In recent marketing years, the payouts from ARC and PLC programs have shown variability, largely influenced by market and local conditions. This variability can make it challenging for individual farmers to choose the most suitable option for their specific area and crop. To assist with this decision, Extension has developed a What-If Tool to help Wisconsin producers analyze potential payments at various price levels and county yields.

This article introduces a decision-making tool designed to help producers determine whether to enroll in the Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) program, following a brief historical overview of both programs.

The American Relief Act of 2025 has extended the 2018 Farm bill for one year. This extension gives agricultural producers another opportunity to choose between ARC and PLC for their base acres in 2025. The deadline to elect or make revisions is April 15, 2025, with potential payments issued by October 2026.

Under the PLC program, payments are only triggered when market year average price of a covered commodity falls below its effective reference price[1]. Unlike PLC, ARC has two types:

- County ARC (ARC-CO) is structured to provide payments when actual county revenue[2] falls below its guaranteed level for a program commodity.

- Individual ARC (ARC-IC) triggers payments to producers when actual farm-level revenue is less than its guaranteed level.

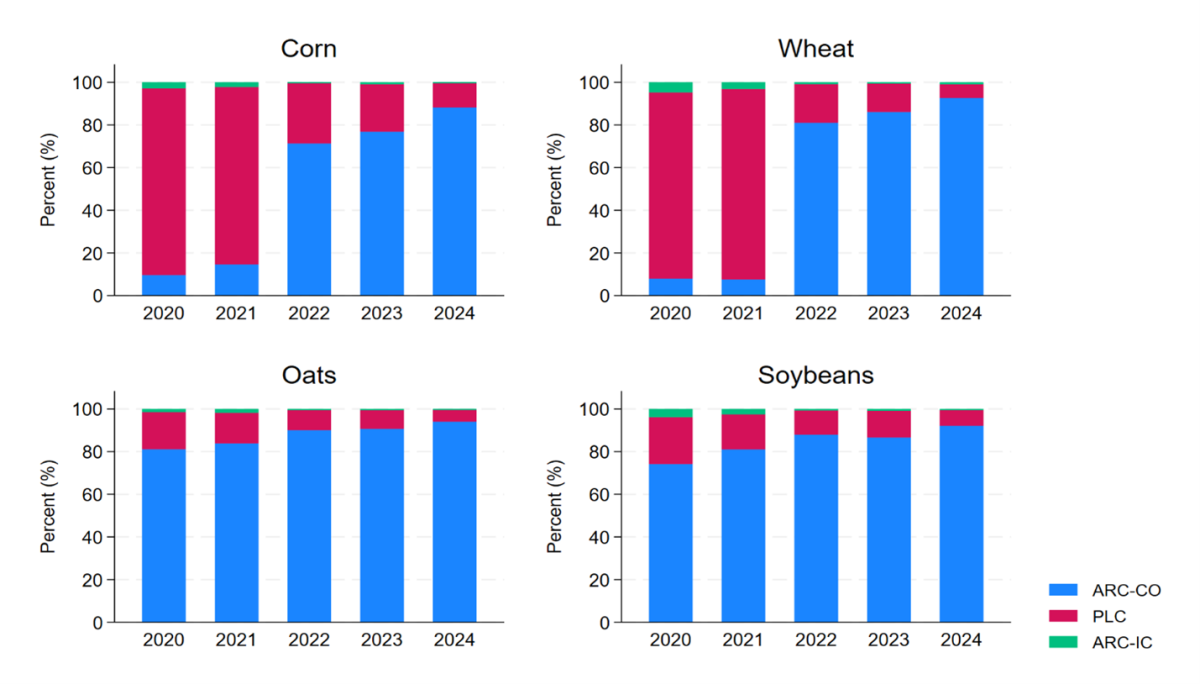

We focus on ARC-CO and PLC because of the low ARC-IC enrollment rates in Wisconsin. Figure 1 shows Wisconsin enrollment rates of base acres for corn, wheat, oats and soybeans from 2020 to 2024. The enrollment of Wisconsin corn and wheat base acres experienced a major shift after 2021. Despite absence of both ARC-CO and PLC payouts in 2020 and 2021, corn producers may have expected significant yield fluctuations in subsequent years, leading them to enroll in ARC-CO.[3] With PLC providing no payouts for wheat in 2021 and ARC-CO paying out $2,087 according to USDA Farm Service Agency (FSA) data, wheat producers may have anticipated yield fluctuations, prompting their shift to ARC-CO.

Figure 1: Enrollment Rates into ARC-CO, ARC-IC and PLC by Commodity, 2020-2024

ARC-CO enrollment rates have an upward trend for oats and soybeans. As shown in Figure 1, at least 80 percent of oats base acres are enrolled in ARC-CO from 2020 to 2024, and more than 70 percent of soybeans base acres are enrolled in ARC-CO.

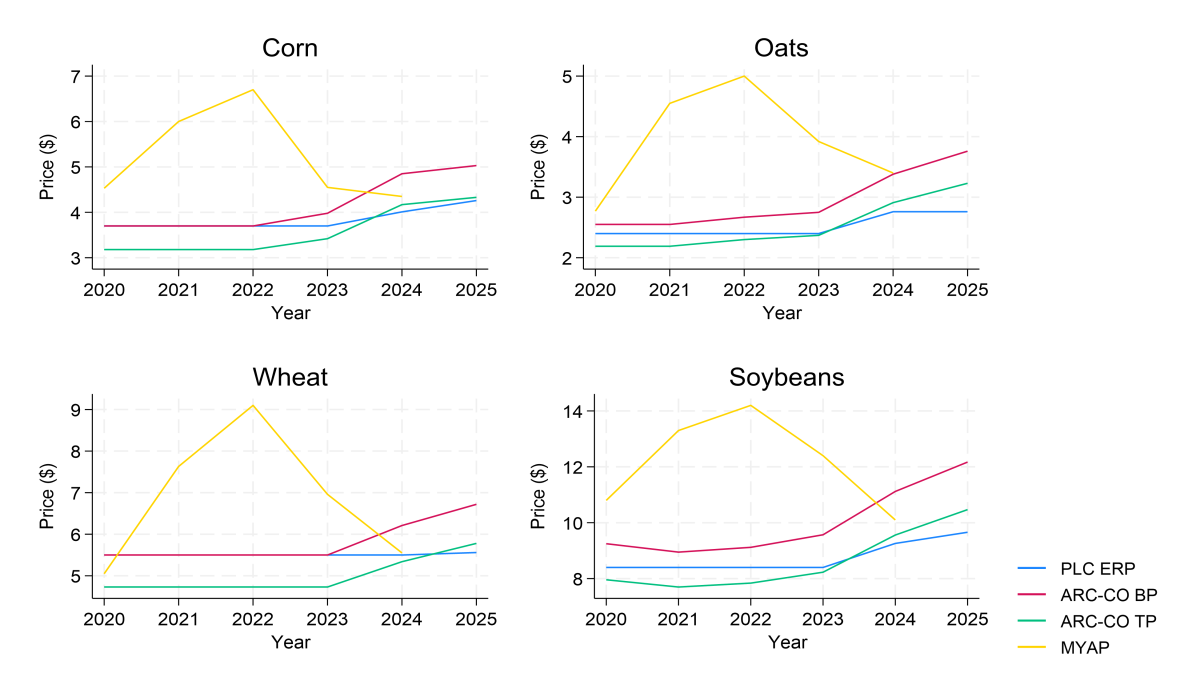

Figure 2 displays the prices for major commodities in Wisconsin from 2020-2025. PLC payouts were not triggered for corn, oats and soybeans from 2020-2024 because the effective reference prices (ERP) were below the marketing year average prices (MYAP).[4] Wheat producers who enrolled their base acres in PLC received payouts in 2020 because the marketing year average price was lower than the effective reference price. However, PLC payouts for wheat were not triggered from 2021 to 2024 because of high prices.

Producers of corn, soybeans and oats may have received ARC-CO payout due to yield shortfalls despite marketing year average prices (MYAP) being greater than ARC-CO trigger prices from 2020-2024.[5] For instance, in Burnett and Oneida counties, corn producers who enrolled their base acres in ARC-CO received payouts in 2023 despite high prices. Oats producers in Polk County who chose ARC-CO in 2023 also received payouts.

Figure 2: Prices of Selected Program Commodities, 2020-2025

Benchmark prices, trigger prices and effective reference prices for selected commodities have increased overtime due to high average prices from 2019 to 2023.[6] In 2025, benchmark and trigger prices are higher than effective reference prices, indicating that ARC-CO may offer better price protection than PLC this crop year. Although ARC-CO will trigger payouts at higher prices, its actual payments may be lower than PLC payouts when farm prices keep declining due to the ARC-CO payout cap.[7]

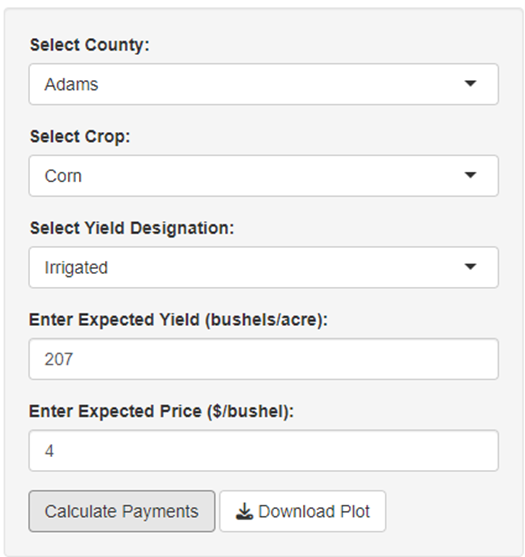

In recent marketing years, the payouts from ARC and PLC programs have shown variability, largely influenced by market and local conditions. This variability can make it challenging for individual farmers to choose the most suitable option for their specific area and crop. To address this, the UW-Madison Division of Extension Farm Management Program has developed a tool (What-If Tool) to help Wisconsin producers analyze potential payments at various price levels and county yields. This tool allows users to select the county, crop, ARC-CO yield designation.[8] Additionally, users can calculate both PLC and ARC-CO payouts by entering expected prices and yields. After the above selections and data entries, users should click “Calculate Payments” to observe potential payouts for ARC-CO and PLC.[9] Users are also able to download a picture of the output.

Figure 3 displays the tool using Adams County as an example. To view payouts for irrigated corn, users should select corn under “Select Crop” and irrigated under “Select Yield Designation”. Users can proceed to enter expected price of $4 and yield of 207 bushels/acre and click “Calculate Payments” to view the payouts per base acre.

Figure 3: Preview of Tool

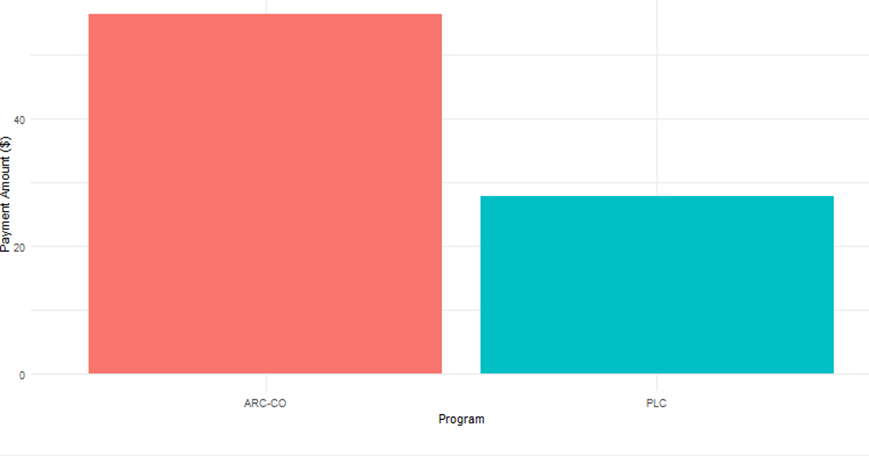

Users can download the output by clicking the “Download Plot” button. Figure 4 displays the output for Adams County. With the data in Figure 3, ARC-CO offers a higher potential payout per base acre than PLC: ARC-CO payout stands at $56.47 per base acre while that of PLC is $27.89 per base acre.

Figure 4: Potential ARC-CO and PLC Payouts in Adams County

While Wisconsin producers decide to enroll in either ARC-CO or PLC using this tool (What-If Tool), they can consider the use of Supplemental Coverage Option (SCO). Producers pay only 35% of the SCO enrollment cost. SCO payouts are triggered when county losses go below 86% of expected revenue. SCO can be an important addition; however, producers cannot combine it with ARC-CO.

[1] The Farm Bill sets the effective reference price for each commodity.

[2] Actual revenue is the product of county yield and market year average price. The guaranteed level of revenue (guarantee revenue) is 86% of benchmark revenue, which is a product of the Olympic average of market prices and county yields from 2019-2023.

[3] To visualize historical PLC payouts under the 2018 Farm Bill, refer to https://sgaku.shinyapps.io/PLC_Payouts/. The historical ARC-CO payouts under the 2018 Farm Bill are available here: https://sgaku.shinyapps.io/ARC_Payouts/.

[4] The Effective reference price is set by the Farm Bill, and can vary annually. Benchmark price is the 5-year Olympic average MYAP, calculated using the 5 years preceding the year prior to the program year.

[5] Trigger price is 86% of benchmark price, which indicates that ARC payouts are triggered when prices fall below this threshold with yields matching their benchmark level.

[6] The reference price of wheat remains unchanged because of the use of Olympic average that eliminates the lowest price of $4.48 in 2019 and the highest price of $8.83 in 2022.

[7] The Farm Bill limits maximum ARC-CO payments to 10% of the benchmark revenue.

[8] After these selections, the app updates the expected yields to the ARC-CO benchmark yield; however, users can make changes.

[9] ARC-CO Payment=0.85 x payment rate, PLC payment= 0.85 x plc yield x plc payment rate. ARC-CO payment rate=guarantee revenue-county revenue and PLC payment rate = Effective reference price – marketing year average price. PLC yield is the established yield. This tool uses 2024 PLC yield for calculations.