The UW-Madison Division of Extension Farm Management Program has developed interactive tools, referred to as payout visualization tools, to assist Wisconsin producers in comparing ARC-County (ARC-CO) and PLC payments by county, commodity, and irrigation type.

The 2018 Farm Bill has been extended for one year until September 30, 2025, under the American Relief Act of 2025. This extension ensures that farm safety net programs such as Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) will continue under their existing structures for an additional year. As a result, producers will have the opportunity to make their annual election between ARC and PLC by April 15, 2025, with any resulting payments to be disbursed in October 2026. This extension provides stability for producers as policymakers consider their next steps in shaping farm policy.

The USDA Farm Service Agency (FSA) has issued payments for commodities covered under ARC and PLC for the 2023/2024 marketing year, based on crops harvested in 2023. With these payments now available, producers can analyze program performance over the five-year period of the original 2018 Farm Bill.

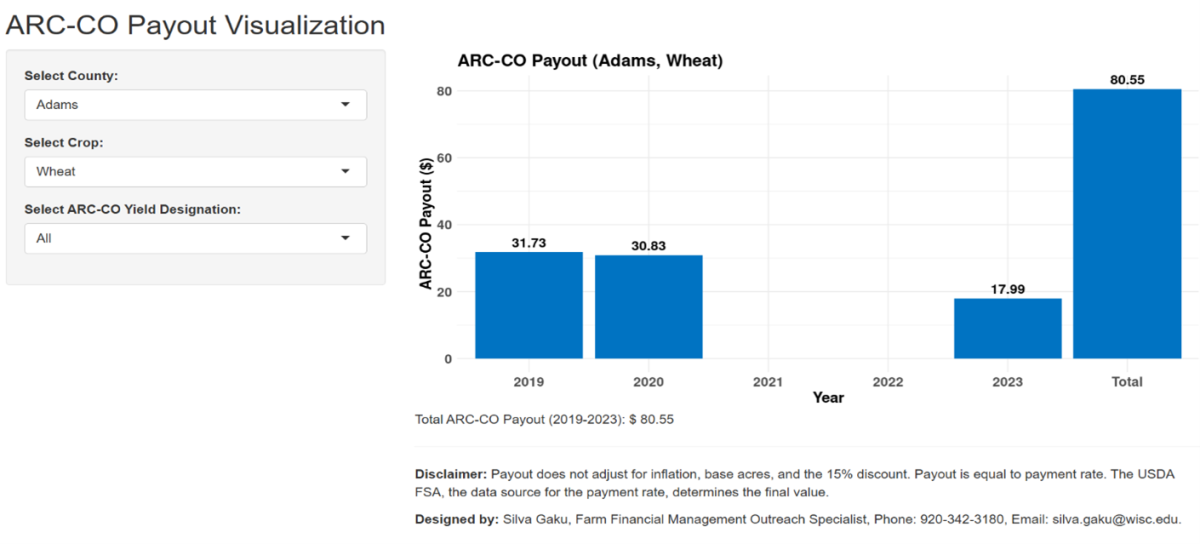

The Extension Farm Management Program has developed interactive tools, including PLC payout visualization tool and ARC-CO payout visualization tool, to assist Wisconsin producers in comparing ARC-County (ARC-CO) and PLC payments by county, commodity, and irrigation type. The ARC-CO tool allows users to select the county, crop, and yield designation, while the PLC tool enables selection of the county and crop for analysis. Although these tools do not account for inflation, potential sequestration or base acre adjustments, they provide a useful starting point for making informed program elections.

Figure 1 presents an example of the ARC-CO tool’s output for Adams County. In 2019, 2020, and 2023, actual revenue[1] fell below the guarantee revenue[2] in Adams County, triggering a total payout[3] of $80.55 per acre for wheat.

Figure 1: ARC-CO Payouts for All Wheat, Adams County

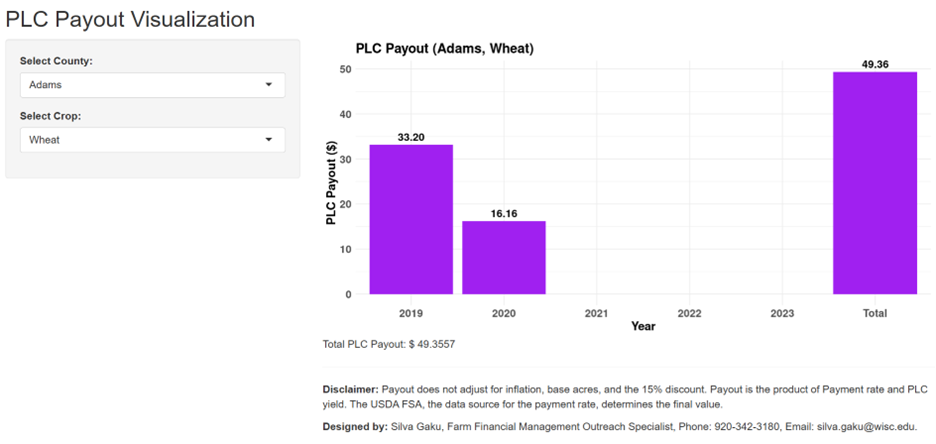

Figure 2 displays the PLC tool’s output for Adams County, where producers who elected PLC received payments in 2019 and 2020. Despite triggering payments twice during the five-year period, total PLC payments[4] for wheat in Adams County amounted to $49.36 per acre. While PLC payments are not county-specific, variations may arise due to PLC yield differences across counties.

Figure 2: PLC Payouts for Wheat, Adams County

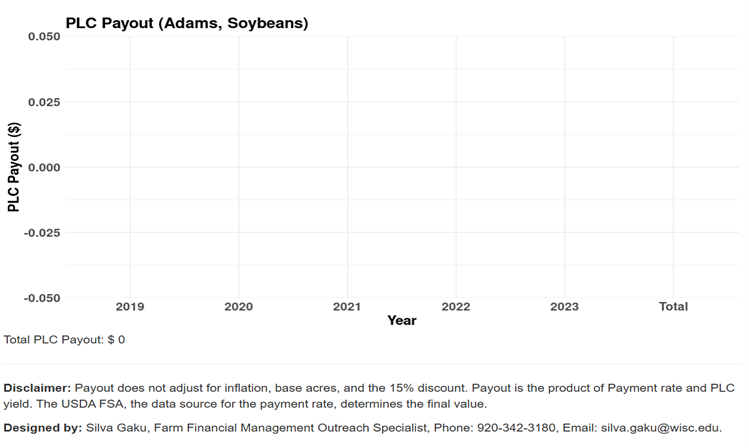

Several commodities, including soybeans and oats, did not trigger PLC payments at any point during the five-year period of the 2018 Farm Bill. This outcome is primarily due to the structure of the PLC program, which issues payments only when the effective price for a given commodity falls below its effective reference price. For soybeans and oats, market prices remained above these reference price thresholds throughout the five-year period, preventing any PLC payments from being issued.

Figure 3 illustrates the payout history for soybeans in Adams County, showing a consistent trend of zero payments each year. As a result, producers who opted for PLC annually on their soybean base acres did not receive any financial support through the program during this timeframe. This underscores a key consideration for producers when making their annual ARC/PLC election—choosing PLC for commodities with historically stable or increasing market prices may result in no payments, leaving producers without additional price-based support during years of moderate or high prices.

While PLC can be beneficial in years when prices decline significantly below the reference price, its effectiveness varies by commodity. For example, wheat or corn may experience periods where PLC payments are triggered, whereas commodities like soybeans may not benefit from PLC at all. Given this historical performance, Wisconsin producers should carefully evaluate price trends and market conditions when making their 2025 program election to ensure they select the most suitable risk management option for their operation.

Figure 3: PLC Payouts for Soybeans, Adams County

The payout trends observed during the five-year period of the 2018 Farm Bill were largely influenced by two key factors: high crop prices and favorable growing conditions. These factors directly impacted both the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs, leading to little to no payments for certain commodities.

Under the PLC program, payments are only triggered when the effective price of a commodity falls below its effective reference price. Throughout this period, market dynamics kept commodity prices above their effective reference levels for crops such as soybeans and oats, preventing PLC payouts. Since PLC is primarily designed as a price safety net, producers of these commodities did not receive financial support through the program during this time.

Similarly, the ARC-CO program is structured to issue payments when actual county revenue falls below the guarantee revenue based on a rolling average of past prices and yields. Favorable weather conditions and strong yields in many regions helped sustain high revenue levels for several commodities, reducing or eliminating ARC-CO payouts. For example, crops such as barley in Adams County did not trigger payments due to both consistently higher actual prices than trigger prices and strong yields matching benchmark thresholds. The high prices and actual yields kept actual revenue above the guarantee revenue.

Market conditions shape the effectiveness of ARC-CO and PLC. Consequently, Wisconsin producers should assess price forecasts, yield expectations, and past payments to select the best risk management strategy in the current program election period.

Wisconsin producers can make an informed ARC/PLC election by reviewing historical program performance using these tools (PLC payout visualization and ARC-CO payout visualization) and analyzing potential payments for these programs. For PLC, producers can compare the projected prices of a commodity to its effective reference price published by the USDA FSA. For example, corn price for this marketing year is projected to be $3.90 and the effective reference price is $4.26, implying that PLC payouts are likely to be triggered. If corn production in a county matches its historical threshold published by the FSA, ARC-CO payouts will also be triggered with the projected price of $3.90. Additionally, agricultural producers should consider how each program fits within their broader risk management strategy, consult with extension specialists, and submit their selection to the USDA Farm Service Agency by April 15, 2025.

[1] Actual revenue=County Yield x Marketing Year Average Price (MYAP)

[2] Guarantee Revenue=86% x Benchmark Revenue. Benchmark revenue is the 5-year Olympic average MYAP multiplied by the 5-year Olympic average county yield. The Olympic averages will be calculated using the 5 years preceding the year prior to the program year.

[3] For simplicity, ARC-CO payout= guarantee revenue – actual revenue. When actual revenue is greater than guarantee revenue, ARC-CO payout is zero.

[4] Here, PLC payouts/payments = PLC yield x (Effective Reference price – Effective Price). Effective price is the higher of the marketing year average price (MYAP) and the national loan rate. The Farm Bill sets the Effective reference price which can vary annually. PLC yield is the established yield.