The dairy industry is currently navigating a complex set of fluctuating domestic demand signals, with week-to-week shifts ranging from “steady” to “strong” to “so-so.” As the sector anticipates new processing capacity coming online in 2025 and beyond, uncertainty remains regarding how this will affect the overall supply of dairy products and where increased demand for producers’ milk will emerge. A positive sign for dairy producers is the slow response in cow number expansion, suggesting that growth may need to come from previously planned herd expansions, potentially increasing competition among milk buyers. High beef and replacement cow prices have also contributed to stagnant cow numbers month over month.

Internationally, milk production has recently declined, and the outlook for future growth is restrained. Meanwhile, softening global cheese markets may present a favorable opportunity for U.S. exports. Although farm-level milk prices have remained stable, profitability is not consistent across all producers. Dairy farming remains an expensive and capital-intensive business, and responses to market signals appear cautious. CME Class III futures prices for the next six months are currently at a discount to today’s prices, indicating that the market may be waiting for some uncertainties to resolve before responding to price-supporting developments.

The dairy market is currently holding steady at approximately $20/cwt for milk, which seems to be the norm for now. If competition for farmers’ milk remains strong, driven by the anticipated increase in processing capacity, we may be able to maintain this price level or potentially see prices rise further. However, if there is a supply response in the form of increased milk production, combined with lower market prices to clear the additional end products entering the marketplace, we could face prolonged price pressures. Conversely, if milk supplies stay relatively stable and the market absorbs the additional product inventory, the $20/cwt level could persist for some time, offering more stability for producers.

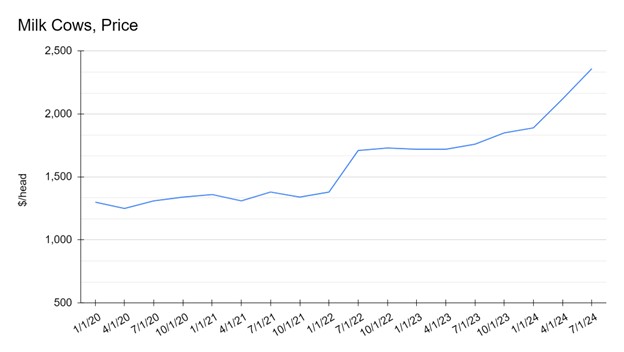

As of July 2024, the price of U.S. dairy cows has risen to approximately $2,500 per head, reflecting a notable increase compared to the July 2023 price of around $1,900 per head. This $600 rise over the past year (Figure 1) highlights a significant upward trend in the market for milk cows, signaling growing demand or other economic factors influencing dairy cattle prices.

As of July 2024, the price of U.S. dairy cows has risen to approximately $2,500 per head, reflecting a notable increase compared to the July 2023 price of around $1,900 per head. This $600 rise over the year (Figure 1) shows the upward trend in the market for milk cows. Local and regional prices can vary widely due to factors such as demand, supply, and transportation costs. As such, these figures are best used as a barometer of broader market trends rather than a precise price.

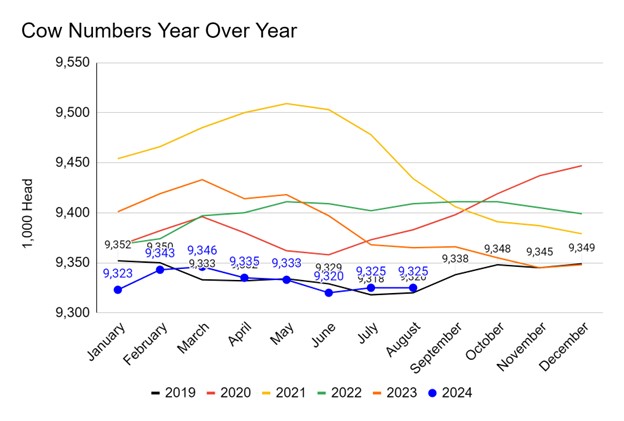

The United States Department of Agriculture National Agricultural Statistics Service (NASS) report updated cow numbers to 9.325 million for August 2024 (Figure 2). Despite a month-over-month number remaining the same as of July 2024, the year-over-year change in cow numbers shows a decrease of 40,000 head for August 2024 compared to August 2023.

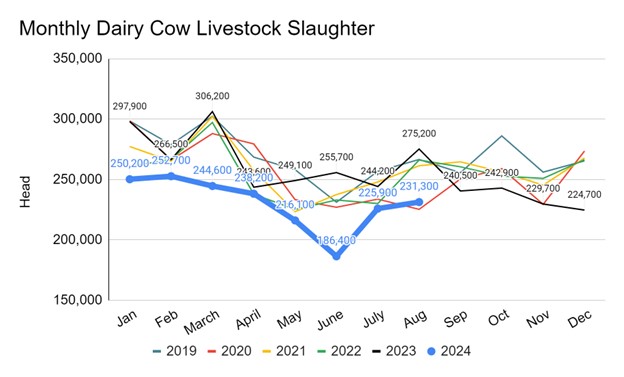

The Livestock Slaughter report by NASS shows that the number of dairy cows slaughtered in August 2024 was 231,300 head (Figure 3). There is a month -over- month increase of 5,400 head in August 2024, with the percentage increase of 2.39%. Despite the month over month rise in cow slaughter the year-over-year number declined to -43,900 with a percentage decline of (-15.9)% slaughtered during the same period in 2023. It is unsurprising that producers are continuing to optimize their animal inventory across various age groups on the farm and retain cows for longer periods.

The monthly average fat test, according to USDA NASS data, rose from 4.00% in August 2023 to 4.09% in August 2024 (Figure 4). There is a month-over-month increase of 0.02%, followed by a year-over-year increase of 0.09% compared to the previous year as of August 2024.

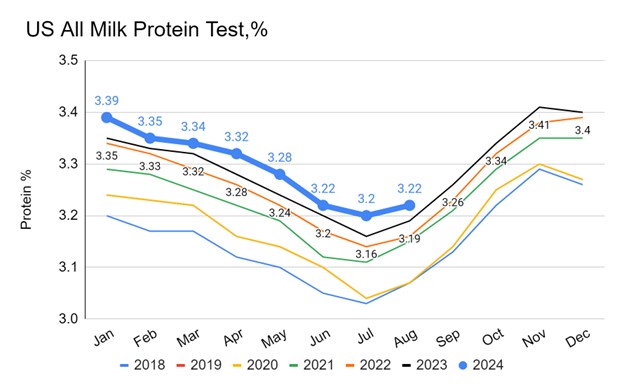

Similarly, milk protein test values have been on a year-over-year rise, averaging 3.16% in 2022, 3.19% in 2023, and 3.22% in August 2024 (Figure 5). There is an increase of approximately 0.03% as of August 2024 compared to the same period in the previous year.

The national dairy herd has consistently increased component production on a year-over-year basis, almost every month. This rise in solids output has offset some of the typical supply effects associated with a declining cow population. There is no indication that the growth in solids will slow down, and 2024 is on track to set new monthly records throughout the year.

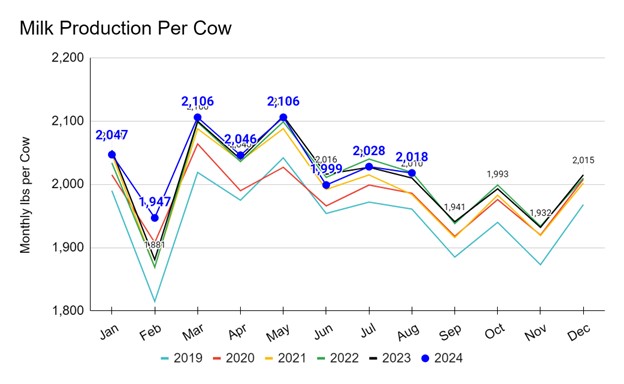

The US dairy herd had an average monthly milk production per cow of 2,018 lbs in August 2024 (Figure 6). Despite a month-over-month decrease of 10 lbs, there was an increase of 8 lbs in year-over- year milk production per cow in August 2024 compared to the same period in the previous year. Thus the month-over-month percentage decline remained -(0.49)% whereas year-on-year percentage increase was 0.40% as of August 2024. Current production per cow remains consistent with long-term historical averages, the modest year-over-year growth in milk production per cow could lead to a stable increase in total milk supply.

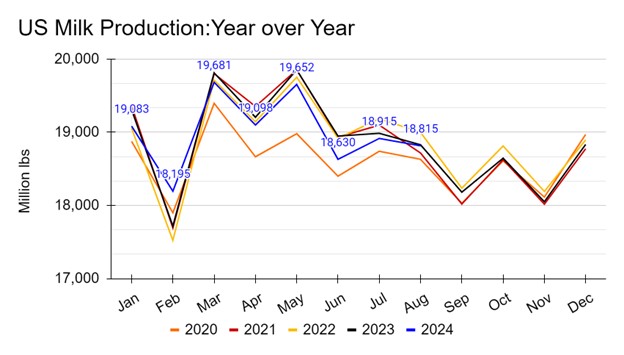

The year-over-year U.S. total monthly milk production is 18.81 million lbs as of August 2024 (Figure 7). This represents a decrease of 100.0 million lbs compared to the same period in 2023, indicating approximately a -(0.53)% decline in August 2024. The year-over-year U.S. total milk production also declined to approximately -13.0 million lbs as of August 2024. Thus the percentage decline remained -(0.07)%.

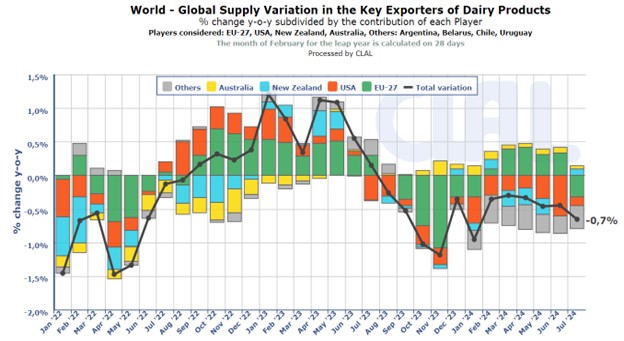

When looking at the data for “Global Supply Variation in the Key Exporters of Dairy Products” by CLAL (https://www.clal.it/en/?section=latte_mensile) for July 2024, the USA’s variation is negative. The year-over-year reduction in dairy supply from the United States is approximately -(0.7)% as of July 2024 (Figure 8).

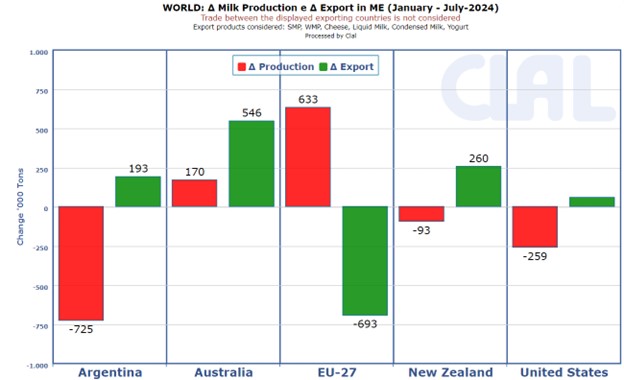

Similarly the statistics for “WORLD: Δ Milk Production e Δ Export in ME (January – July-2024)” by CLAL (https://www.clal.it/en/mini_index.php?section=prod-export-me-countries ) from January to July 2024, U.S. milk production saw a slight drop, while exports increased marginally. Exports mainly include the exports of cheese, fluid milk, condensed milk, yogurt, SMP, and WMP (Figure 9). This shift suggests the industry is sensitive to international demand, allocating more of its available supply to export markets despite lower overall production. The trend reflects the continued importance of exports in balancing the U.S. dairy market. Furthermore The U.S. dairy market is in a competitive export situation, and to maintain higher farm prices, exports must continue through the remaining months of 2024.

Dairy producers will need to closely monitor both demand trends and shifts in production levels, as these factors will play a critical role in determining future price dynamics. A combination of fluctuating domestic demand signals, evolving processing capacity, and international market shifts will all contribute to price movement. Additionally, supply responses, such as changes in herd sizes or milk output, could either stabilize prices at current levels or apply downward pressure, depending on market absorption of new product inventories and international demand for U.S. dairy exports.