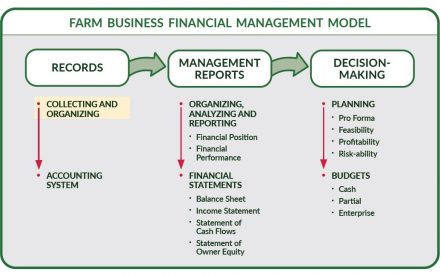

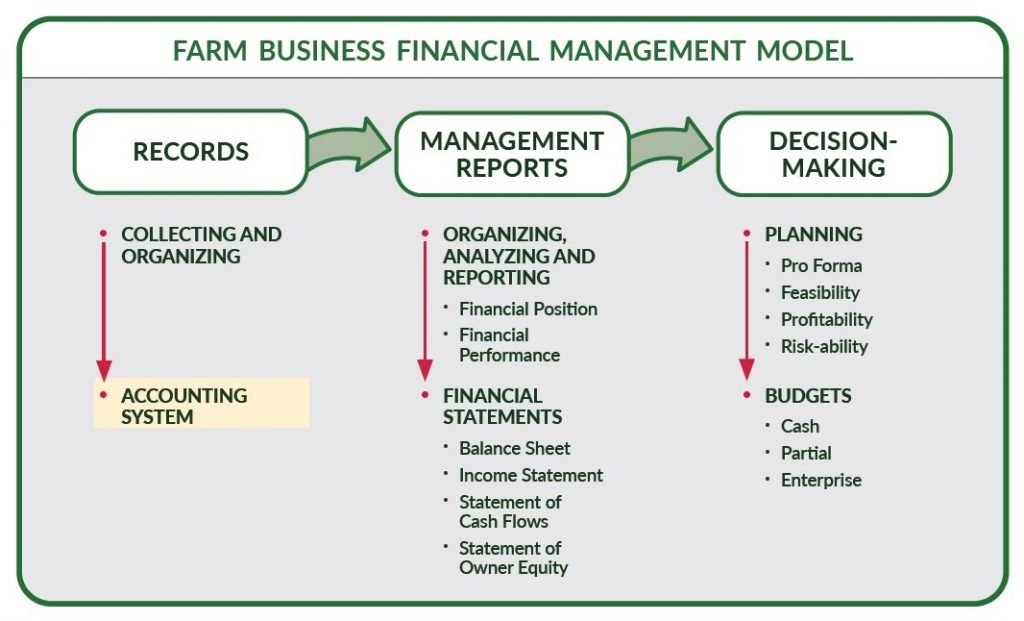

An accounting system is a set of actions and methods designed to collect, store, and process financial transactions into management reports for decision-making.

Introduction

Farming is widely viewed as a “way of life” rather than a business. Both financial and production records are required to provide information the farmer needs to make critical risk management decisions. Farmers need to keep records to pursue effective risk management strategies that will enhance the longer-term profitability of their business. Recordkeeping begins with collecting and organizing of the farm business’ production (physical) and financial (income/expense) information.

Methods

Cash Accounting

Most farmers utilize cash basis accounting to report income (revenues) and expenses (costs) when cash is exchanged. Cash accounting method is an acceptable method for reporting taxable farm income. However, additional information may be needed for informed management reports and decision-making.

Accrual Accounting

Accrual accounting recognizes income and expenses when they occur, not necessarily in the year received or paid. Income and expenses are more appropriately matched in a production year and provide a more accurate evaluation of profit (loss). Income tax records for production businesses are required by the IRS to be based on accrual accounting.

Journal Entry

Business transactions are recorded in a journal and may be listed for specific accounts or grouped and summarized by accounts.

Single Entry

A single-entry accounting system is characterized by only one entry made for each transaction, much like a check register. For most farm businesses a single-entry system will suffice. However, a single-entry system does not tract accounts like inventory, accounts payable/receivable, nor create a balance sheet or income statement. It also does not coincide with GAAP.

Double Entry

A double-entry accounting system provides the most detailed accounting of farm business transactions, but requires a significant amount of time to learn and implement. For every transaction going out, there must be a corresponding transaction coming in (debit/credit). This double entry method provides a cross check and ensures that errors are minimized. It is the best option and is the accepted accounting system in use for most businesses today.

Summary

Farm business records are important for tax planning but are also utilized to generate management reports that will enhance the long-term profitability of the farm business. Financial management does not mean the producer has to use an accrual accounting system, but it does mean accrual adjustments must be made in order to achieve financial statements (required on an accrual basis) for financial management (i.e. determining financial performance). Overall management includes both financial management (accrual basis) and tax management (cash basis). Both management approaches need to be understood and reconciled.

Test your knowledge of accounting systems

Which option best describes why record keeping is important?

- Pursue effective risk management strategies.

- Provide essential information on a timely basis.

- Satisfaction of IRS tax reporting requirements.

- Track accounts like inventory, accounts payable/receivable.

- Create a balance sheet or income statement.

- All of the above

Answer: 6. All of the above

True or False: Under accrual accounting, revenues are reported in the accounting period when services or goods have been delivered.

Answer: TRUE. In addition, expenses are reported in the accounting period when an expense matches the revenues or is used up.

This is one in a series to introduce you to the farm business financial management model. This presentation provides information on an accounting system. An accounting system is a set of actions and methods designed to collect, store, and process financial transactions into management reports for decision-making.

More Farm Pulse Financial Management Resources

References: Farm Financial Standards Council. (2021, January). Financial Guidelines for Agriculture.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.