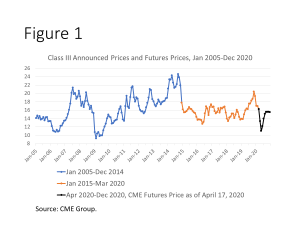

As I write this article, the COVID-19 news is marginally better. The curves are flattening, and people are starting to whisper about life beyond COVID-19. Economic recovery is unfortunately likely to be a longer climb. The situation presents some potentially tough conversations for dairy businesses that have faced the double whammy of an unusually long downturn in cyclical prices (Figure 1) and now extended price erosion due to the virus.

As I write this article, the COVID-19 news is marginally better. The curves are flattening, and people are starting to whisper about life beyond COVID-19. Economic recovery is unfortunately likely to be a longer climb. The situation presents some potentially tough conversations for dairy businesses that have faced the double whammy of an unusually long downturn in cyclical prices (Figure 1) and now extended price erosion due to the virus.

It is important to note that this is a once-in-a-lifetime (hopefully once in a century) perfect storm of events thrust upon dairy businesses in a way that offered virtually no way to prepare. Make no mistake; the villain in this story is the long cycle of low prices and COVID-19, both of which were out of the individual manager’s control. Admittedly, that may be a small consolation as the bills pile up and prices decline. Every crisis has an eventual end and our challenge is focusing on those decisions that we can control that puts our families, our business and ourselves in the best position post-crisis.

The decision-making process begins with an honest and transparent review of the business including:

- What is the status of the operation’s infrastructure including cows, facilities, management capacity, management energy and employees?

- What is the status and past trends of working capital, profitability, equity, debt, cost of production, family living expenses and other financial metrics?

- How will these financial metrics fare at different price levels?

- What are potential alternatives for your business ranging from no change in current operations to transition to a new business model including reduction, expansion, partnership, value-added, new enterprise or a decision to guard equity and exit the industry?

At the risk of being too simplistic, dairy businesses may find themselves in one of three camps. The first camp (Long-Haulers) is the subject of this article.

- Long-Haulers: I am in it for the long haul and my big challenge is how to cash flow until we get to the other side of the COVID-19 crisis.

- Guardian Transitioners: The piling up of low prices the last few years, need for modernizing the operation, other factors and now challenges from the COVID-19 crisis is causing too much erosion of my hard-earned farm equity. My challenge is how to successfully transition to a different business model that guards the future of my family’s equity.

- On-the-Fencers: I am unsure of what to do and need to know how to analyze the next steps for my operation.

The Long-Haulers Challenge – Cash flowing to the other side of this crisis

An important point to keep in mind is that net cash flow must be positive or at least zero (breakeven). The question is not if a business will cash flow, but how. Breakeven cash flow could be obtained by simply not paying bills and debt service or selling capital assets[1]. It is, of course, much better for the long-term health of the business if management decides how to proactively cash flow versus a cash flow outcome that results from neglect. How to plan and manage cash flow begins with understanding the parts, the anatomy of cash flow.

+ (1) Cash operating income

+ (2) Capital asset sales

+ (3) Non-farm income

– (4) Cash operating expenses (not including interest or depreciation)

– (5) Capital asset purchases

– (6) Debt service (principal and interest payments)

– (7) Family living expenses

– (8) Non-farm expenses including income taxes

+ (9) New borrowing

= NET CASH FLOW

Creating greater cash flow must come from one of these nine areas. Thus, the key to increasing cash flow is a deep dive into these nine components to see where there are creative management possibilities. Following are a few food-for-thought ideas for each part.

- Increase Cash Operating Income

- Greater production efficiency such as cow/calf comfort, conception rates and health protocols that result in higher productivity and/or less medical issues.

- Marketing

- Sell market inventory

- Seek or increase custom work income

- Increase in government program payments

- Lease out capital assets when not in use

- Increase Capital Assets Sales

- Sell underperforming capital assets

- Outsource production activities and sell associated assets

- Eliminate low profitability enterprises and sell associated assets

- More aggressive culling of underperforming cows

- Increase Non-Farm Income

- Create or increase off-farm employment

- Sale of non-farm assets

- Contributions from extended family

- Diversify operations to include other income streams such as repair/welding shop, seed sales, agritourism, locally grown meats and other food products, hunting fees, horse boarding, storage for boats and campers, etc.

- Reduce Cash Operating Expenses[2]

- Negotiate lower input and farmland rental prices

- Cheaper ration ingredients

- Better feed bunk management

- Variable rate application, reduced planting populations, etc.

- Reduce downtime of workers and/or time spent on nonproductive pursuits through better scheduling, monitoring, written work goals, analysis of performance expectations or wage tied to performance.

- Collaborate with other farms such as bulk buying, shared fieldwork, shared machinery, shared labor, etc.

- Improved feeding procedures that lower feed waste and improve intake by all cows including the slowpokes at the feed bunk.

- Dry off and cull cows more aggressively and feed them a cheaper ration.

- Reduce Capital Asset Purchases

- Delay asset replacement

- Consider repair versus purchase

- Hire custom operators

- Collaborate to swop machinery for labor

- Used versus new purchases

- Reduce Debt Service

- Restructure: lengthen amortization and lower annual payments

- Interest only payments

- Negotiate for lower interest rates

- Principal write-off

- Reduce Family Living and Non-Farm Expenses

- Set up and track family living expenses

- Review and negotiate lower automatic payments such as cell phone, internet, TV service, etc.

- Local vacations

- Insurance audit to assure adequate coverage and potentially lower premium costs

- Cash payments versus charge or credit cards

- See 7.

- New Borrowing

- New short-term operating loan

- Longer-term loan collateralized with lendable equity on capital assets

What can I do to get started tomorrow after breakfast?

- Find a cash flow budgeting tool. Universities, consultants, banks and others have cash flow budget tools such as https://farms.extension.wisc.edu/articles/cash-flow-budgeting/[3].

- Use the tool to begin cataloging your cash outflows and inflows for the year ahead.

- Tap into your advisors including your spouse, business partners, lender, nutritionist, employees, crop consultant, accountant, local Extension agent and others. Challenge them to put their creative brains to work reviewing the nine component parts of the cash flow anatomy. You may be surprised what they discover.

- Communicate and be transparent with these and other advisors and service providers. Your efforts to make the tough decisions may help them to go the extra mile to help you.

In “normal” times, cash flow from more efficient operations is generally the focus (numbers 1 and 4 in the cash flow anatomy). These are not normal times. Finding ways to cash flow especially in the nearby months of this crisis, may take more herculean efforts and cooperation in delaying debt service, creating repayment plans and other decisions that create cash needed to get over the bridge to the other side of this crisis. Don’t go it alone! Use your resources.

The Long-Hauler has a resilient personality that finds a silver-lining in every dark cloud. Learning, developing and working a positive cash flow may be one of those silver linings.

[1] Selling capital assets, such as cows, provides cash flow in the short run, and is a tool in the toolbox, but it also eliminates a potential profit-making asset for the future.

[2] Be careful not to reduce operating expenses at a level that reduces productivity even more. Much cheaper rations could be fed, but the cost in lost milk production would be even greater.

[3] Source: University of Wisconsin-Madison Division of Extension and the Center for Dairy Profitability.