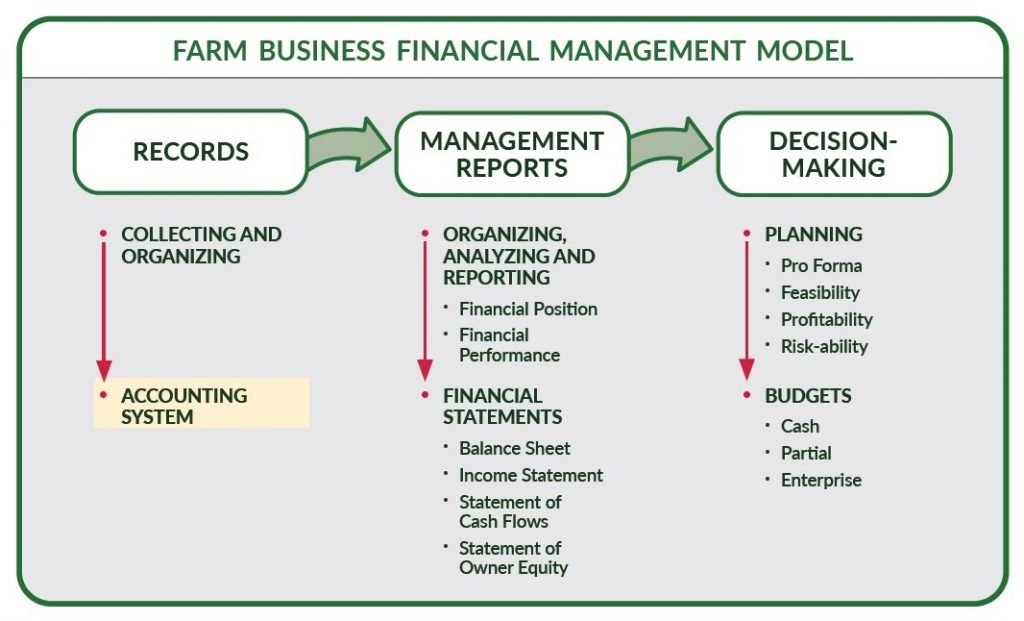

Selecting the best recordkeeping tool will assist in making management decisions for the future.

At the end of the year, farmers may be reviewing their income tax obligations and marketing plans or completing a business or enterprise analysis. A successful farm manager is already keeping good, accurate records throughout the year. Selecting the best recordkeeping tool will assist in making management decisions for the future.

Farmers need a complete and accurate farm financial records system. A paper farm account book requires a farmer to manually enter data with the potential for mathematical errors. Another option might be to hire a professional for financial recordkeeping, but this could be cost-prohibitive.

Electronic recordkeeping

An electronic method of recordkeeping can complete calculations, sort and assist with summarizing the data. However, farmers do need to have the basic knowledge of computers and time to learn the software program to ensure income and receipts are entered correctly. Software programs vary in cost and complexity. Seek advice from ag professionals, such as a tax preparer or accountant, that might be able to assist with training, data entry, or account reconciliation.

Below are a few examples of computerized financial recordkeeping systems. Farmers should consider what aspects are needed with their accounting systems and how much time and money they are willing to spend. Compare the computer systems’ features, phone or online support, and prices for the software and add-on modules.

There is no “best” record-keeping system for all situations. Evaluate which option might work the most effectively to generate the management reports needed for farm business decision-making.

Spreadsheets, such as Microsoft ExcelⓇ or a similar program.

- Cornell Small Farms Program has an example for high tunnel crop producers.

- University of Missouri Extension has an example farm record book.

- Michigan State University Extension has farm record book for management

Farm accounting software programs

- QuickenⓇ Computer Software is a popular financial software program, though it must be adapted for agricultural enterprises. Quicken is a single-entry or cash accounting system, so adjustments must be made to generate accrual statements. Oklahoma State Extension has developed an excellent reference. Nebraska Center for Agricultural Profitability provides a free training course.

- QuickBooksⓇ Computer Software is also a very popular finance software program, but it must be adapted for agricultural enterprises. QuickBooks is an accrual double-entry system, so some assistance may be needed for proper data entry. Kansas State Extension has a good resource. Nebraska Center for Agricultural Profitability provides a free training course.

- CenterPointⓇ Accounting for Agriculture is an accrual double-entry accounting system.

- EasyFarm Accounting and Management Software is a single-entry cash basis accounting system.

- Farm Biz or Ultra Farm Accounting Software programs are cash basis systems.

- PcMarsⓇ Farm Accounting Software can be installed as a single-entry cash system or an accrual double-entry system.

Author’s note: The software programs and companies listed above are not an all-inclusive list and do not constitute a recommendation for any of these products. Any information provided in this article is not intended to be a substitute for accounting or legal services from a competent professional.