asset protection, and finances will be available in 2023.

Disclaimer: This information changes often. This is educational information, not tax or legal advice. Information is based on material from the Land Grant University Tax Education Foundation (LGUTEF), www.Ruraltax.org, and IRS. Please be a good consumer of professional services and seek the advice of a tax professional for planning and return preparation.

Margin Coverage Option (MCO) for Wisconsin Ag Producers

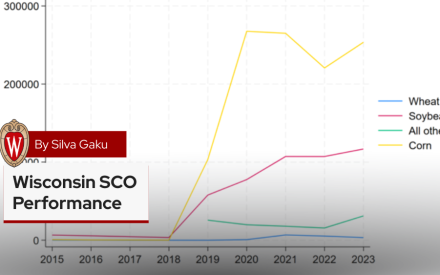

Margin Coverage Option (MCO) for Wisconsin Ag Producers Wisconsin Supplemental Coverage Option (SCO) Performance

Wisconsin Supplemental Coverage Option (SCO) Performance Forage Risk Management in Wisconsin, 2015-2024

Forage Risk Management in Wisconsin, 2015-2024 Managing forage production risk with Whole Farm Revenue Protection

Managing forage production risk with Whole Farm Revenue Protection