This article was originally published in Progressive Dairy.

For many farmers, farming is widely viewed as a “way of life” rather than as a business. The Internal Revenue Service (IRS) considers an activity a trade or business if it is conducted with a profit motive. Profit is defined as income or receipts greater than expenses, where expenses include depreciation of capital assets. Just a note, this determination of “profit motive” does not require that a profit be generated, only that there is a motive for making a profit in conducting the activity. For tax purposes, generally all individuals, partnerships, or corporations that cultivate, operate, or manage farms for a gain or profit–either as owners or tenants–are farmers. Farming activity includes livestock, dairy, poultry, fish, fruit, and truck farms.

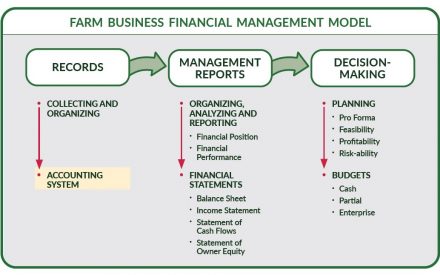

Farming is a complex business which demands accurate records and careful financial management. Both financial and production records are required to provide information the farmer needs to make critical risk management decisions. Recordkeeping begins with the collecting and organizing of the farm business’ production (physical) and financial (income/expense) information. More information on records to keep and methods of recordkeeping can be found in the collecting and organizing records article.

Record Retention

Regardless of the method that a dairy farmer uses, they likely have a lot of documents in storage! Unfortunately, there is not a steadfast retention rule regarding all these records. Several federal agencies have document retention requirements, including IRS and those related to hiring employees (OSHA, FLSA, etc.). It’s essential to understand which categories apply to know what documents to keep.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, farmers may need to keep the records forever.

- Legal documents, such as business formation records, deeds, property appraisals, bill of sale documents, etc., should be kept indefinitely.

- According to the IRS, tax returns should be kept for three to seven years, depending on the situation. The statute of limitations period for income tax returns is generally three years. It is six years if there is a substantial understatement of gross income. A good rule to thumb is to add a year to the statute of limitations period. Using this approach, farmers should keep most of their income tax records for a minimum of four years, but it may be more prudent to retain them for seven years.

- Retain all farm business financial records applicable to income taxes, including depreciation schedules and year-end financial statements, for at least seven years. A certified public accountant (CPA) may recommend keeping accounting records indefinitely.

- All business banking, credit card, and investment statements, as well as canceled checks, should be kept for seven years, possibly longer, depending on business or tax circumstances.

- Keep all permits, licenses and insurance policy documents until a replacement is received for expired ones.

- The Fair Labor Standards Act (FLSA) requires employers to keep payroll records “for at least three years.” Refer to the federal record retention guidelines for a precise breakdown of requirements for personnel records. For instance, documents relating to exposure from harmful agents must be kept for 30 years after employment ends. In contrast, farmers should keep OSHA accident forms for five years after the incident.

- Keep job advertisements, applications and resumes on file for at least one year.

Summary

Record keeping is best kept simple! Both financial and production records need to be collected and organized to generate management reports for farm business decision-making. Establishing a record retention policy ensures a farmer can comply with recordkeeping standards when needed.

Note: This article is intended to provide general information and should not be construed as providing accounting or legal advice. It should not be cited or relied upon as legal authority. For advice about how the issues discussed here might apply to your individual situation, you should consult a certified public accountant or attorney.

The Importance of a Good Set of Financial Records

The Importance of a Good Set of Financial Records Selecting your Farm Accounting System

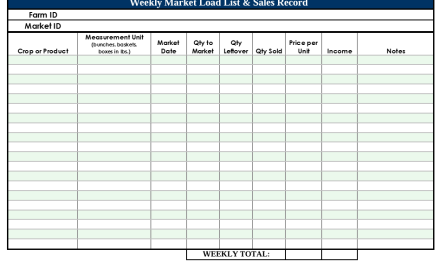

Selecting your Farm Accounting System Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers

Recordkeeping Instructions and Templates for Small-Scale Fruit and Vegetable Growers ▶ Watch: Financial Statement and Analysis Spreadsheet Walkthrough

▶ Watch: Financial Statement and Analysis Spreadsheet Walkthrough