U.S.-Canada Dairy Trade Dispute: Quotas, Trade Flows, and Economic Impacts

Quotas and Tariff-Rate Quotas in Dairy Trade

Composition of U.S. Dairy Exports to Canada by Product Category

Timeline of U.S.-Canada Dairy Trade Relations

Trade Volume and Value of Dairy Trade

Quotas and Tariff-Rate Quotas (TRQs) in Dairy Trade

Canadian Supply Management and TRQs

Canada’s dairy sector operates under a supply management system that tightly regulates domestic production and imports. High tariffs are imposed on dairy imports exceeding fixed quota volumes, effectively shielding Canadian farmers from foreign competition. Canada maintains over-quota tariff rates exceeding 200% on most dairy products, with rates approaching 300% on some items like butter (International Dairy Foods Association [IDFA], 2023).

Under the United States-Mexico-Canada Agreement (USMCA), which took effect in 2020, Canada preserved its supply management framework but agreed to implement specific TRQs for U.S. dairy exports. TRQs permit a defined volume of imports at low or zero tariffs, beyond which prohibitive tariffs apply (Office of the United States Trade Representative [USTR], 2023). Canada maintains 14 separate dairy TRQs, covering a wide range of dairy products including milk, cream, cheese, butter, skim milk powder, yogurt, and ice cream. Within these quotas, U.S. products enter tariff-free, while any excess is subject to steep over-quota tariffs (USTR, 2023).

Tariff-Rate Quotas (TRQs) by Product Category

Under the USMCA, Canada’s TRQs for U.S. dairy are allocated by product category, with increasing volumes each year. Table 1 summarizes key dairy TRQs for U.S. exports, including quotas for Year 6 (2025) and the fully phased-in Year 19 quotas. All in-quota imports enter duty-free, whereas over-quota imports incur high Most-Favored-Nation (MFN) tariff rates, often exceeding 200%.

Table 1

Canadian Dairy TRQs for U.S. Imports under USMCA. Year 6 quotas represent approximate current access; quotas grow gradually until Year 19. Over-quota tariffs are Canada’s WTO Most-Favored Nation (MFN) rates.

| Dairy Product Category | Year 6 Quota (2025, MT) | Final Quota (Year 19, MT) | Over-Quota Tariff Rate (MFN) |

|---|---|---|---|

| Milk (fluid milk) | 50,000 | 56,905 | ~241% tariff |

| Cream | 10,500 | 11,950 | >200% (high tariff) |

| Skim Milk Powder | 7,500 | 8,536 | ~201% (high tariff) |

| Butter & Cream Powder | 4,500 | 5,121 | ~298% (very high tariff) |

| Cheese (processing) | 6,250 | 7,113 | ~245% (high tariff) |

| Cheese (all types) | 6,250 | 7,113 | ~245% (high tariff) |

| Yogurt & Buttermilk | 4,135 | 4,706 | >200% (high tariff) |

| Whey Powder (ends Y10) | 4,135 | N/A | ~208% (high tariff) |

| Other Dairy Products | 3,450 (various) | ~3,900 (various) | >200% (high tariff) |

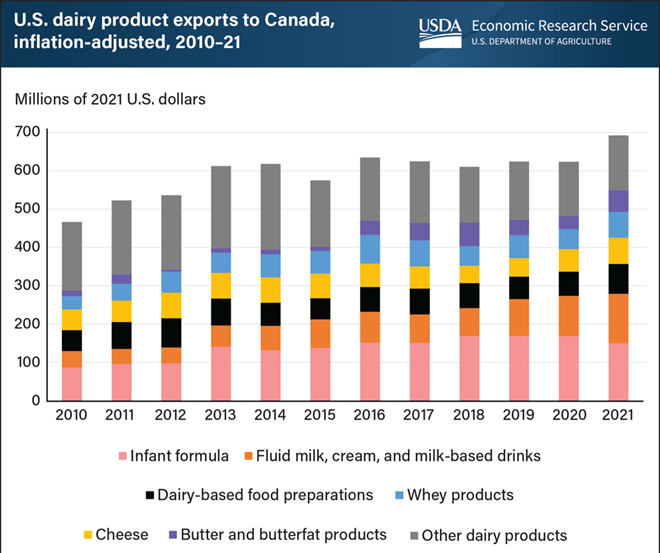

Composition of U.S. Dairy Exports to Canada by Product Category

Fluid Milk and Cream

U.S. exports of fluid milk and cream to Canada benefit from the country’s proximity and the perishability of these products, allowing for efficient trade. In 2021, U.S. exports of fluid milk, cream, and milk-based beverages to Canada were valued at approximately $128.5 million, accounting for 18–19% of U.S. dairy exports to Canada (Economic Research Service [ERS], 2023). These exports tend to fill much of the allowed quota volume under USMCA (ERS, 2023).

Cheese represents a growing segment of U.S. dairy exports to Canada. In 2021, U.S. cheese exports totaled approximately $68 million, around 10% of total U.S. dairy export value to Canada (ERS, 2023). This increase is associated with expanded TRQ volumes under USMCA (FAS, 2023). Although Canada imports smaller quantities compared to Mexico, recent quota expansions have led to greater utilization and increased U.S. market share.

Butter and Butterfat Products

Butter and related products have become a key area of export growth. From 2010 to 2021, U.S. exports of butter and anhydrous milk fat to Canada increased by $41.7 million (ERS, 2023). By 2022, Canada accounted for 43% of all U.S. butterfat exports, more than doubling the prior year’s volume (Farm Progress, 2023). Canada’s domestic butterfat shortfall has led to consistent quota utilization under USMCA and strong demand for U.S. product.

Other Dairy Products: Infant Formula, Whey, and Miscellaneous

Infant formula is the top U.S. dairy export to Canada by value, reaching $151 million in 2021 and comprising 22% of total dairy exports to Canada (ERS, 2023). Canada’s limited domestic production has driven demand. Whey and dairy-based ingredients such as lactose, ice cream, and yogurt also contribute to total trade value, although in smaller volumes than with major buyers like China or Southeast Asia. These specialized and higher-value goods tend to dominate U.S. dairy exports to Canada, while bulk commodities are directed elsewhere (ERS, 2023).

TRQ Administration Disputes

A major dispute concerns how Canada allocates its TRQs. Initially, Canada reserved large portions (80–85%) of many TRQs exclusively for Canadian dairy processors, granting import licenses mainly to companies with little incentive to use the full quotas (USTR, 2023). The U.S. argued this practice violated USMCA’s requirement for fair administration of TRQs. In 2021, the U.S. filed the first USMCA dispute over Canada’s TRQ allocations. A dispute panel ruled in favor of the U.S. in December 2021, finding Canada’s practices in breach of the agreement (World Trade Organization [WTO], 2021).

Canada subsequently revised its TRQ allocation rules, but the U.S. continued to argue that these changes were insufficient. A second USMCA panel in 2023 resulted in a mixed ruling, allowing some of Canada’s revised practices to continue (Cornell University, 2023). These disputes underscore that quota allocation remains a contentious issue, with the U.S. seeking greater market access while Canada defends its supply management system.

Timeline of U.S.-Canada Dairy Trade Relations

1940s–1970s: Early Protectionist Policies

- 1942–1970s – Canada introduces and strengthens dairy supply management policies, initially to stabilize domestic dairy production and ensure consistent prices for farmers.

- 1971 – Canada formally establishes the supply management system for dairy, setting production quotas and limiting imports with high tariffs.

1987–1995: Canada Faces International Pressure on Dairy Tariffs

- 1987 – The Canada-U.S. Free Trade Agreement (CUSFTA) is signed, but dairy is excluded from major tariff reductions, keeping Canada’s supply management system intact.

- 1994 – The North American Free Trade Agreement (NAFTA) is signed between the U.S., Canada, and Mexico. Again, Canada successfully excludes its dairy sector from tariff reductions.

- 1995 – The World Trade Organization (WTO) Agreement on Agriculture replaces quantitative dairy import restrictions with high tariff-rate quotas (TRQs) for Canada. Over-quota tariffs exceed 200% for most dairy products.

1996–2016: Ongoing Disputes and Limited U.S. Market Access

- 1997 – The U.S. challenges Canada’s dairy export subsidies at the WTO, arguing that Canada is dumping skim milk powder at artificially low prices. WTO rules against Canada, forcing policy changes.

- 2003 – Canada introduces special milk ingredient pricing, allowing processors to buy milk ingredients at lower rates, leading to further U.S. complaints.

- 2016 – Canada introduces Class 7 pricing (later a key issue in the USMCA), allowing cheaper domestic sales of milk proteins, undercutting U.S. dairy exports.

2017–2020: NAFTA Renegotiation and USMCA Dairy Market Opening

- 2017 – The Trump administration demands NAFTA renegotiation, citing Canada’s dairy tariffs and Class 7 pricing as unfair trade barriers.

- 2018 – The United States-Mexico-Canada Agreement (USMCA) is finalized, replacing NAFTA. Canada agrees to:

- Increase U.S. dairy market access via expanded TRQs.

- Eliminate Class 7 pricing that disadvantaged U.S. dairy exporters.

- 2020 – USMCA takes effect. However, the U.S. claims that Canada’s TRQ allocations unfairly restrict access.

2021–Present: USMCA Disputes and Ongoing Legal Challenges

- 2021 – The U.S. files a dispute under USMCA, arguing Canada is favoring domestic processors in TRQ allocations.

- 2022 – A USMCA dispute panel rules in favor of the U.S., requiring Canada to modify how it distributes TRQs.

- 2023 – Canada adjusts TRQ administration, but the U.S. files another complaint, arguing the changes are still unfair.

- 2024 – The dispute remains unresolved, with the U.S. continuing to push for broader market access and fair TRQ distribution.

Trade Volume and Value of Dairy Trade

U.S. Exports to Canada

Canada is the second-largest export market for U.S. dairy products after Mexico (United States Department of Agriculture Economic Research Service [USDA ERS], 2023). U.S. dairy exports to Canada have grown significantly, rising by 48% from 2010 to 2021, from approximately $466 million in 2010 to $692 million in 2021. This growth accelerated after USMCA implementation in 2020. U.S. dairy exports to Canada were approximately $525 million in 2021, increasing to $718 million in 2022 and $757 million in 2023 (USDA ERS, 2023). By 2024, U.S. dairy exports reached an estimated $877 million, reflecting a 67% increase since 2021.

Canada’s Exports to the U.S.

Canada’s dairy exports to the U.S. are comparatively limited due to its supply management system. Canada’s total dairy exports globally were valued at approximately C$3.5 billion in 2021, with only a minor fraction going to the U.S. (Progressive Dairyman, 2023). Canadian dairy exports primarily consist of niche ingredients such as skim milk powder, whey, and premium cheeses. Given Canada’s focus on domestic supply, the trade imbalance is structural, with the U.S. exporting significantly more dairy to Canada than vice versa.

Source: USDA, Economic Research Service using data from Foreign Agricultural Service’s Global Agricultural Trade System and U.S. Bureau of Economic Analysis

Economic Impact on Farmers, Consumers, and the Dairy Market

Impacts on Canadian Farmers

Canada’s quota-based system ensures stable, high farm-gate milk prices, benefiting farmers but creating barriers for new entrants. While the number of dairy farms has declined due to consolidation, the system has maintained profitability for those who hold quota (McGill University, 2023). However, some analysts argue the system limits efficiency and export potential.

Impacts on U.S. Farmers

For U.S. farmers, Canada’s import restrictions represent a lost market opportunity. The limited quotas under USMCA allow U.S. dairy to enter Canada but remain constrained. Despite this, U.S. dairy exports to Canada increased by about 34% due to USMCA (Texas Tech University, 2023).

Impacts on Canadian Consumers

Consumers in Canada pay higher prices for dairy due to import restrictions and supply controls. The Organisation for Economic Co-operation and Development (OECD) estimated that Canadian dairy policies imposed an average annual cost of $2.7 billion on consumers from 2000 to 2017. Households pay an estimated $500 more annually for dairy due to supply management (McGill University, 2023).

Policy Recommendations and Economic Perspectives

Experts recommend incremental liberalization of Canada’s dairy market while compensating farmers for quota losses. Potential solutions include:

- Expanding market access by increasing TRQ allocations.

- Providing financial compensation to farmers affected by liberalization.

- Reforming domestic pricing policies to align with market conditions.

- Allowing competitive exporters to produce beyond quota limits for international markets.

- Improving TRQ administration to ensure fair access for importers.

- Using trade agreement mechanisms to resolve disputes and ensure compliance.

Conclusion

The U.S.-Canada dairy trade dispute reflects ongoing tensions between protectionist policies and free trade principles. USMCA has increased U.S. dairy exports to Canada, but disputes over TRQ administration persist. Policy reforms aimed at gradual market liberalization, coupled with compensation mechanisms for affected farmers, could improve trade efficiency and consumer welfare while reducing bilateral tensions.

Links and Resources

- Cornell University. (2023). USMCA dairy dispute panel issues mixed ruling. Cornell University Institute for Food and Agricultural Standards. https://www.food.cornell.edu/usmca-dairy-dispute-2023

- Economic Research Service. (2023). Dairy data: U.S. dairy export and import data. United States Department of Agriculture. https://www.ers.usda.gov/data-products/dairy-data/

- Farm Progress. (2023). U.S. dairy exports set new records in 2022. https://www.farmprogress.com/marketing/us-dairy-exports-set-new-records-2022

- Foreign Agricultural Service. (2023). U.S. dairy export statistics. United States Department of Agriculture. https://www.fas.usda.gov/data/dairy-products

- International Dairy Foods Association. (2023). Tariff barriers and TRQs in Canadian dairy. https://www.idfa.org/

- McGill University. (2023). Economic impacts of Canada’s dairy supply management system. Desautels Faculty of Management. https://www.mcgill.ca/desautels/

- Office of the United States Trade Representative. (2023). United States–Mexico–Canada Agreement: Agreement details and enforcement. https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement

- Organisation for Economic Co-operation and Development. (2018). Agricultural policy monitoring and evaluation 2018: Canada. OECD Publishing. https://doi.org/10.1787/agr_pol-2018-en

- Progressive Dairyman. (2023). Canada’s dairy trade and export dynamics. https://www.progressivedairycanada.com/

- Texas Tech University. (2023). USMCA and U.S. dairy exports: A review of trade performance and access issues. Davis College of Agricultural Sciences & Natural Resources. https://www.depts.ttu.edu/agriculturalsciences/

- United States Department of Agriculture Economic Research Service. (2023). Dairy trade statistics and analysis: U.S. and Canada. https://www.ers.usda.gov/

- World Trade Organization. (2021). Canada—Dairy TRQ allocation measures: Panel report. https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds604_e.htm

Milk, Cookies, and Christmas Eve: Santa’s Dairy Tab by the Numbers

Milk, Cookies, and Christmas Eve: Santa’s Dairy Tab by the Numbers Dairy Market Dynamics and Domestic Constraints: A Dairy Sector Assessment as of June 2025

Dairy Market Dynamics and Domestic Constraints: A Dairy Sector Assessment as of June 2025 U.S.–Canada Dairy Trade Relationship (2025–Present)

U.S.–Canada Dairy Trade Relationship (2025–Present) Suspension of FDA’s Grade “A” Milk Proficiency Testing Program – A Comprehensive Analysis

Suspension of FDA’s Grade “A” Milk Proficiency Testing Program – A Comprehensive Analysis