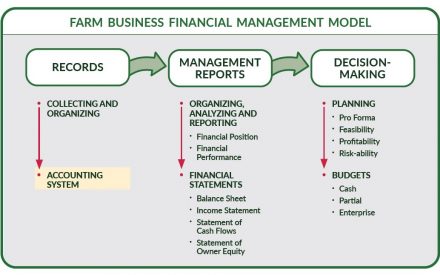

Knowing where to start with financial analysis can be overwhelming. It may be helpful to remember this just one step in the Farm Financial Model:

Records → Management Reports → Decision Making

Cash vs. Accrual Accounting Records

It’s important to know if your records are on a cash or accrual basis. Most farm records are cash basis, meaning revenues and expenses are recorded when the transaction happens. Cash records are easier to keep and are used for income tax reporting. Accrual adjustments take into account when an item was actually produced or used. For example, if a farm prepaid for seed last fall an accrual adjustment would be to record that expense the year the seed is planted. Without this adjustment, the current year’s crop expenses would appear to be less than what they really are. Accrual adjustments should be used for analysis and decision making.

Farm Financial Standards

As a result of the 1980’s farm crisis, the Farm Financial Standards Task Force developed a set of uniform financial standards for agriculture. Currently there are 21 financial measures in the standard. To make analysis manageable, the 21 measures can be easily organized into five general categories:

- Liquidity: the farm’s ability to meet financial obligations as they come due

- Solvency: the farm’s ability to pay all its debts if it were sold tomorrow

- Profitability: the difference between the value of goods produced and the cost of the resources used in their production

- Repayment Capacity: the farm’s ability to repay term debts on time

- Financial Efficiency: how effectively your farm business uses assets to generate income

The Farm Financial Scorecard is an excellent resource to determine where your farm stands (green light, yellow light, red light), and provides concise definitions for each standard. In troubleshooting, using the scorecard and five general categories can help farms narrow down areas to focus on for improvement.

DuPont Analysis

The DuPont System for Financial Analysis is a financial diagnostic system that uses many of the same ratios as the Farm Finance Scorecard. However, it is different in how the ratios are diagnostically used. This analysis focuses on three primary levers of profitability:

- Turnings: Asset utilization or working assets to create gross revenues

- Earnings: Efficiency or how well management does in converting gross revenues into net revenues after expenses are paid

- Leverage: The use of debt financing to multiply the profit earning capability of one’s own equity

Working Capital

If a full farm financial analysis is more than you can take on at this time, at a minimum consider calculating your farm’s Working Capital. Working Capital is calculated by subtracting current liabilities from current assets. In other words, how much does the farm have access to above what it owes this year? Working capital is one of the 21 farm financial standards under Liquidity. Determining what is sufficient Working Capital is greatly dependent on farm size and enterprises.

To compare farms of all sizes Working Capital can be calculated as a ratio: total current farm assets / total current farm liabilities. A Working Capital Ratio of 2.0 would indicate the farm business has $2 of current assets for every $1 of current liabilities. A ratio of 1.3 or less indicates the farm has little cushion for working capital should something unexpected happen. A value less than one indicates the farm does not have enough current assets to cover current liabilities.

Resources

University of Wisconsin – Extension: Farming Your Finances

University of Wisconsin – Center for Dairy Profitability Dupont Analysis Tools

Iowa State Ag Decision Maker: Financial Troubleshooting

Iowa State Ag Decision Maker: Whole Farm Financial Fact Sheets

University of Minnesota Center for Farm Financial Management: Farm Finance Scorecard

Fearless Farm Finances, Book, Published by MOSES