Given recent changes in U.S. trade policies, specifically, the introduction of a 25 percent tariff on imports from Canada and Mexico coupled with increases in existing tariffs on China, there is need to better understand the potential ramifications on Wisconsin’s agricultural economy. In 2024, Wisconsin farmers were involved in exporting $593.8 million in products to 58 different countries and food processors exported $2.57 billion in products to 133 countries. While the level of farm product exports has remained fairly stable over the 2009 to 2024 period, the exports of food processors have increased by 118 percent over the same period.

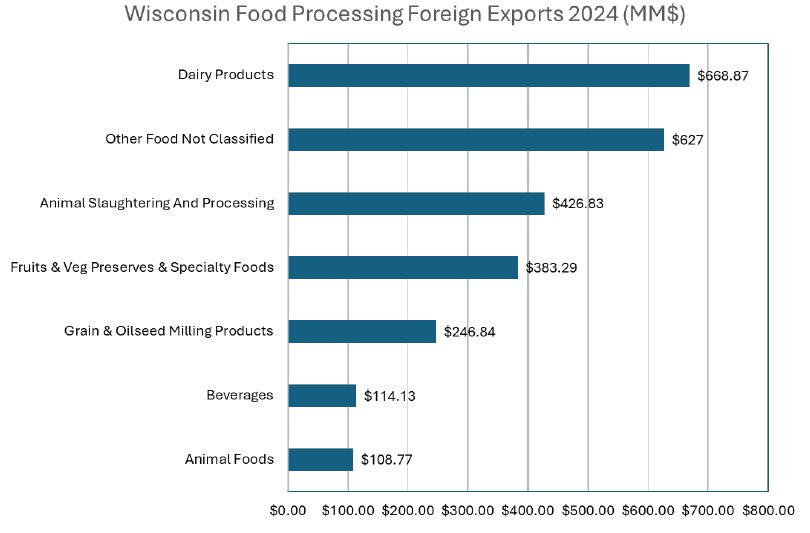

The largest farm-sourced foreign exports are oilseed and grain crops at $333.5 million followed by support activities for animal production at $162.6 million. A major component of the latter industry classification is the exports of bovine semen, particularly to China. The largest food processing industry is dairy products with $668.9 million in foreign exports followed by meat processing with $426.8 million.

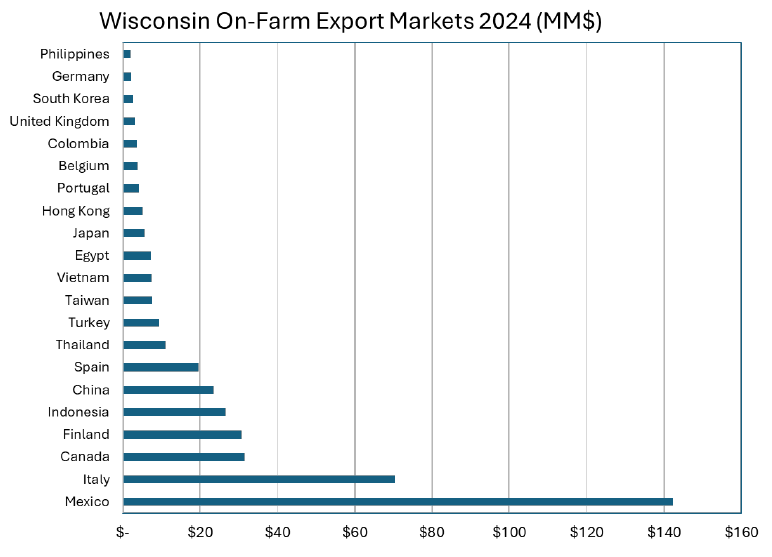

The largest exporting partner for on-farm activity is Mexico ($142.3 million), followed by Italy ($70.3 million), Canada ($31.5 million) and Finland ($30.7 million). The largest export market for Wisconsin food processors is Canada ($1.03 billion), followed by Mexico ($286.7 million), China ($190.0 million) and South Korea ($171.7 million).

In total, including a more modest forestry industry, Wisconsin foreign exports support 21,700 jobs with the bulk stemming from food processing. This economic activity generated by agricultural foreign exports also generates tax revenues that flow to all levels of government including $85.5 million flowing to state government.

Economic Impacts of Foreign Exports

| Employment | Employment Labor Income (MM$) | Total Income (MM$) | Industry Revenues (MM$) | |

|---|---|---|---|---|

| On-Farm | 7,321 | 366.1 | 510.5 | 910.3 |

| Forestry | 624 | 36.3 | 46.5 | 57.8 |

| Food Processing | 13,781 | 953.7 | 1,569.8 | 4,708.4 |

| Combined | 21,726 | 1,356.1 | 2,126.8 | 5,676.5 |

Impacts of Foreign Exports on Government Revenues

| Local (MM$) | State (MM$) | Federal (MM$) | Total (MM$) | |

|---|---|---|---|---|

| On-Farm | 1.1 | 13.2 | 77.5 | 91.7 |

| Forestry | 1.2 | 2.2 | 7.0 | 10.4 |

| Food Processing | 41.0 | 70.2 | 218.1 | 329.4 |

| Combined | 43.3 | 85.5 | 302.7 | 431.5 |

A widely held position is that to grow the Wisconsin agricultural economy, particular attention must be paid to expanding foreign exports. Here food processing has seen steady growth in foreign exports, and this growth has a positive spillover effect on Wisconsin farmers through increased demand throughout the supply chains. The viability of these export markets for Wisconsin agricultural products is particularly sensitive to trade policies. Given the size of exports to Canada and Mexico in particular, the recently imposed 25 percent tariffs are likely to be matched with reciprocal tariffs. The estimated economic impact is still uncertain, and it is unclear if some agricultural and food products will be exempt from U.S. tariffs or retaliation, but any ensuing trade disputes with these countries will almost certainly have negative consequences for Wisconsin agriculture.

Milk, Cookies, and Christmas Eve: Santa’s Dairy Tab by the Numbers

Milk, Cookies, and Christmas Eve: Santa’s Dairy Tab by the Numbers Margin Coverage Option (MCO) for Wisconsin Ag Producers

Margin Coverage Option (MCO) for Wisconsin Ag Producers Dairy Market Dynamics and Domestic Constraints: A Dairy Sector Assessment as of June 2025

Dairy Market Dynamics and Domestic Constraints: A Dairy Sector Assessment as of June 2025 U.S.–Canada Dairy Trade Relationship (2025–Present)

U.S.–Canada Dairy Trade Relationship (2025–Present)