The All Milk price and Class III milk prices have shown a modest start in the early months of 2024. Prices have not reached the lows of 2023; the most noteworthy development has been the robustness of Class IV prices, bolstered by strong butter prices.

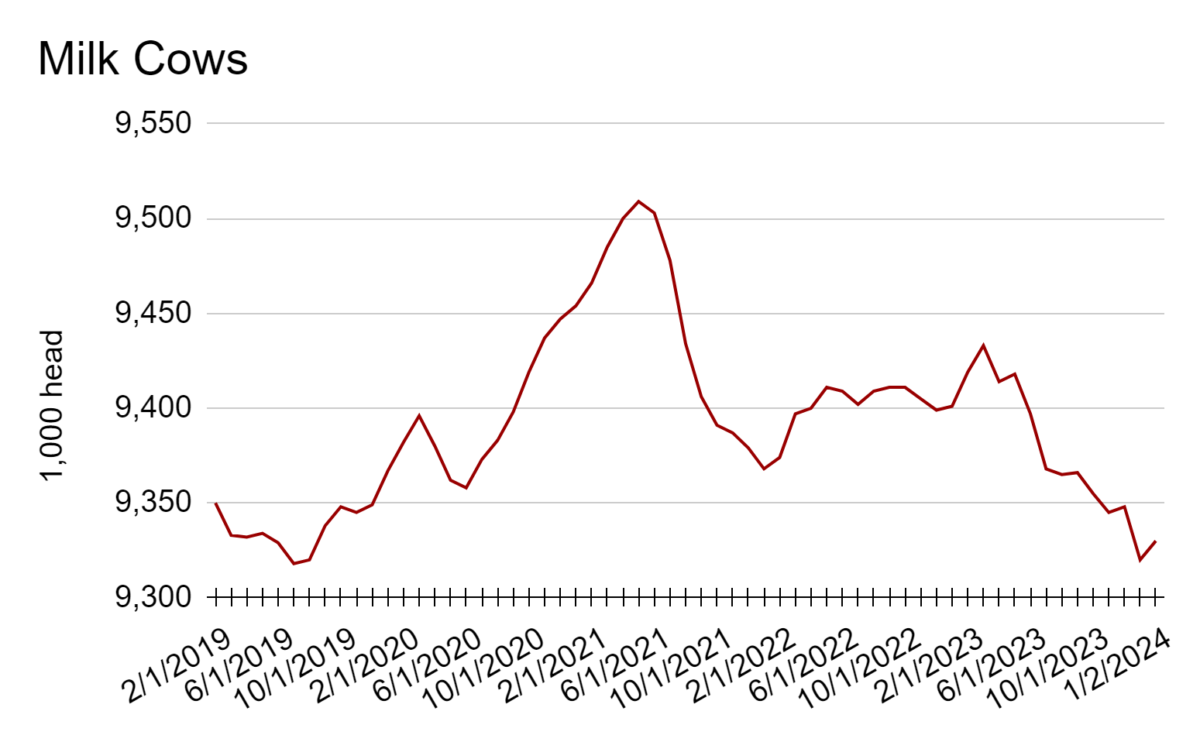

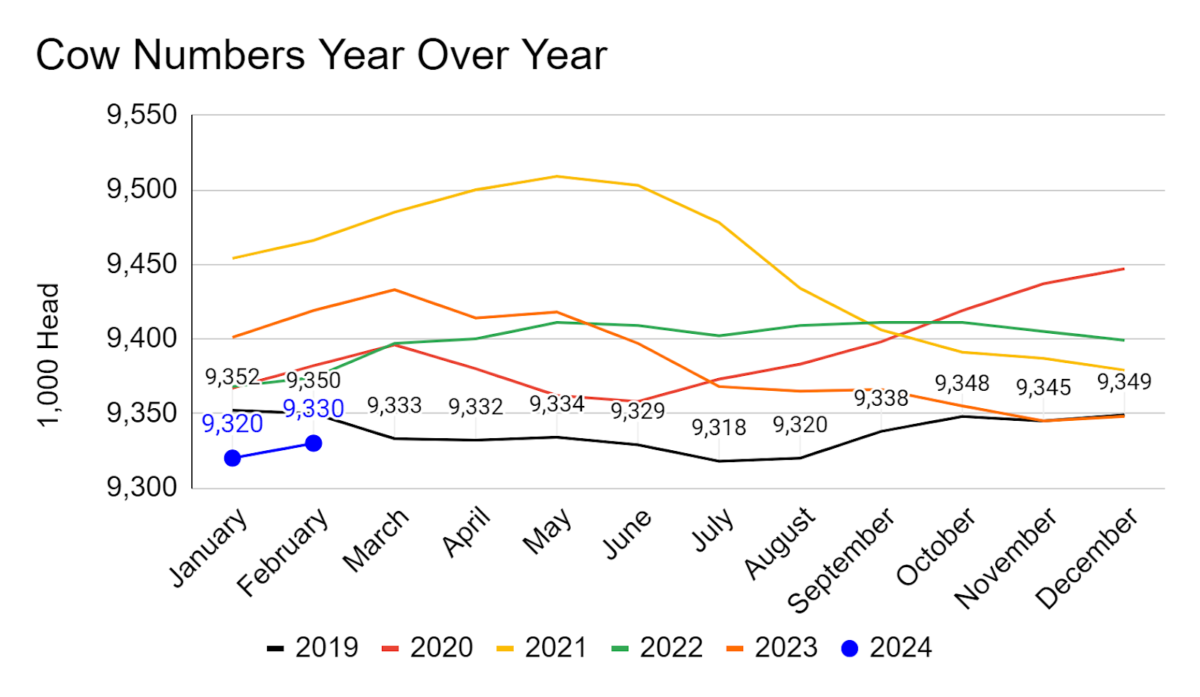

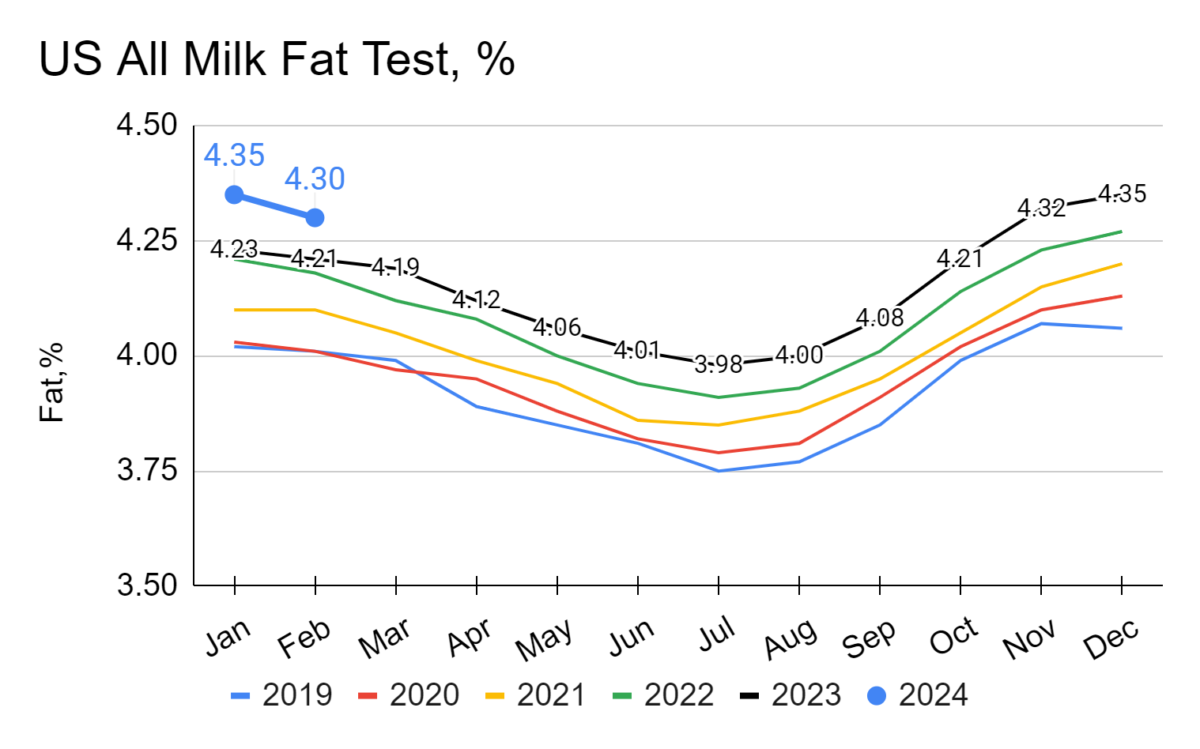

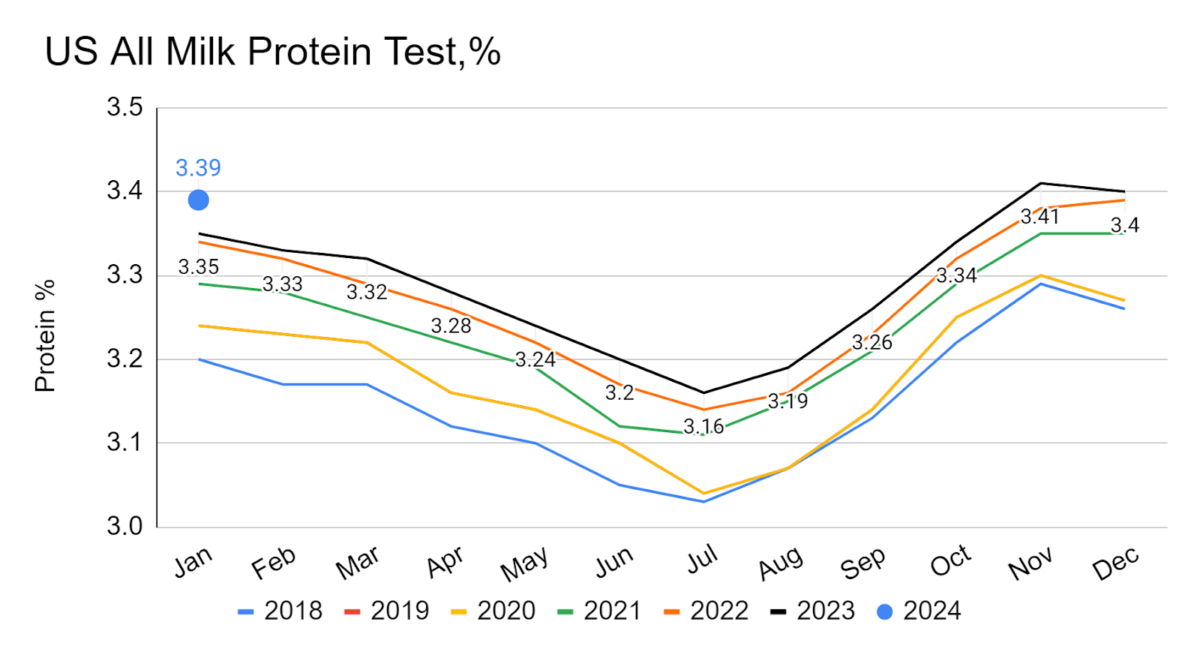

The low prices of 2023 and the current stagnant prices in 2024 can be cured by either an increase in market demand or a decrease in milk supply. A significant factor in our current pricing challenges has been the lack of demand. The markets’ response has been to reduce cow numbers. Despite the reduction in cow numbers, the market has not yet demonstrated a sustained positive price response. One contributing factor is the continued strong production of milk components. The production of U.S. milk solids is setting new records, indicating a diminishing correlation between cow numbers and total milk solids produced. This trend towards increased production efficiency appears to be long-term and shows no signs of slowing.

It is reasonable to assume that demand-side price pressures continue to affect the market. With an estimated investment of over $7 billion in dairy processing projected between now and 2026, it is difficult to maintain a bullish outlook. An increase in cheese processing could limit the upward price potential for Class III. Similarly, enhanced U.S. butter production, together with potential increases in global milk supply, could mitigate the future positive impacts on Class IV prices. Currently, the most feasible prospect for a near-term increase in milk prices would be through a surge in demand, especially from exports.

Milk price forecasts look towards the latter half of 2024 for a possibility of meaningful price support. Producers can manage some of their margin risk through the Dairy Margin Coverage (DMC) program offered by the Farm Service Agency (FSA), with enrollment closing on April 29, 2024. Recent forecasts indicate that DMC margins for 2024 are less likely to result in payments, given the decline in feed prices, such as corn and soybean meal. Producers are advised to consider these forecasts cautiously; the growing season still remains uncertain, and market conditions could change significantly, potentially triggering payments.

It is not unusual to see a forecast of $0 or minimal net benefit from DMC enrollment during the enrollment period. However, as seen in previous years, market dynamics do change within the program year, leading to a positive net benefit for past participants. The DMC program remains one of the most cost-effective and straightforward risk management tools available, particularly for the first 5 million lbs. of production. While often cited, the analogy of purchasing car insurance without intending to make a claim remains apt. 2023 served as a reminder of how swiftly market conditions can shift and their substantial impact at the farm level.