The Federal Reserve Bank, known by many as the Fed, has chosen to raise interest rates four times over the past year to combat rising inflation. Inflation can be caused by different factors; however, it is generally the result of too much demand and insufficient supply, leading to high prices. Many Americans received excess funds during the pandemic, and along with supply chain disruptions, this has resulted in rising demand for items, an inability to get those items, and an increase in the cost for these items.

The rising of interest rates is one option that the Fed is pursuing to cool off inflation, thus reducing the money supply in the economy. Generally, the money supply is the total amount of money circulation through the economy. The Fed can control the money supply through quantitative easing, the process of buying and selling of assets backed by the Treasury Department.1 During the pandemic the Fed chose to buy assets, thus allowing banks to make loans to people or businesses. The Fed is now selling those assets, reducing the money supply, and trying to reduce inflation.

Impact on Commodity Prices

Research shows that changes in interest rates and the money supply influence commodity prices.2 The Fed’s policy to reduce interest rates and build larger money supplies during the pandemic may be correlated to an increase in commodity prices. Thus, the Fed’s new policies to increase interest rates and shrink the money supply may depress commodity prices.

High inflation and rising interest rates will likely erode a farm business’ liquidity, which is the farm’s ability to meet financial obligations as they come due. While a farmer may have been paying attention to the increase in commodity prices and resulting revenue, they may not have noticed the quickly rising input costs due to increased inflation. Should commodity prices start to decline, costs may remain elevated and be slow to adjust downward. Profit margins may be reduced and even become negative, driving a future demand for more farm debt.

Current Farm Debt

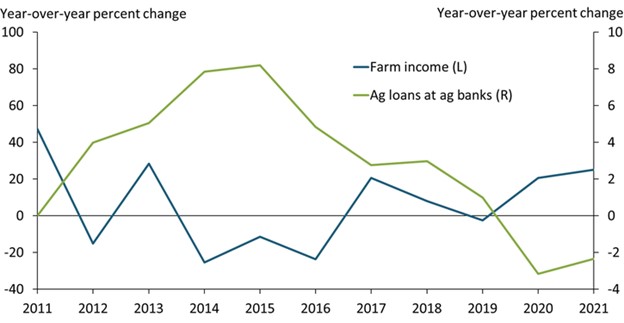

The Fed chose to reduce interest rates following the “Great Recession,” pulling down the federal funds rate, the short-term interest rate that banks charge each other, and keeping it near zero for several years. These low interest rates resulted in inexpensive borrowing for farmers and encouraged many to take on cheap debt. Summer reports published by the Federal Reserve Bank of Kansas City reported strong growth in farm real estate debt which pushed agricultural loan balances higher in the second quarter of 2022.3 Outstanding farm debt increased about five percent from the previous year, the fastest pace in nearly six years. As Chart 1 below shows, the last ten years have seen changes in farm income (blue line) that have been negatively correlated with changes in agriculture bank’s loan balances.4 As farm income declined, more farmers sought out loans with agriculture banks.

Chart 1: When farm income increases, the value of ag loans at ag banks declines

Many farmers chose to increase their liquidity during the pandemic, utilizing high commodity prices and government program payments to pay down outstanding accounts payable, lines of credit, and loan balances. Chart 1 reflects this decline in ag loans in 2020. However, increased input costs may be sneaking up on farmers and result in the use of these short-term debt obligations again in 2022 and 2023.

Rising rates lead to increased risks

Rising interest rates will have a direct impact on farmers that are borrowing money. For example, a line of credit with a lender that is set to fluctuate throughout the year, may have risen three percent since March 2022.

Here are a few considerations to reduce your risks now that interest rates have increased.

- Complete a financial analysis of your farm business to review repayment capacity and liquidity ratios.

- Consult with your lender about these ratios and the debt structure of your loans.

- Determine if your loans have fixed or variable interest rates. Loans with variable interest rates have been affected by the Fed’s policy to raise rates.

- Develop a cash flow projection to see how your profit margins may be impacted by additional rate hikes.

- If margins will be reduced, consider restructuring your loans to a fixed interest rate.

- Complete a sensitivity analysis to determine how different commodity prices and input costs along with changes in interest rates will affect your cash flow.

- Consider marketing options to lock in commodity prices.

- Review expenses to reduce costs that may have risen due to inflation.

Summary

Farmers may be well positioned to tackle the downturn in commodity prices. Yet not all farms are well positioned to handle the rising interest rates. Farmers that plan to take out new loans, renew operating loans, or have debt with variable rates that may adjust higher as interest rates rise should consult with their lender about potential refinancing or restructuring of their debt. Increased interest expense can hurt profitability so a farmer should work with their lender to review their financial situation. Agricultural financing can be a crucial tool to continuing production, expanding operations, or trying different enterprises. Be sure to have a strong relationship built up with your lender. Higher interest rates and input costs may be a part of a farm’s cash flow challenges in the year ahead.