This year the Farm Service Agency (FSA) opened the enrollment period for the 2022 Dairy Margin Coverage (DMC) program on December 13, 2021 and it will remain open until February 18, 2022. Some year’s we are not conflicted about what our enrollment decision should be. If we are forecasting a poor year, then DMC is a very affordable basic margin insurance product for smaller farms and most everyone should probably sign up for a high margin coverage.

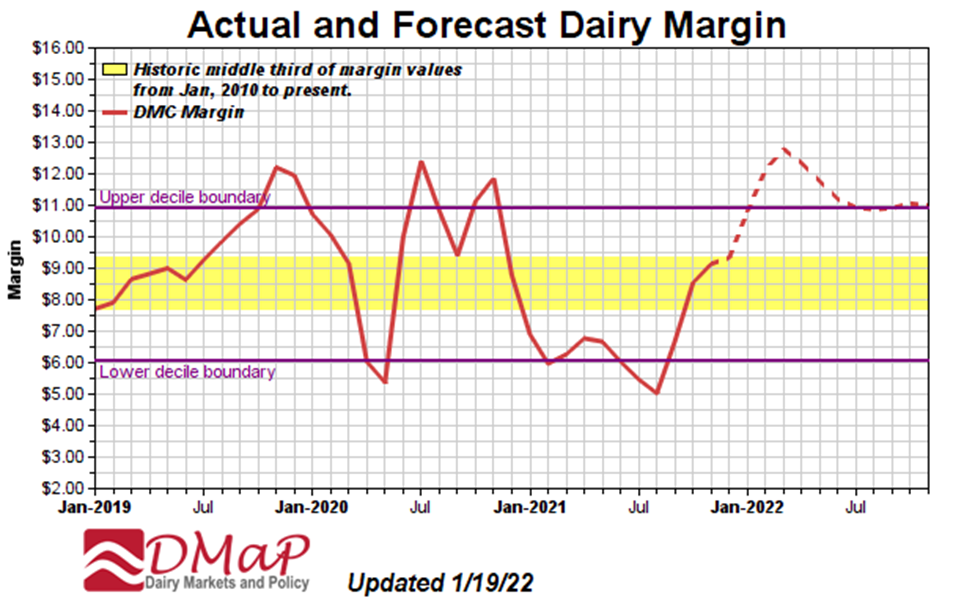

The chart shows us in the dashed line that futures markets are forecasting a very strong margin for 2022. This might also make decisions fairly easy for producers as there is a small likelihood that we would expect indemnity payments in the year given our current understanding of milk supply and demand for dairy products in the year ahead. But, I would caution us to remember that we were in essentially the same circumstance during the 4th quarter of 2019 when it was enrollment time for the 2020 year… and then COVID showed up.

Markets can’t see perfectly around the corner which is why we have risk management programs. DMC is a fairly simple tool to provide a substantial amount of protection for smaller farms against low milk prices, high feed costs, or some combination of both. Congress has tweaked several of the program parameters, which began as the Margin Protection Program, over the years to make the current program more farmer friendly.

This last year, FSA changed the hay values used in the margin calculation to be 100 percent dairy quality, or supreme alfalfa, rather than the lower quality alfalfa values used in MPP or the 50-50 values used in the early DMC program. This has the effect of raising the ration value calculation and triggering indemnity payments more often than in the past. Moreover, the ration change will be backdated to January 2020 and producers will be compensated for any additional payments that would have been made given their enrollment decisions over the last two years.

One other important change that was made has given smaller producers the opportunity to increase their annual production history up to 5 million pounds of milk. This is called Supplemental DMC Enrollment. Any producer whose annual historic production (AHP) is less than 5 million pounds can make a one-time update using their 2019 actual marketings. FSA will add 75 percent of the difference between 2019 production and their historic annual production to their production base up to 5 million pounds. So, if my APH was 4 million pounds and my 2019 marketings are documented at 6 million pounds, my potential increase is: (6 – 4) x 0.75 = 1.5 million pounds. But, since that is increase would now make my APH: 4 + 1.5 = 5.5 million pounds, I am capped at a 5 million pound APH. However, this will certainly help access additional Tier 1 coverage. FSA will also backdate my new APH to my enrollment decisions from 2021.

The decision for this year boils down to what am I trying to accomplish with DMC. If I am looking for risk management and am concerned about my ability to survive another pandemic impact event, then I would enroll for as much $9.50 Tier 1 coverage as my APH allows. Afterall, this maximum coverage in the program only costs 15¢ which is a relatively small cost for this level of protection.

If my APH is near or below 5 million pounds, then this may be adequate risk management protection for my farm. If my APH is well above 5 million pounds and I’m looking for risk management protection, then I would still enroll for as much Tier 1 protection at the $9.50 level as I can…it is inexpensive coverage for that milk. Any milk above 5 million pounds will need to be protected differently. Maybe buying up DMC coverage on Tier 2 to a $5.00 level is a very basic strategy. This improves catastrophic coverage by a dollar and it only costs a half-penny. Any additional risk management will need to be done with other programs like working with your broker to sell a futures contract or purchase a put option. Or, other risk management programs like Dairy Revenue Protection or Livestock Gross Margin might be attractive. Or, check with your handler to see what cash forward contracts may be available to provide protection on a portion of your expected marketings.

If your farm can sustain a bout of low milk prices or higher feed costs, then maybe you would choose to self-insure this year. Since the likelihood of indemnity payments is forecast to be fairly low, you might choose to forego even the 15¢ cost of $9.50 coverage in Tier 1. I would remind you that this was the decision made by many producers in the 4th quarter of 2019 who later regretted the lack of coverage in 2020.

If you want to look at current margin forecasts which are updated daily, you can go to https://DMC.DairyMarkets.org Here you can also go back in history to see what coverage would have looked like in previous years. Please consider your DMC enrollment decision carefully and make an informed decision about coverage for 2022.