MCO offers protection against unexpected drops in operating margins — the difference between revenue and input cost. Interested producers should contact their crop insurance agent to learn more about how MCO could work for their operation.

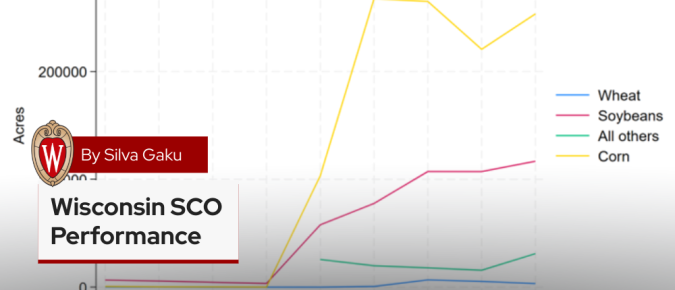

Supplemental Coverage Option (SCO) is a crop insurance product that provides additional coverage for an underlying crop insurance policy. This article provides a brief overview of Wisconsin SCO and discusses its performance from 2015 to 2023.

To help producers manage the risks associated with forage production, several insurance and support programs are available to Wisconsin producers. This article provides a historical examination of forage risk management programs available in Wisconsin from 2015 to 2024.

Producers can use Whole Farm Revenue Protection to mitigate the risks associated with forage production, offering revenue protection for an entire farm operation rather than individual crops or livestock.

Variability in crop markets can make it challenging for farmers to choose the right ARC/PLC program for their specific area and crop. This ‘What-If’ Tool helps Wisconsin producers analyze potential payments at various price levels and county yields.

The Extension Farm Management Program has developed interactive tools to assist Wisconsin producers in comparing ARC-County (ARC-CO) and PLC payments by county, commodity, and irrigation type.

In this presentation, Sylvanus Gaku, Extension Farm Financial Management Outreach Specialist, covers what producers need to know for the 2025 ARC/PLC sign-up.

This article provides estimates of economic assistance for Wisconsin producers following the passage of the American Relief Act, 2025, on December 20, 2024.

There are four strategies that can be pursued to help manage farm business risks.

Understanding how a farmer’s own risk preferences and that of others affect the risk management decisions made for the farm business is important.

Let’s look at the concept of price risk with an example of the average monthly corn prices in the United States.

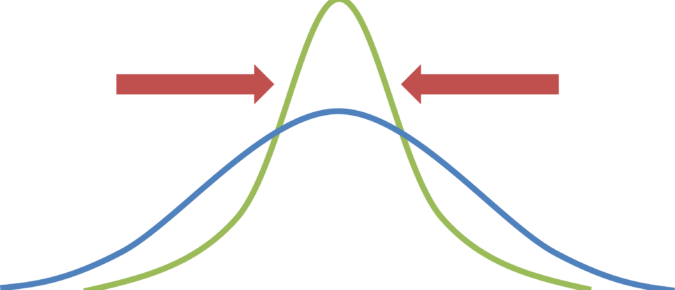

The greater the uncertainty, the greater the risk.

The more likely a negative factor will occur, the greater the risk potential.

The new year often brings thoughts of income taxes and tax preparation. Some farmers might have received a loan servicing assistance payment if they were experiencing certain types of financial distress.

Pick up any farm magazine or listen to any farm podcast and it won’t be long before the phrase “Costs of Production” comes up. Knowing costs of production is an important piece of management information and vital in many farm management decisions. Yet, as obvious as it sounds, pop open the hood and the messiness is revealed.

Join Kevin Bernhardt, Extension Farm Management Specialist, and Katie Wantoch, Extension Farm Management Outreach Specialist, as they share financial tools and analysis methods to aid in answering these questions and making informed decisions.

Whether it is marketing decisions, best production practices, human resource management or technology adoption, a major piece of information for the farm business decision-maker is knowing the costs of production. Two major questions in determining costs of production are how to calculate and which cost of production.

There are many tools farm managers can use to inform their decision-making. One simple and effective tool for many farm management applications is breakeven costs of production. This is particularly useful in marketing decisions as the breakeven cost of production is the price needed to cover costs. If a profit goal is added to the breakeven cost of production, then the decision-maker knows what price will not only cover costs, but also a profit goal.

Cyclical lows tend to be a time of greater anxiety for many and include increased exit from the industry. However, even in cyclical lows, some farms are making profits. For these farms, it is also a time of opportunity as capital asset prices for machinery, land, and cows are often lower as well. The question is: What do these successful farms look like at the end of cyclical highs that enable them to continue that success during cyclical lows?