This article provides a brief overview of Wisconsin Supplemental Coverage Option and discusses its performance from 2015 to 2023.

What is Supplemental Coverage Option?

Supplemental Coverage Option (SCO) is a crop insurance product that provides additional coverage for an underlying crop insurance policy. Since its authorization by the 2014 Farm Bill, SCO provides coverage window from the coverage level of the underlying policy to 86 percent. For instance, if a producer has a revenue protection policy with an 80 percent coverage level, SCO’s coverage window is 80 percent to 86 percent.

Although SCO provides additional coverage for underlying policies, it cannot be combined with Agriculture Risk Coverage: only producers with Price Loss Coverage (PLC) base acres are able to sign-up for SCO.[1] Indemnity under SCO is triggered when the ratio of county revenue to its expected revenue falls below 86 percent. Producers who signed-up for SCO receive the full amount of the covered loss if the ratio of county revenue to its expected revenue is the same as the coverage level of the underlying policy. SCO is not free; however, the producer bears only 35 percent of its cost after a government subsidy.[2]

Using historical data to guide your SCO decision

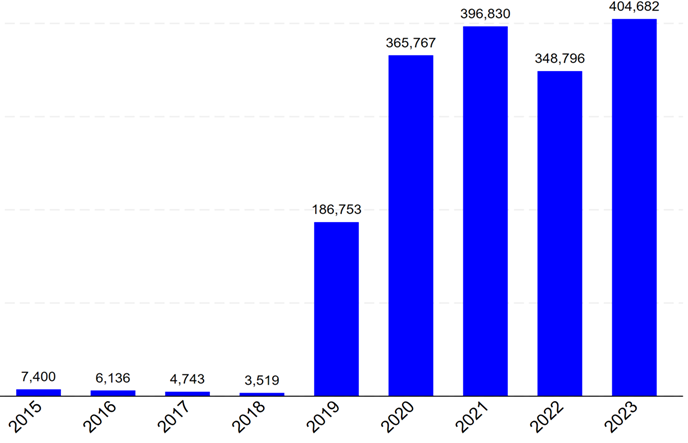

To inform producer decision making in this commodity year, the historical performance of SCO is presented. Figure 1 displays the enrolled acres from 2015 to 2023. Prior to 2019, SCO acres in Wisconsin declined by 52 percent from 7,400 acres in 2015 to 3,519 acres in 2018; however, enrollment rates increased by more than 5 times from 3,519 acres in 2018 to 186,753 in 2019 probably due to producers having preference for PLC which they can combine with SCO.[3] Under the 2018 Farm Bill, enrolled acres increase significantly from 186,753 acres in 2019 to 404,682 acres in 2023.

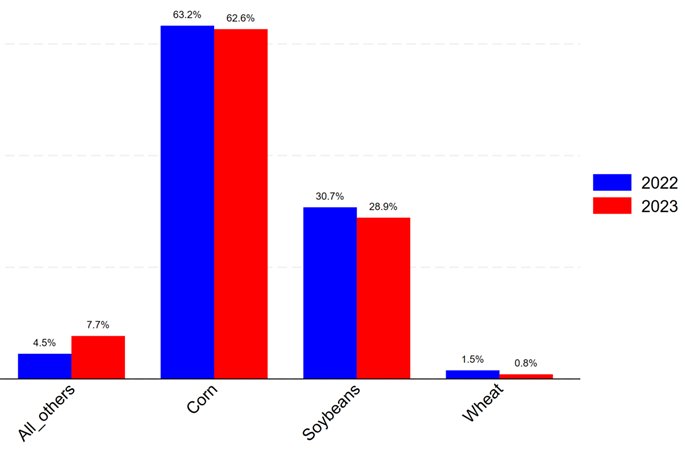

Despite a 16 percent increase in enrolled acres from 348,796 in 2022 to 404,682 in 2023, the variation in the distribution of SCO acres by commodity was small. Enrollment rates for corn, soybean and wheat declined marginally from 2022 to 2023: Corn and wheat acres declined by less than a percentage point, while soybean acres declined by approximately 2 percentage points. However, enrollment rates in other commodities increased from 4.5 percent in 2022 to 7.7 percent in 2023.

Comparing Wisconsin SCO acres by commodity

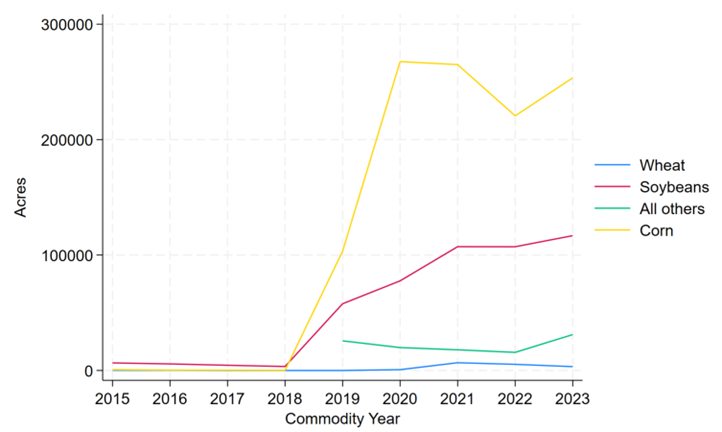

The pattern of participation may vary over time. In view of that, Figure 3 displays the trend of acre enrollments by commodity from 2015 to 2023. Before the 2018 Farm Bill, Soybean acres dominated in Wisconsin. This pattern changed since 2019: corn has dominated acre enrollments in Wisconsin.

Figure 3: SCO Acres by Commodity, 2015-2023

SCO and underlying insurance policies

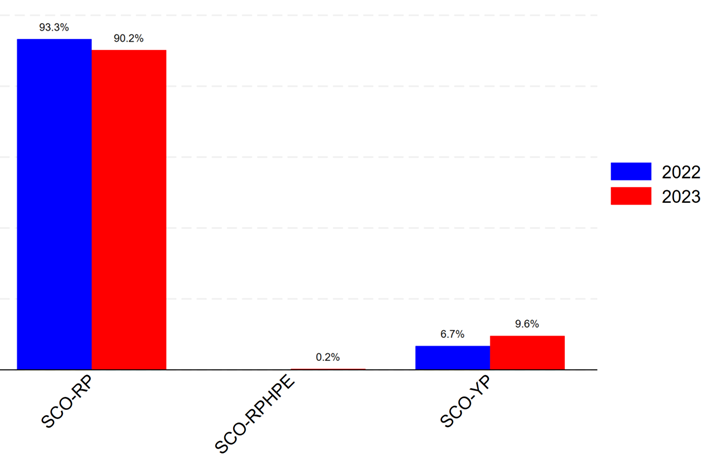

SCO supplements an underlying policy (Revenue with Harvest Price Option (RP), Revenue without Harvest Price Option (RPHE) and Yield Protection (YP)). To examine the underlying policy mostly combined with SCO, Figure 4 displays the share of SCO acres by insurance types from 2022 to 2023.

Figure 4: Share of SCO Acres by Insurance Type, 2022-2023

SCO-RP dominates in 2022 and 2023 with its share above 90 percent. SCO-YP comes second with its share ranging from approximately 7 to 10 percent. SCO-RPHPE has the lowest share in all years with its share ranging from 0 to 0.2 percent.

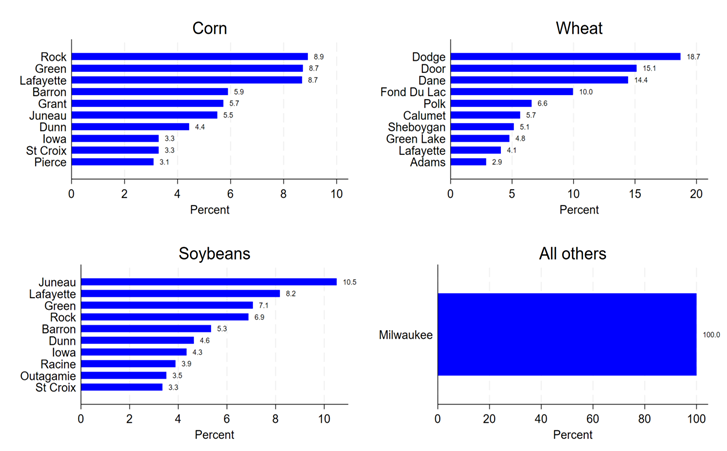

Wisconsin RP policies ranked by county

Geographically, enrollment rates in RP, the most popular underlying policy, may differ. In view of that, Figure 5 displays the ten counties with the highest share of enrollment in RP in a descending order.

Figure 5: Counties with the Highest RP Shares, 2023

In 2023, Rock County recorded the highest share of RP acres for corn, while Dodge County had the highest share of RP acres for wheat. While only Milwaukee County had acres enrolled for all other commodities, Juneau County recorded the highest share of RP acres for soybeans.

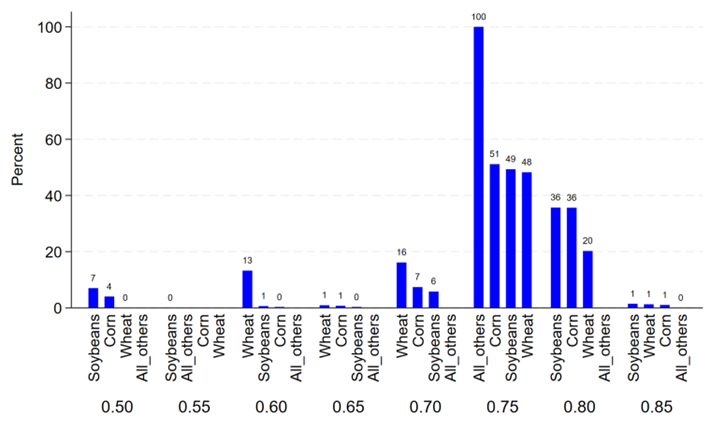

RP insurance coverage levels in Wisconsin

Figure 6 displays the most popular coverage levels for the underlying RP insurance in 2023. The most common coverage level for all the commodities is 75 percent. The 75 percent coverage level accounted for 48, 49, 51 and 100 percent of acres enrolled in wheat, soybeans, corn and all other commodities respectively.

Figure 6: Acre Distribution by Coverage Level, 2023

The SCO insurance product has generated some interest in Wisconsin. According to data from the USDA RMA Summary of Business, there was interest in SCO in 2023 for corn, soybeans, and wheat, as well as in Rock, Dodge, Juneau and Milwaukee counties.

References

Gaku, S. (2025a). 2025 ARC and PLC Decision Tool. Farm Management. https://farms.extension.wisc.edu/articles/2025-arc-and-plc-decision-tool/

Gaku, S. (2025b). Historical ARC and PLC Payouts in Wisconsin. Farm Management. https://farms.extension.wisc.edu/articles/historical-arc-and-plc-payouts-in-wisconsin/

USDA RMA. (n.d.). Supplemental Coverage Option for Federal Crop Insurance National Fact Sheet | RMA. Retrieved March 11, 2025, from https://old.rma.usda.gov/en/Fact-Sheets/National-Fact-Sheets/Supplemental-Coverage-Option

Zulauf, C., Schnitkey, G., Swanson, K., Coppess, J., & Paulson, and N. (2020). Historical Look at SCO (Supplemental Coverage Option) Participation. Farmdoc Daily, 10(18). https://origin.farmdocdaily.illinois.edu/2020/01/historical-look-at-sco-articipation.html

[1] While Agriculture Risk Coverage (ARC) provides payments when actual revenue falls below its guaranteed level, Price Loss Coverage (PLC) offers payments when the market year average price of a covered commodity drops below its established reference price. For more on the performance of these two programs in Wisconsin see the following two articles: Gaku (2025a, 2025b).

[2] USDA RMA (n.d.)

[3] Zulauf et al. (2020)