What happened in 2020 that has created this important need for cash basis farmers to seek trusted advice for year-end considerations? Net farm income (a broad measure of profits) in the United States is forecasted to increase 22.7 percent ($19.0 billion) to $102.7 billion in 2020, according to USDA Economic Research Service (ERS). If adjusted for inflation, net farm income in 2020 would be 25.4 percent below its peak in 2013 ($137.6 billion), but still 13.8 percent above 2000-2019 average ($90.2 billion).

The projected increase in net farm income is despite forecasted declines of cash receipts (income) for all commodities of 3.3 percent ($12.3 billion) to $358.3 billion in 2020. Higher cash receipts for fruit and nuts is expected to more than offset the loss for corn, soybeans, and wheat. Total animal and product cash receipts are expected to decrease 8.1 percent (14.3 billion) in 2020. Total production expenses are forecasted to decrease 1.3 percent ($4.6 billion) in 2020 to $344.2 billion. Interest expenses and livestock purchases are expected to drop, but fertilizer and cash labor expenses are forecasted to slightly offset this decline.

Government Farm Payments Significantly Increase in 2020

Direct government farm payments – which include Federal farm program payments paid directly to farmers – are expected to be the significant difference in 2020 and are forecasted to increase $14.7 billion (65.7 percent) to $37.2 billion. The anticipated increase is due to supplemental and ad hoc disaster assistance for COVID-19 relief, including payments from the Coronavirus Food Assistance Program (CFAP) ($16 billion) and the Paycheck Protection Program (PPP). Although administered as a “loan,” the PPP loans may be forgiven if the program’s requirements are met. These loans are treated as a direct payment to farmers by ERS and forecasted at $5.8 billion in 2020. In addition, farmers received Market Facilitation Program (MFP) payments authorized in 2019 but paid in 2020 (3rd round of payments or 25% of total MFP payments). Crop farmers may see payments under the Agriculture Risk Coverage (ARC) program or Price Loss Coverage (PLC) program. The Dairy Margin Coverage Program, that replaced the Dairy Margin Protection Program in the 2018 Farm Bill, is forecast to make net payments of $200 million to U.S. dairy operators in 2020.

Income Bunching

Farmers have experienced a number of challenges in 2020. COVID-19 has caused many ripple effects in the U.S. and among communities in Wisconsin. Unexpected payments may have assisted farmers in weathering 2020 a little better than anticipated. Proper management of this income bunching is important to maximize its benefit when tax planning.

Many of the government program payments must be included in a farmer’s gross income in the year that it was received. These payments were issued as a result of a market disruption or price loss and will be taxed as ordinary income. Government program payments are reported on lines 4a and 4b of IRS Form 1040, Schedule F. See Schedule F Instructions, page 4. In addition, this income will be subject to self-employment tax for farmers. Federal and State government program payments that farmers may have received in 2020 include:

- ARC & PLC program payments (received October or November)

- CFAP-1 and CFAP-2 payments (received June, August, September – December)

- MFP payments (received January or February)

- Wisconsin Farm Support Program (received July or August)

Defer Payments

Farmers may receive crop insurance payments in 2020 as a result of crop damage, drought, freeze, or other crop losses (destruction of crops). In most cases, a farmer must report crop insurance proceeds in the year received. Under some circumstances, the crop payment may be deferred to the following year’s income if a farmer typically sells the crop the year following its harvest. Payments from revenue insurance that covers the combination of yield risk (poor crop yields) and price risk (low prices) can be postponed only to the extent they are paid for yield risk.

Also, farmers may have crop and livestock sales that were planned and some that were unexpected. Farmers may want to defer income from commodity sales by utilizing a deferred payment contract and receiving payment the following year. Flexibility is a key feature of these contracts since a farmer may elect to report this income in 2020 or defer the receipts to 2021 when government program payments are forecasted to return to pre-COVID levels. Deferred payment contracts may be done on a contract-by-contract basis with small or large amount of commodity sales over one or multiple contracts. See IRS Farmers (ATG) Chapter Nine – Grain.

Other COVID Relief Payments

Many Americans received their economic impact payment, also called stimulus payment or recovery rebate credit, authorized by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). These were $1,200 payments ($2,400 for a couple) and $500 for children under 17 years of age. The payment is not income and taxpayers will not owe tax on it. See IRS COVID Tax Tips 2020-55.

A farmer may have received a Paycheck Protection Program (PPP) loan in 2020. As with several government programs during the COVID-19 pandemic, rules and guidance on these programs are always evolving. Current Treasury rules do not allow deductions for expenses paid with forgiven PPP loan proceeds. Current rules indicate forgiven PPP proceeds will not be included in taxpayer’s gross income and expenses paid with forgiven proceeds (such as payroll costs) will not be deductible, ultimately avoiding a double tax benefit. Discuss this issue with an accountant or tax preparer for guidance. If a loan hasn’t yet been forgiven, the expenses remains deductible. Though the PPP proceeds that are later forgiven could trigger the recovery of these expenses, resulting in income that must be recognized and a future tax liability. If a farm has used all the PPP proceeds even before the 24-week covered period, working on the forgiveness application in tandem with tax preparation may be very helpful for this unprecedented year.

Some farmers also received Economic Injury Disaster Loan (EIDL) advances in the amount of $1,000 per employee (up to maximum of $10,000). These advances (called grants by Small Business Administration) may reduce PPP loan forgiveness. Because the CARES Act does not exclude EIDL grants from gross income (as it does a forgiven PPP loan), these payments should be reported in a farmer’s gross income unless additional guidance is provided by IRS.

End of Year Tax Planning

Farmers have several tools available to assist with managing their tax liability, however some of these tools need to be taken advantage of prior to December 31, 2020. Avoiding income spikes and dips prevents overall income from being taxed at unnecessarily high tax rates. Consult with a trusted tax professional to discuss if one of these options may work best for your farm business.

- Prepay farm inputs. Most farmers already understand this but more IRS audit activity on these payments report deposits do not qualify as prepayments. To qualify, prepays should:

- Have a stated farm input (seed, gas, diesel, fertilizer, chemicals, etc.),

- Have a stated quantity,

- Have a stated price per unit,

- Not allow for a substitution, and

- Should not exceed 50% of farm expenses (in most situations).

- Income averaging.

- Retirement account contributions.

- Gift commodities to charity.

- Timing purchase or sale of assets.

- Managing deprecation of assets.

References:

- 2020 Farm Sector Income forecast. USDA Economic Research Service. https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/farm-sector-income-forecast/

- 2020 Farmer’s Tax Guide, Publication 225. Internal Revenue Servie. https://www.irs.gov/publications/p225

- Neiffer, P. (Oct. 21,2020). CliftonLarsonAllen. https://blogs.claconnect.com/agribusiness/key-year-end-tax-planning-tools/

- Tidgren, K. (Oct. 27, 2020). Center for Iowa Agricultural Law and Taxation. https://www.calt.iastate.edu/blogpost/end-year-considerations-unprecedented-year

Margin Coverage Option (MCO) for Wisconsin Ag Producers

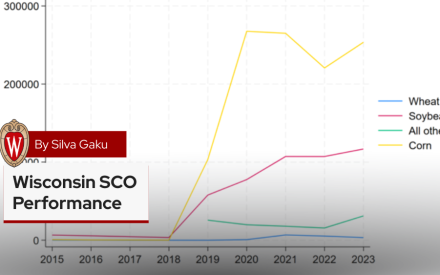

Margin Coverage Option (MCO) for Wisconsin Ag Producers Wisconsin Supplemental Coverage Option (SCO) Performance

Wisconsin Supplemental Coverage Option (SCO) Performance Forage Risk Management in Wisconsin, 2015-2024

Forage Risk Management in Wisconsin, 2015-2024 Managing forage production risk with Whole Farm Revenue Protection

Managing forage production risk with Whole Farm Revenue Protection