Table of Contents

This article is written and adapted from presentation sessions delivered during the 2024 Dairy Team Webinar Series. The goal of this paper is to summarize key concepts and provide a summary-level understanding of the currently proposed changes to Federal Milk Marketing Orders (FMMOs). These changes are motivated by the desire to address evolving market dynamics, shifts in milk production patterns, and changes in regional supply-demand. Industry stakeholders are seeking to modernize pricing structures to better align with current production costs, consumer demand, and promote orderly dairy markets.

Introduction

In response to evolving dynamics within the dairy industry, several changes to milk pricing under Federal Milk Marketing Orders (FMMOs) are under consideration. These changes, presented by Chuck Nicholson and Leonard Polzin as part of the 2024 Dairy Team Webinar Series, focus on critical updates to FMMOs, such as adjustments to make allowances, Class I differentials, and procedural steps of the producer referendum. This article provides an overview of the proposed modifications and their potential implications for dairy farmers and processors.

The Role of FMMOs

Federal Milk Marketing Orders were designed with several objectives aimed at stabilizing the U.S. dairy industry, particularly in fluid milk markets. These objectives (table 1) are summarized below. In their current form, FMMOs perform various functions, including classified pricing, pooling, minimum price setting, market information dissemination, and audit oversight.

| Objective | Description |

|---|---|

| Promote Orderly Marketing Conditions | Ensure stability in fluid milk markets to avoid disruptions. |

| Improve Dairy Farmers’ Income | Enhance income opportunities for dairy farmers, providing financial stability. Particularly via milk pooling. |

| Balance Bargaining Power | Ensure fair trade terms between producers and processors, protecting farmers’ interests. |

| Ensure Consumer Access to Quality Milk | Guarantee an adequate supply of high-quality milk for consumers at reasonable prices. |

The Case for Change

Recent developments in the dairy industry have prompted a re-evaluation of FMMO pricing structures. Some of the key reasons (table 2) for this are highlighted below. These factors led to discussions around potential changes to the milk pricing system, prompting hearings and extensive industry engagement.

| Issue | Description |

|---|---|

| Fluctuations in Premium Payments | Declines in premium payments to farmers have raised concerns. |

| De-pooling | Processors opting out of pooling milk, affecting market stability. |

| Cooperative Re-blending | Challenges in how cooperatives blend and redistribute payments to producers. |

| Rising Input Costs for Dairy Product Manufacturing | Higher costs for manufacturing dairy products, such as cheese and butter, impacting processors’ profitability. |

| Negative Producer Price Differentials (PPDs) | Occurrences of negative PPDs, leading to further income challenges for producers. |

Overview of the USDA’s Recommended Decision

The USDA’s Recommended Decision proposes several important adjustments (table 3) detailed below. These changes aim to address the evolving cost structures and market conditions impacting the U.S. dairy sector.

| Proposed Change | Description |

|---|---|

| Increase Standard Milk Composition | Raise protein content from 3.1% to 3.3%Raise Other Solids from 5.9% to 6.0%Raise Nonfat Solids from 9.0% to 9.3% |

| Remove Cheese Barrels from Class III Pricing | Exclude cheese barrels from Class III pricing calculations, focusing more on block cheese prices. |

| Increase Make Allowances | Adjust make allowances upward for key dairy products like cheese, butter, NDM, and dry whey to reflect rising production costs. |

| Revert to “Higher of” Method for Class I Skim Milk | Return to using the “higher of” Class III or Class IV prices for determining Class I skim milk pricing. |

Milk Pricing Variations

It is important to note that not all farm milk is priced through FMMOs. In some regions, buyers other than Class I processors can opt out of regulation, further complicating pricing dynamics.

Impacts of Make Allowance Adjustments

Increasing allowances for dairy product manufacturing such as cheese, butter, NDM, and dry whey to better reflect rising production costs, as illustrated (table 4) below.

| Dairy Product | Current Make Allowance ($/lb) | Proposed Make Allowance ($/lb) | Percentage Increase |

|---|---|---|---|

| Cheese | 0.200 | 0.250 | 25% |

| Butter | 0.170 | 0.220 | 29% |

| Nonfat Dry Milk (NDM) | 0.150 | 0.185 | 23% |

| Dry Whey | 0.195 | 0.240 | 23% |

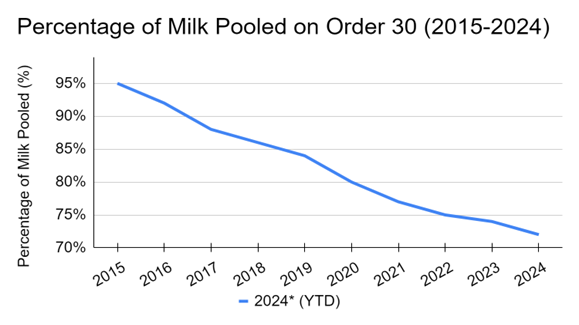

Data on Pooled Milk and Manufacturing Costs

An analysis of historical data reveals variations in milk pooling over the past decade. Between 2015 and 2024, the percentage of milk pooled in Wisconsin and Minnesota under FMMO Order 30 fluctuated, as shown in Figure 1 below.

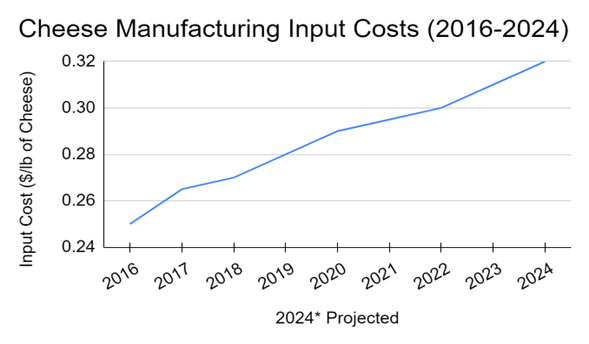

Similarly, new data on cheese manufacturing input costs from 2016 to 2024 show a steady increase in expenses, excluding the COVID-19 period, impacting dairy processors’ profitability. (figure 2) outlines changes in input costs.

FMMOs Referendum and Voting Process

The referendum process under Federal Milk Marketing Orders (FMMOs) allows dairy producers and cooperatives to vote on proposed changes or termination of an order. After the USDA issues a Final Decision on potential changes, the referendum ensures that those directly affected by the order have a say in its future. The referendum focuses on whether the industry is better off with the order or without it, rather than a simple preference for the proposed changes.

- Purpose of Voting: Voting on an FMMO referendum is centered on the impact of having an order which includes the proposed changes or terminating it. Maintaining the status quo is not an option. Termination would eliminate not only FMMO milk pricing but also additional benefits such as auditing, testing, and market information. For example, after the termination of the Western Order in 2004, milk prices aligned closely with Class III prices, reflecting the loss of pooling opportunities and the elimination of the Producer Price Differential (PPD). The data of recent PPD year to date for Orders 32 and 30 is given (table 7) below.

| Order | Average PPD (Jan 2022 – Present) |

|---|---|

| Order 32 | $1.20/cwt |

| Order 30 | $0.29/cwt |

- Eligibility for Voting: Eligibility to vote in an FMMO referendum is determined based on the following criteria (table 8) for both individual producers and cooperatives. These criteria ensure that only those directly involved in the regulated market during the specified period can participate in the voting process.

| Voter Type | Eligibility Criteria |

|---|---|

| Producers | Must deliver milk to a handler regulated by the FMMO during the representative month |

| Must be actively engaged in producing Grade A milk at the time of the referendum | |

| Cooperatives | Must represent producers actively producing and marketing Grade A milk within the order’s geographic area |

| Must be actively marketing milk, either processing or selling it, in the FMMO region |

- Bloc Voting by Cooperatives: Cooperatives, acting as representatives of producers, have the option to bloc vote on behalf of all their members. Bloc voting allows the cooperative to submit a single ballot that counts for all its members, provided they submit a certification of the vote to the USDA. If a cooperative chooses not to bloc vote, individual producers within that cooperative may cast their ballots independently.

- Voting Process and Threshold: The USDA specifies the logistics of the voting process, including key dates for eligibility and ballot submission (table 9). The timeline typically spans 30 to 45 days.

If bloc voting occurs, cooperatives can cast a unified ballot for all eligible members, contributing towards the two-thirds requirement. The USDA will first count the number of producers who vote, followed by the total milk volume they represent, if needed.

| Voting Outcome | Threshold for Approval |

|---|---|

| Amend the Order | 2/3 of voting producers must approve OR |

| 2/3 of milk volume represented by voting producers must approve |

- Implications of the Vote: The referendum can result in one of two outcomes:

- Adoption of the Proposed Changes: The provisions of the Final Decision would be implemented, leading to amendments in the FMMO.

- Termination of the Order: The order would cease to exist, eliminating FMMO pricing, along with key benefits. It is important to note that maintaining the current provisions without changes is not an option.

- Impact on Farm Milk Prices: The effect of the recommended changes will vary by order and depend on multiple factors, including the utilization of milk, the type of pricing used (Multiple Component Pricing versus Skim-Butterfat Orders), and evolving supply-demand dynamics. The potential impacts on milk prices based (table 10) on these variables is given below. The variability across these factors means that producers should carefully consider how changes to the FMMO could affect their revenue streams.

| Factor | Impact on Farm Milk Prices |

|---|---|

| Utilization of Milk | Prices will vary based on how milk is used within the order |

| Pricing Type | MCP orders may see different price fluctuations compared to Skim-Butterfat Orders |

| Supply and Demand Dynamics | Milk prices will respond to broader market changes over time |

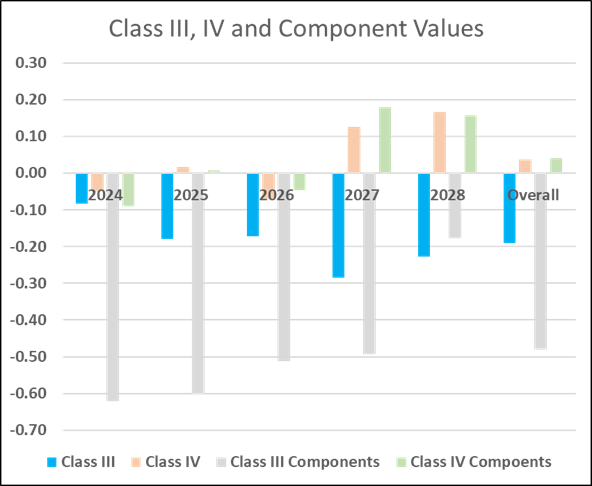

Forecasting Impacts: 2024-2028

Dr. Chuck Nicholson and Dr Mark Stephenson performed dynamic modeling to forecast the potential impacts of these proposed changes on milk prices from 2024 to 2028. The modeling results suggest that pricing outcomes will vary depending on regional utilization rates, market conditions, and supply-demand dynamics.

Conclusion

The effect of the Recommended Decision on farm milk prices will be multifaceted. The extent of these impacts will depend on the various components included in the decision. To provide clarity, these changes have been analyzed individually. The outcomes will differ by Federal Milk Marketing Order (FMMO), as factors such as milk utilization and pricing structures (e.g., Multiple Component Pricing versus Skim-Butterfat Orders) play a vital role. Additionally, prices will fluctuate over time, driven by evolving supply-demand dynamics and market adjustments to the new regulations.