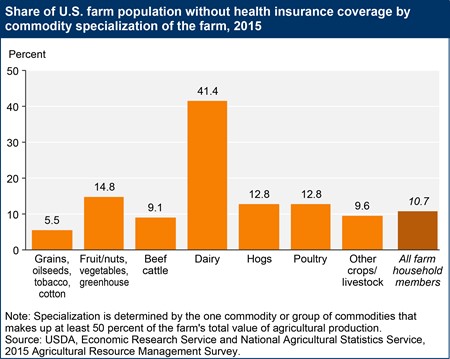

According to the USDA, 11% of U.S. farmers don’t have health insurance coverage. For dairy farmers, the number is even higher—a staggering 41%.

While going without health insurance is problematic for any population, farmers and their families are particularly vulnerable to the ill effects of being uninsured. People without health insurance are more likely to delay routine check-ups and less likely to seek treatment when they need it, which can lead to major medical issues later. Especially on a small farm, a medical crisis could shut down daily activities and impact farmers’ livelihoods —and that’s on top of being on the hook for the full cost of uninsured medical care. Considering the high cost of health care these days, many uninsured farmers and their families are only a single medical hardship away from financial strife and potentially crippling debt.

Farmers want access to affordable health insurance

As the number of farms in the U.S. has declined over the last few decades, more research is being done on the impacts to rural communities, including insights into the challenges inherent in owning and operating a farm. While profitability is a priority for farmers, quality of life and access to health care is often equally important. Grassland 2.0, a USDA funded research project based at UW-Madison, recently conducted more than 75 interviews within three distinct regions in Wisconsin. They found that farmers want “robust and accessible health care designed for the agricultural community” as well as “access to health insurance for farmers and affordable health care.”

Navigating health insurance options can be challenging

Unfortunately, navigating the complex world of health insurance can be especially challenging for farmers. Private insurance can be too expensive for those who are self-employed. As a result, some farmers find it necessary to get an off-farm job just to get access to employer-based health insurance. Additionally, being self-employed means more complex tax situations, which can impact eligibility for income-based health programs. Many farmers’ incomes are too high to qualify for state based Medicaid, called BadgerCare Plus; and to qualify for Medicare, you need to be 65 or older.

Tax subsidies from HealthCare.gov can lower the cost of insurance

While the process of getting insurance can be challenging, farmers do have options, such as HealthCare.gov, the federal Health Insurance Marketplace. Most people in Wisconsin qualify for financial help on HealthCare.gov to lower their costs. According to the Centers for Medicare & Medicaid Services, 89% of Wisconsin residents who enrolled on HealthCare.gov in 2022 qualified for cost savings. While financial help on HealthCare.gov is based on income, new subsidies through 2025 allow people with higher incomes to now qualify for financial help. January 16 is the deadline to sign up for coverage for 2024 plans that start February 1,2024. If you miss the deadline, many life events can qualify you for a Special Enrollment Period, such as when you lose health coverage from your job or have a change in income or household size. To learn more about coverage options in Wisconsin, you can visit WisCovered.com, a consumer website from the Wisconsin Office of the Commissioner of Insurance.

“If prices were too high for you or your family in previous years on HealthCare.gov, I encourage you to look again. You could qualify for a tax credit to lower your monthly premiums, even if you didn’t qualify before.”

Kimberly Turner, Health Insurance Navigator with Covering Wisconsin.

Covering Wisconsin can help

Recognizing how complex and confusing the health insurance system can be—and how crucial health coverage is to people’s well-being—Covering Wisconsin helps Wisconsin residents navigate the system.

A program of UW-Extension and a free community resource, Covering Wisconsin has Health Insurance Navigators located within communities throughout the state who help people understand their options, compare plans, connect with programs that provide financial help, and sign up. Farmers can get help understanding how being self-employed impacts their eligibility in programs and how to find affordable coverage.

Navigators can also help people with problems they’re having with their current health insurance plan, such as billing issues and appeals for when a health insurance company says it won’t cover the cost of the care. Health Insurance Navigators are trained and federally and state licensed to provide non-biased, expert help. Working with a Covering Wisconsin