What is Basis?

When you sell a load of grain locally, you receive a price that is different from the futures price. This difference is termed ‘basis’. Basis is simply the difference in value between what the futures market says a bushel of grain is worth and what a buyer will pay for that bushel at their location (cash, spot or daily to arrive price).

More specifically, basis is the difference between an offered cash price at a specific location and the price of the next futures contract which will mature. A futures price represents today’s opinion of a commodity’s value at a specific time in the future. Whereas cash price represents the price at which sellers and buyers are willing to trade the commodity on a particular date at a given location. The basis accounts for the difference in the supply and demand relationships in the local market relative to the futures market.

Variables that determine basis

There are several variables that determine basis at a specific time and location.

Your local basis is going to directly impact your farm’s profitability. Knowing the expected basis enables you to calculate a futures price into an expected local cash price. You can then compare that to your expected breakeven price and decide whether or not to hedge or use price risk management tools. Knowledge of basis also will assist you in making storage decisions. Finally, calculating basis will help you to compare and evaluate the quality of local grain bids offered by other local markets.

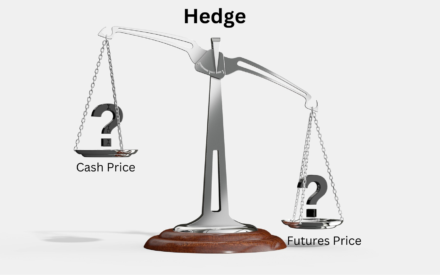

Understanding basis behavior can help in successful hedging options. The primary reason in evaluating basis is its potential to strengthen or weaken. You may have heard these terms used before when referring to basis: weak basis and strong basis.

The figure below graphically displays the changes in cash prices relative to future prices when calculating basis. Click on each arrow to learn more about weak and strong basis.

Typical Basis

The graph to the right shows typical grain basis movements throughout the year.

Assume that futures prices stay at the level shown with a straight line on the graph. The cash price decreases between summer and fall harvest, shown on the graph with the thick curved line. This makes the local basis weaken.

After harvest, cash price typically increases, yielding a stronger basis into the spring.

At fall harvest, the supply of the commodity is largest so you can expect a larger negative basis.

Grain buyers will pay less per bushel because they know not all farmers have sufficient storage and will need to sell grain out of the field. If a grain buyer fills all of their storage, they may temporarily change their basis to an even larger negative value to dissuade farmers from delivering grain to their location.

What all this means is that the basis widens into fall harvest and narrows during storage season (spring and summer), in a relatively predictable manner. Usually, the futures prices are above cash prices until contract maturity. This may be reversed in inverted markets where the cash prices are greater than futures prices (i.e. due to the strong current demand for the product). At the time of contract maturity we expect both the cash and futures to be one and the same and basis to be zero.

Although typical, this pattern doesn’t hold every year. Events can temporarily change the basis either direction. Full bins at an elevator create a strongly negative basis. Needing to fill a train may create a short, stronger basis window. Basis trends are predictable, but they are not absolute.

Many cooperatives or other grain buyers track both historical and current basis on their websites. If you can’t easily find the local basis online, call your grain buyer and inquire. Seeing the current basis value in comparison to historical trends allows you to better interpret the current basis to make the best marketing decisions for the current situation.

Basis trends can impact your marketing decisions both for grain that is in the field (pre-harvest) and for grain that is being stored (post-harvest).

Basis and Storage Decisions

An important use of local basis information is improving the quality of your grain storage decisions each year. If you have a good feel for how basis levels change through the year in your local market, this information can be combined with current futures prices to decide whether storage is an attractive option in your local area.

Putting grain into storage requires you to accept risk. This risk is relatively low if you can assure a return to storage with other tools, such as forward contracts, etc.. Basis changes alone usually will not fully pay for on-farm storage.

The graph to the right will help you to understand the importance of storage costs that are the major component of basis from fall harvest to spring or beyond. Understanding the differences in basis using nearby and distant futures prices will help you to make storage decisions.

Usually, you will see lower prices and weakest basis at fall harvest. You can then pay for storage by capturing one, or both, of these factors as they move in your favor. The key is your storage costs!

To assist your decision making, Steve Okonek, Extension Agriculture Educator, has created an Excel spreadsheet for calculating storage or market carry costs.

Some years there may not be any return on storing grain after harvest. See the Wisconsin corn prices and basis from early 2021 in the table below.

| Delivery Month | Future Price | Basis | Expected Cash Price |

| Jan 2021 | Mar = $5.25 | -$0.35 | $4.90 |

| Feb 2021 | Mar = $5.25 | -$0.35 | $4.90 |

| Mar 2021 | Mar = $5.25 | -$0.35 | $4.90 |

| May 2021 | May = $5.28 | -$0.35 | $4.93 |

| Jun 2021 | July = $5.24 | -$0.35 | $4.89 |

The expected cash price from January to June 2021 ranged from $4.89 to $4.93 per bushel. This was only a $.04 difference! The cost of storing grain may have resulted in a loss or no profitable return during this time period.

Basis and Carrying Charge

In the previous farm example the farmer needs to keep in mind changes to the futures price. If futures price declines, he could lose money. If futures price stays the same or increases, the farmer would make more money. This article has provided you with information on typical basis patterns throughout the year and shown that basis will usually strengthen through the storage season. However, does basis strengthen enough to offset the carrying charge?

Carrying charge is the difference in price between the nearby futures contract and more distant (deferred) delivery futures contracts. Futures contracts are traded by delivery in March, May, July, September, and December. “Deferred” contracts are futures contracts traded further from expiration than the nearby futures contract. For example, in the month of November, the December contract is the “nearby” futures contract while the January, March, etc. are deferred futures contracts.

Futures price is used to calculate carrying charge as basis can alter calculations and return an incorrect result. Carry can be positive or negative. Positive carrying charges may occur when deferred futures contracts trade at a premium to nearby contracts. Negative carrying charges, more commonly known as an inverted market, occur when nearby futures contracts trade at a premium to deferred contracts.

Carry will vary between commodities each year. Corn may have a strong carry and wheat may be weak in the same year. Soybeans seldom have a strong carry. A strong carry occurs when there are excess supplies of a commodity and future buyers are not concerned about supply. Under excess supply, buyers are willing to pay farmers to take the risk of storage, rather than taking on the risk of storage themselves. A weak carry, or a negative carry, may occur under tight supply as buyers are willing to buy and hold the commodity themselves rather than risk not having the commodity in the future. A negative carry is a signal to sell commodities at harvest. If the carry is weak, a farmer can sell at harvest or store unpriced grain for later sale or pricing opportunities.

Summary

Understanding that basis reflects the local supply and demand for grain and can vary by location is important for your grain marketing decisions. You should also determine if a carrying charge in the market is enough of an incentive for you to store grain.

Be sure to keep in mind that before storing your commodity after harvest, you should review the cost of storing grain.

Components of storing grain versus selling your commodity at harvest may include:

- Storage facility cost,

- Interest expense on stored grain,

- Extra drying costs or shrinkage,

- Extra handling charges,

- Grain quality deterioration.

While some of these components may be incurred when the commodity is harvested or goes into storage, other costs may accumulate during the time that the grain is stored. The proper use of storage may increase your income. However, maximum storage income results from selective rather than continuous use of storage facilities.

It is important to understand basis and carry to help you make storage versus “sell the crop now” decisions. It also helps you to better understand a number of the tools that may also be used in grain price risk management transactions.

Defining a Grain Marketing Plan

Defining a Grain Marketing Plan Defining Cash and Futures Markets

Defining Cash and Futures Markets Developing a Grain Marketing Plan

Developing a Grain Marketing Plan Identifying Factors of a Grain Marketing Plan

Identifying Factors of a Grain Marketing Plan