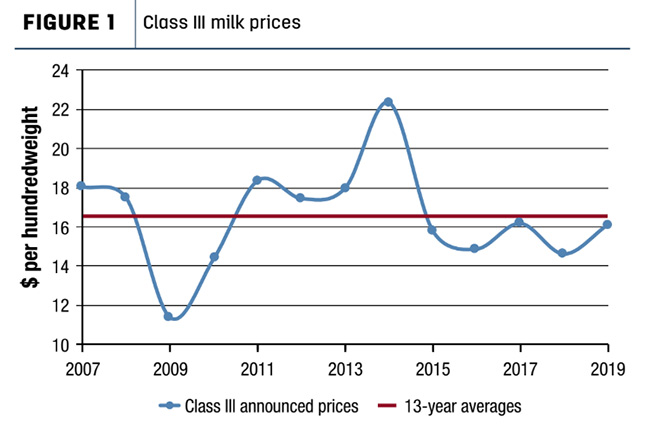

As I write this article, January 2020 Class III futures are $18.15 per hundredweight (cwt), a $1.65 increase since my semester of teaching started in September and well above the annual averages for the last five years (Figure 1). Higher prices are a welcome piece of news for dairy farmers after living through five consecutive years of challenged profitability due to low prices (Figure 1).

We know all too well that the dairy industry is cyclical – what is down today will be up tomorrow and vice versa. Hopefully, we are in the beginning of climbing to the top of cyclical profitability. However, just like the challenge of managing the bottom of the cycle, the top of the cycle also has management challenges, part of which is rebuilding from the previous low and preparing for the next.

We know all too well that the dairy industry is cyclical – what is down today will be up tomorrow and vice versa. Hopefully, we are in the beginning of climbing to the top of cyclical profitability. However, just like the challenge of managing the bottom of the cycle, the top of the cycle also has management challenges, part of which is rebuilding from the previous low and preparing for the next.

Several options emerge depending on the business’s situation, including asset replacement, business expansion in scale or scope, rebuilding working capital and paying off debt. The last, paying off debt, is the focus in this article – but first, a summary of the others.

Some dairy businesses have been putting off capital asset replacement for five years, and they may have machinery, building/land improvements or breeding stock needs that can’t wait any longer. Data from the University of Wisconsin’s Center for Dairy Profitability of 173 farms (median herd size of 134 cows) shows net machinery replacement decreasing 61% from 2014 to 2018. Funds for asset replacement were needed elsewhere in the operation, forcing the old tractor to work another year.

A second area producers may be looking with profits is investing in barns, parlors, robots, cows and land to take advantage of economies of scales or investing in new profit centers that add value or diversify operations. These investments set the foundation for lower costs and greater profitability in the future. They are sound strategies that are best contemplated when there are profits. Care should be taken to structure new investments so increased returns self-liquidate investment costs.

The third and fourth areas are not as exciting as capital replacement and new investments, but for some they may be the best financial decision.

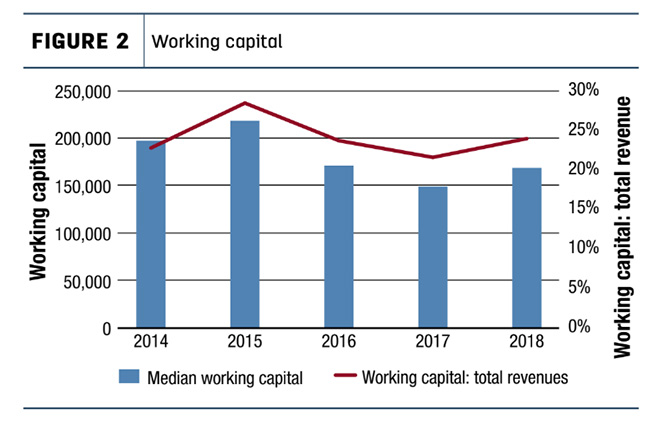

The third area is rebuilding working capital (current assets minus current liabilities). Working capital is one of the best sources of risk management in the dairy farm business. It is that rainy day fund one can go to when the need arises.

The year of 2014 gave an opportunity to build working capital, and thankfully so as that reserve was sorely needed in the years that followed.

The year of 2014 gave an opportunity to build working capital, and thankfully so as that reserve was sorely needed in the years that followed.

Figure 2 shows that working capital eroded from a high of $218,475 (28% of total revenues) in 2015 to a low of $149,100 in 2017 (21% of total revenues). Many lenders mentioned that in the last couple of years, one of the greatest challenges their customers were facing is the loss of their working capital, and the uncomfortable question was “now what?”

The two sides of debt

One answer to “now what?” is the fourth area: new loans to cover operating losses, which can be dead-weight debt. As a child of the 1980s debt crisis in agriculture who watched too many family farm sales, I grew up with the notion that debt is evil. As I grew in my economics career, I realized debt is a two-sided coin. Yes, it can be bad, it can be a drag on profitability, and it certainly can be stressful. Yet it can also be a valuable tool for increasing profitability, expanding operations and bringing the next generation into the operation.

The key is the purpose of the debt financing. If assets were purchased with debt financing, and those assets return profits greater than the interest paid for the debt, then debt is working to increase profitability. On the other hand, if debt is used for purposes that do not return enough profits to pay the interest on the debt, then the debt is a drag on profitability and will continue to be until it is paid off. An example illustrates the point.

Table 1 shows results from three different operations, each that started with borrowing $100,000. Operation 1 borrowed $100,000 at 6% for machinery, cows or some other capital asset and put it to work to create greater cost efficiency, greater productivity or both, resulting in a profit return of $8,000. After paying the $6,000 of interest on the loan, Operation 1 was left with $2,000 of additional profits.

Table 1

| Operation 1 | Operation 2 | Operation 3 | |

| Debt Financing | $100,000 | $100,000 | $100,000 |

| Profits from Debt Financed Assets | $8,000 or 8% | $6,000 or 6% | 0 |

| Interest Rate | 6% | 6% | 6% |

| Total Interest Paid | $6,000 | $6,000 | $6,000 |

| Net Profits | $2,000 | 0 | ($6,000) |

This is called leverage. Operation 1 used (leveraged) someone else’s money to create new profits for themselves. It is also sometimes called an “equity multiplier.” That is, Operation 1 used debt-financed capital to multiply their owner equity by an additional $2,000.

However, debt-financed capital can also multiply the other way. Operation 2 had fewer returns from their debt-financed capital investment, $6,000, which is the same as the interest cost. This left zero profits from the new investment – nothing lost but nothing gained.

Operation 3 illustrates the danger of debt. In this case, there were zero profit returns from the purpose of the debt. The debt may have been for new assets that just did not work in creating any returns, or it may have been for covering past losses or unpaid operating loans. Either way, the interest still must be paid, and thus the multiplier effect still worked; it just worked the wrong way. Operation 3 must find $6,000 from somewhere else in the operation to pay the cost of debt; it’s a drag on profitability.

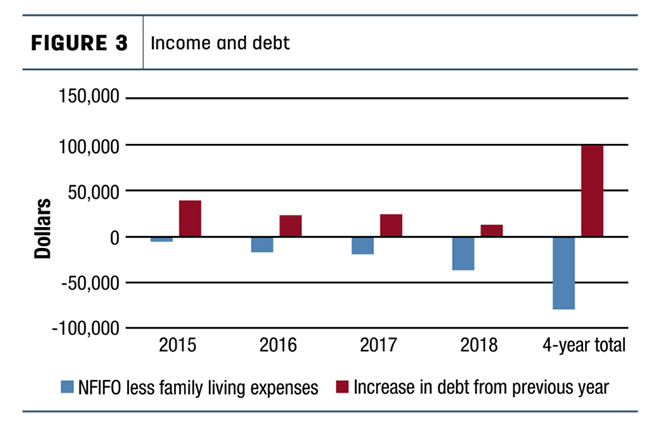

For the 173 dairy farms in the Center for Dairy Profitability database, median net farm income from operations minus family living expenses was negative every year from 2015 to 2018 (Figure 3). Covering those losses included using working capital, which dairy farmers did, potentially selling capital assets, off-farm income and by taking out loans to cover the losses.

For the 173 dairy farms in the Center for Dairy Profitability database, median net farm income from operations minus family living expenses was negative every year from 2015 to 2018 (Figure 3). Covering those losses included using working capital, which dairy farmers did, potentially selling capital assets, off-farm income and by taking out loans to cover the losses.

Figure 3 also shows the change in median level of debt from the previous year, which increased each year since 2015. The median farm in the database is now carrying $99,193 more debt today compared to four years ago.

The question is: What was that debt used for? Is it an Operation 1, that used the debt to create greater returns, or is it an Operation 3, that used the additional debt to cover losses? The database does not reveal that answer, but discussion with lenders and farmers suggests it is likely Operation 3-type debt. If that is the case, then the multiplier effect is working against these farms and is a drag on profitability. It’s dead-weight debt.

With the hopeful return of profits, each dairy manager will have to make decisions based on what is best for their operation. The best decision could be asset replacement, business expansion in scale or scope, rebuilding working capital or paying off dead-weight debt that is dragging profitability.

What the dairy farmer can do tomorrow morning after breakfast is work with their lender, consultants, accountant and others to evaluate the critical control points for their operation. Where will money spent have the greatest impact? Investing in capital replacement or new investments is appealing, more fun and may be the best financial decision.

However, the less exciting efforts of building working capital and paying off dead-weight debt may for some be the more prudent financial decision. Working capital as a percent of total revenues should be 25% to 30% or greater. If it is less, then it may be an area that needs management attention. Return on assets should be higher than the average interest rate on loans, which means the positive multiplier is at work.

With respect to dead-weight debt, I’m reminded of the story of the dead horse. If the horse is dead, don’t try to feed it, water it or brush its mane – just bury it. The same may be good advice for dead-weight debt.